Can you guess which company this is?

| 2014 | 2024 | Compound annual growth rate |

Revenue | $518 million | $2.9 billion | 19% |

Net income | $13.9 million | $257 million | 34% |

Free cash flow | $13.4 million | $251 million | 34% |

Share price | $17.82 | $175.25 | 26% |

Source: Liontrust, Bloomberg, as at 19.09.25. Past performance does not predict future returns

Pretty outstanding returns, right? Yet at the beginning of 2025, when we first bought the shares, they were trading at a price/earnings ratio of just 16. That was cheaper than the S&P 500 on 25x or the MSCI All Country World Index on 20x!

Why might that be? High debt? No… this company has 1.3x net debt to EBITDA (earnings before interest, tax, depreciation and amortisation); very manageable and below its long-term average of around 2x; Low returns on capital? No… it made a five year and ten-year average return on invested capital of 14% and 16% respectively (source: Liontrust, Bloomberg, September 2025) – high returns which have improved over time. Low market share? No… this business has consistently taken share over several years.

The company is called Installed Building Products. It installs insulation, largely for US residential properties. It started life as Edwards Insulation in 1977, based in Columbus, Ohio. The founder’s son Jeff Edwards began working in the business in the 1990s and recognised a huge scaling opportunity. He started buying similar family-owned insulation installer firms around the country, gained procurement discounts from suppliers as the group grew larger, and then used the excess profitability to reinvest into further acquisitions and drive more scale efficiencies (e.g., on insurance, accounting and payroll costs).

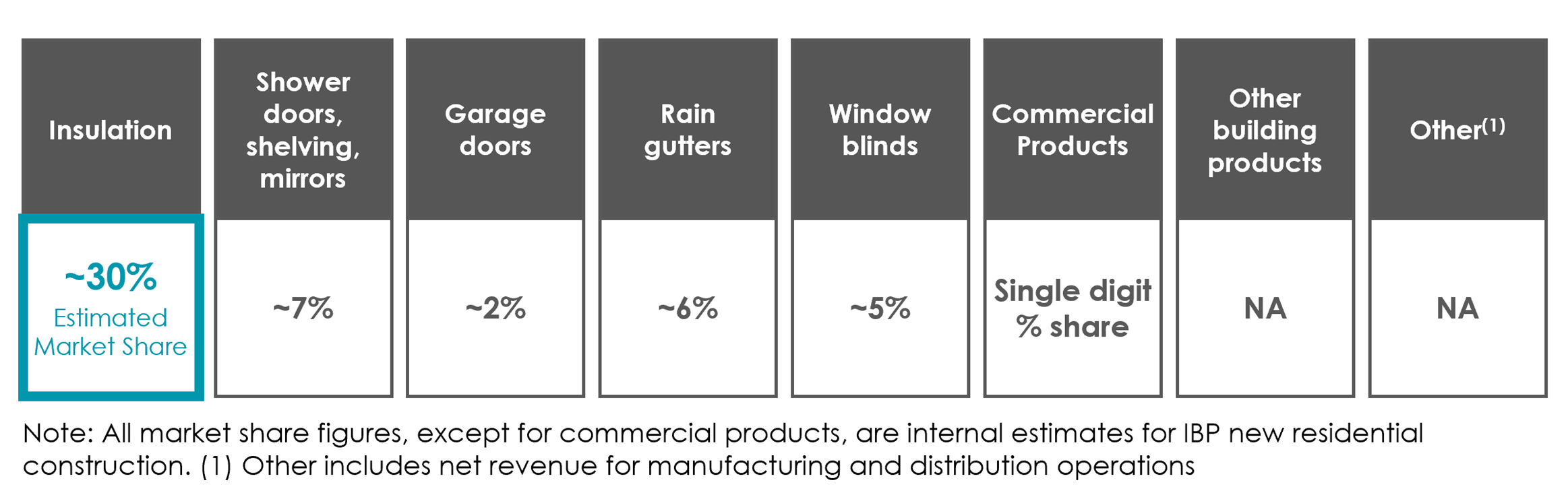

Starting with just one branch some 50 years ago, IBP now represents around 30% of the total US insulation installation industry. The business now has considerable scale and distribution advantages – IBP can procure and install insulation for less than the cost of an individual general contractor just buying the insulation material!

