About the MA Explorer Funds

The primary objective of the six Multi-Asset Explorer funds is to generate capital growth and/or income over the long term, which we define as five years or more. To achieve this, the funds explore the best investment opportunities across a range of asset classes, geographies, sectors and funds. The names of the funds represent the maximum exposure they can each have to equities: 35%, 45%, 60%, 70%, 85% and 100%. In managing these funds, the Multi-Asset team uses passive vehicles where it is appropriate to do so and they are available and invest in actively managed funds where we believe the opportunity to deliver higher returns is greatest or where passive funds are not an option.

While unlike the Multi-Asset Blended and Multi-Asset Dynamic Passive ranges, the Multi-Asset Explorer funds do not target risk, the latter are risk profiled.

Our Multi-Asset Explorer Funds

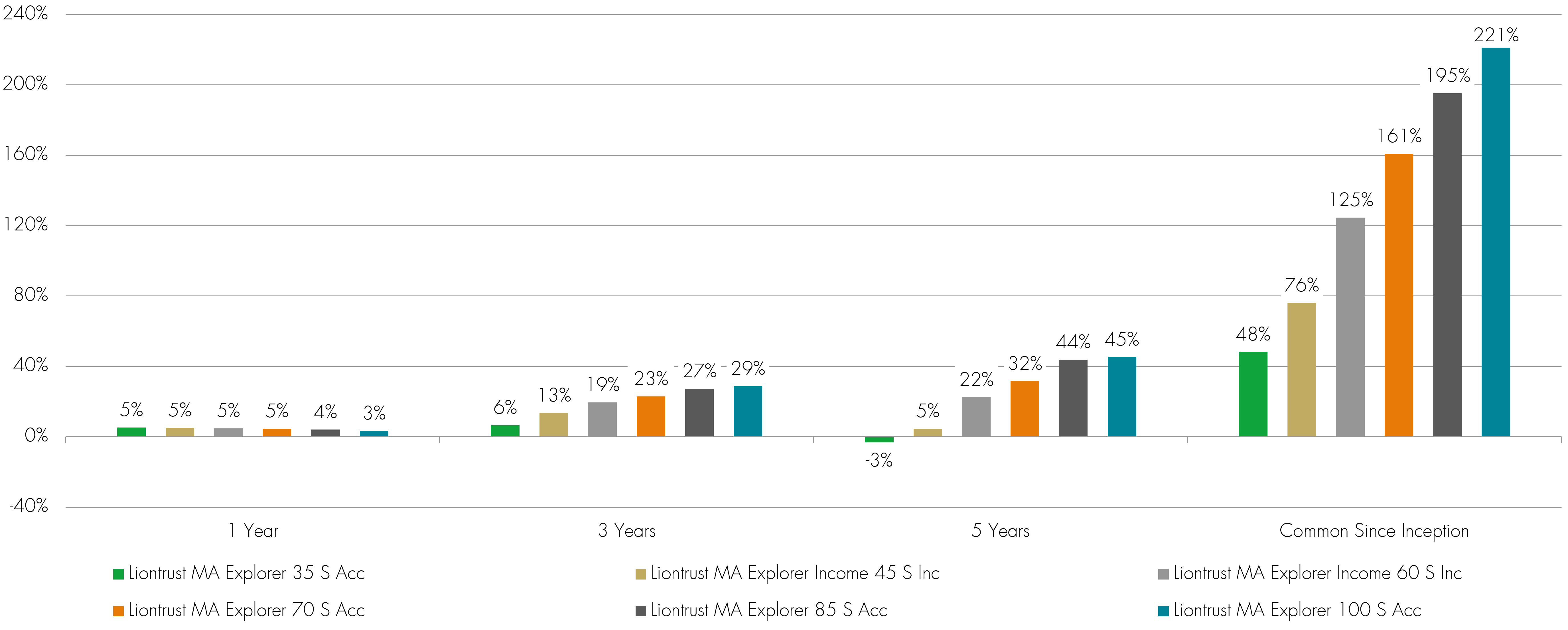

Performance of the Liontrust Explorer fund range

Source: FE Analytics, as at 30.06.25. Since inception data runs 10.04.07 to 30.06.25. Primary share class, total return figures are calculated on a single pricing basis with net income (dividends) reinvested. Performance figures are shown in sterling. Transaction costs are included for the period shown but may differ in the future as these costs cannot be determined with precision in advance.

Past performance does not predict future returns. You may get back less than you originally invested.

Literature

Latest insights

Your contacts

Key Risks

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments

- Credit Risk: There is a risk that an investment will fail to make required payments and this may reduce the income paid to the fund, or its capital value;

- Counterparty Risk: The insolvency of any institutions providing services such as safekeeping of assets or acting as counterparty to derivatives or other instruments, may expose the Fund to financial loss;

- Liquidity Risk: If underlying funds suspend or defer the payment of redemption proceeds, the Fund's ability to meet redemption requests may also be affected;

- Interest Rate Risk: Fluctuations in interest rates may affect the value of the Fund and your investment;

- Derivatives Risk: Some of the underlying funds may invest in derivatives, which can, in some circumstances, create wider fluctuations in their prices over time;

- Emerging Markets: The Fund may invest in less economically developed markets (emerging markets) which can involve greater risks than well developed economies;

- Currency Risk: The Fund invests in overseas markets and the value of the Fund may fall or rise as a result of changes in exchange rates.

- ESG Risk: there may be limitations to the availability, completeness or accuracy of ESG information from third-party providers, or inconsistencies in the consideration of ESG factors across different third party data providers, given the evolving nature of ESG.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Disclaimer

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.