The company is now expanding into adjacent categories such as doors, gutters and fireproofing. IBP can offer its large customer base these extra products alongside insulation, effectively utilising its existing distribution heft and is therefore winning share in these complementary areas from a low starting point.

[1]Source: Liontrust, Bloomberg, as at September 2025.

Source: IBP Q2 2025 Investor Presentation.

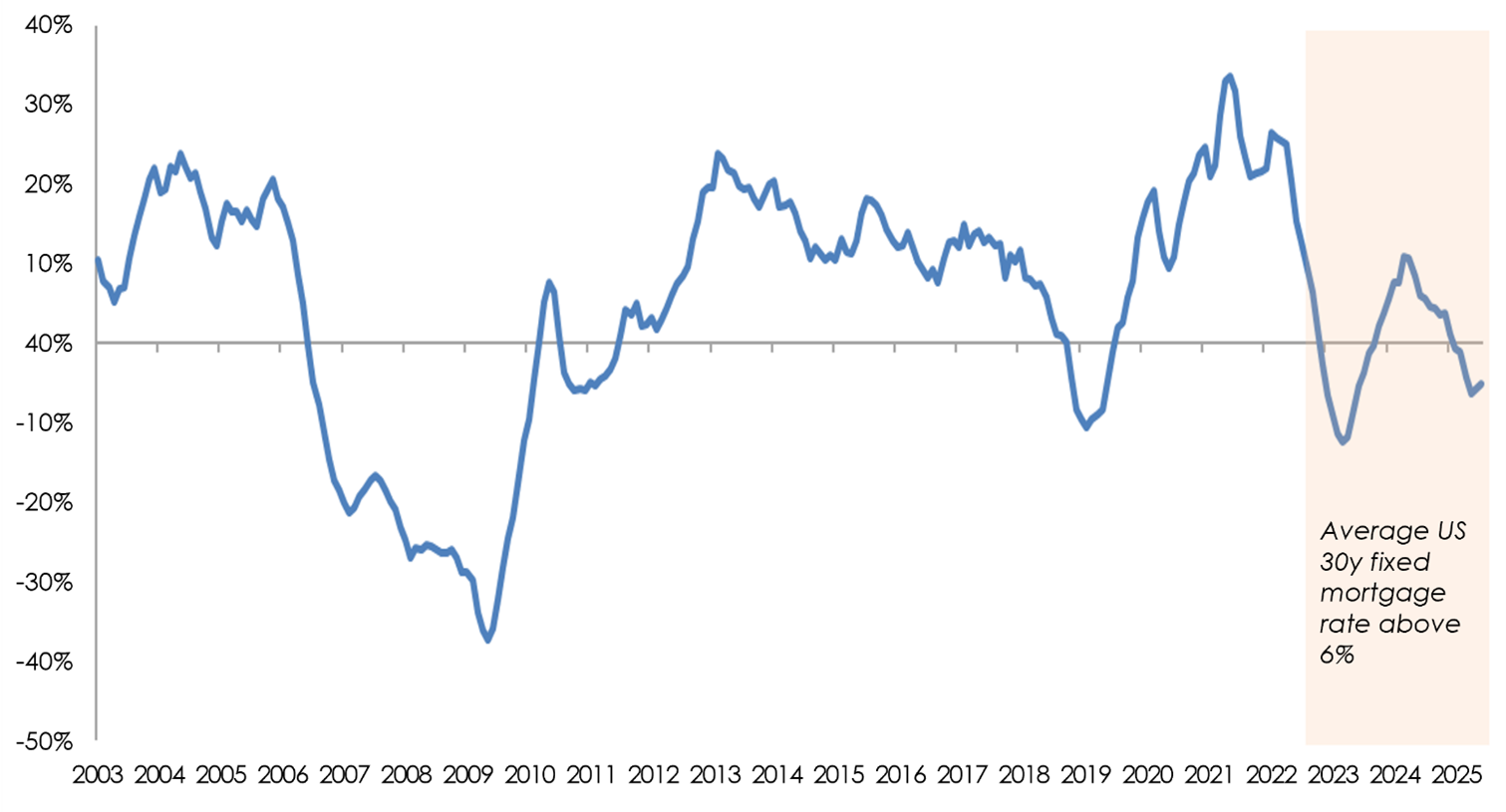

But going back to the valuation – why were we able to buy such a high-quality compounder at such a cheap level? Well IBP’s core end-market is US residential housing, which has had a tough time of late. US residential construction spending, which is typically cyclical, has been notably weak over the past three years. This is largely due to higher interest rates, driving US mortgage rates above 6% – levels not seen since before the global financial crisis (GFC) in 2009. As a result, new home affordability is stretched for many Americans and private housing demand has slowed.

US residential construction spending: year-on-year growth (seasonally adjusted annual rate)

Source: US Census Bureau, Freddie Mac, Federal Reserve Bank of St. Louis. As of 31.07.25.

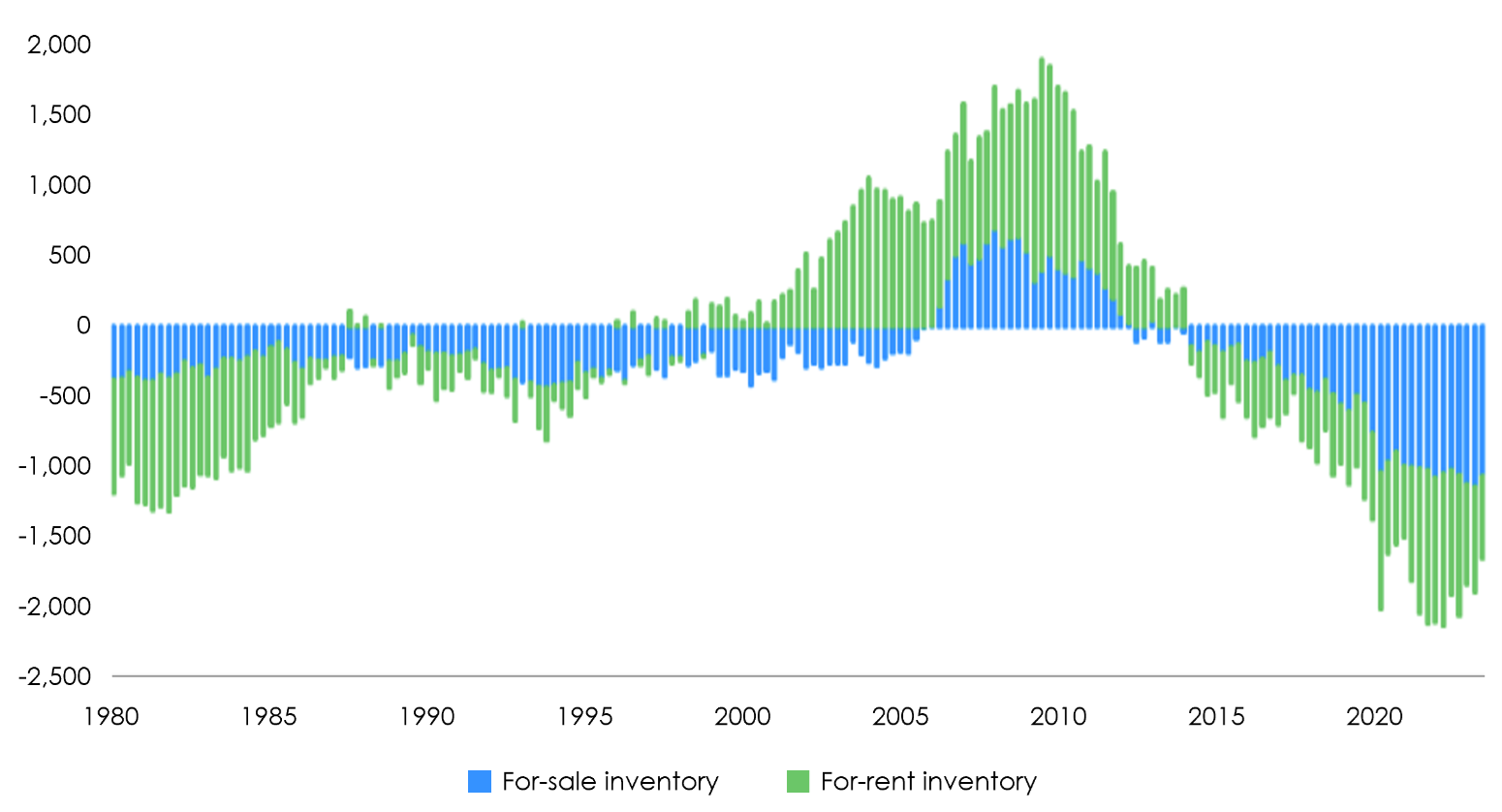

However, we remain optimistic for an eventual recovery and future growth. The housing market post-GFC was a shadow of its former self, as expected. The number of new homes built per year remained below early 2000s levels for a decade – but not just because of previous overbuilding. The rates of people aged 25-35 in the USA living with their parents went from 10% in 2000, to 15% in 2010, and to 17% in 2022, according to the US Census Bureau. This was driven by lower wage growth compared to house price appreciation and lower accumulated savings for a deposit – painful impacts of the GFC. That has caused pent-up demand for new homes as the millennial generation eventually ‘move out’. We can add to this US population growth driven by immigration over the past decade, as well as large numbers of Americans migrating domestically (particularly from high tax to low tax states).

The result – as Moody’s Analytics calculated – is a hypothetical housing deficit of more than 1.5 million homes, which could take anywhere from 4 years (JP Morgan estimate ) to 10 years (CBRE estimate ) to fill, depending on the rate of acceleration of new housebuilding.

Source: US Census Bureau, Moody’s Analytics, as at January 2024

Since we invested in IBP for the first time in January 2025, the company has achieved market share gains and healthy profitability above market expectations. Lower interest rates are a catalyst for new mortgage applications and new household construction growth to return – and we have just seen a 0.25% rate cut from the US Federal Reserve in September 2025. This is a small step but in the right direction for potential homebuyers. IBP’s share price has certainly responded well this year, up 50% year-to-date (in USD, as of 19 September 2025).

We visited the company at its headquarters in Columbus, Ohio in August 2025 to learn more about the cultural aspects of integrating new acquisitions, as well as competition with its arch-nemesis TopBuild (both companies share c.70% of the US insulation installation market but rarely compete head-on as they operate in different regions). We were delighted to hear about their excitement to continue growing share across new verticals, protecting the balance sheet with low leverage through cycles, and returning capital to shareholders with thoughtful buybacks at low prices.

We see IBP as a hidden gem that ticks the boxes for long term success – a healthy cash generative business with a strong distribution moat, led by a visionary owner-operator (Jeff Edwards still owns 15% of IBP), with myriad opportunities to redeploy capital and drive long term compounding.

Here I am checking out some insulation at IBP HQ:

[2]One Good Year Does Not Solve America’s Housing Shortage - Moody's CRE

[3] When will the crisis in U.S. housing affordability end—and how? | J.P. Morgan Private Bank U.S.

[4] Digging Out of the U.S. Housing Affordability Crisis | CBRE Investment Management

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds managed by the Economic Advantage team:

- May invest in smaller companies and may invest a small proportion (less than 10%) in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, a fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause a fund to defer or suspend redemptions of its shares. May invest in companies listed on the Alternative Investment Market (AIM) which is primarily for emerging or smaller companies. The rules are less demanding than those of the official List of the London Stock Exchange and therefore companies listed on AIM may carry a greater risk than a company with a full listing.

- May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- May invest in companies predominantly in a single country which maybe subject to greater political, social and economic risks which could result in greater volatility than investments in more broadly diversified funds.

- Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

The risks detailed above are reflective of the full range of Funds managed by the Economic Advantage team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

Alex Wedge

Alex Wedge joined the Economic Advantage team in March 2020 and became a co-manager at the start of 2021. Alex moved from Singer Capital Markets, one of the largest dedicated small cap brokers in London, where he had spent over seven years, latterly as a senior member of the equity sales team.

Bobby Powar

Bobby Powar joined the Economic Advantage team as a fund manager in 2024, and in January 2025 became co-manager of the Liontrust Global Smaller Companies Fund. Bobby moved from Artemis Investment Management, where he was a Global Equity Analyst.