Donald Phillips, Head of Credit in Liontrust’s Multi-Asset team, highlights the evergreen attractions of high yield bonds in uncertain economic times, and explains why an active approach is essential to mitigate systemic risks and minimise defaults.

An evergreen asset class

We consider high yield bonds to be an ‘evergreen’ asset class which offers investors attractive risk-adjusted returns in a wide variety of economic environments.

Due to its ‘junk’ nickname, high yield can often be approached with some reticence. This label stems from a period in the early 1990s when capital allocation was not at its most diligent, while also reflecting its technical classification of capturing everything that fails to make it into the investment grade category. It doesn’t, however, chime with the positive developments in the asset class seen in the last 30 years.

Naturally, defaults are a part of the high yield market, as are occasional bouts of volatility. What’s important to remember is that high yield consists of a large pool of companies making interest payments (coupons), and these provide the vast majority of returns. In fact, over the very long term, more than 100% of the total return is income from coupons.

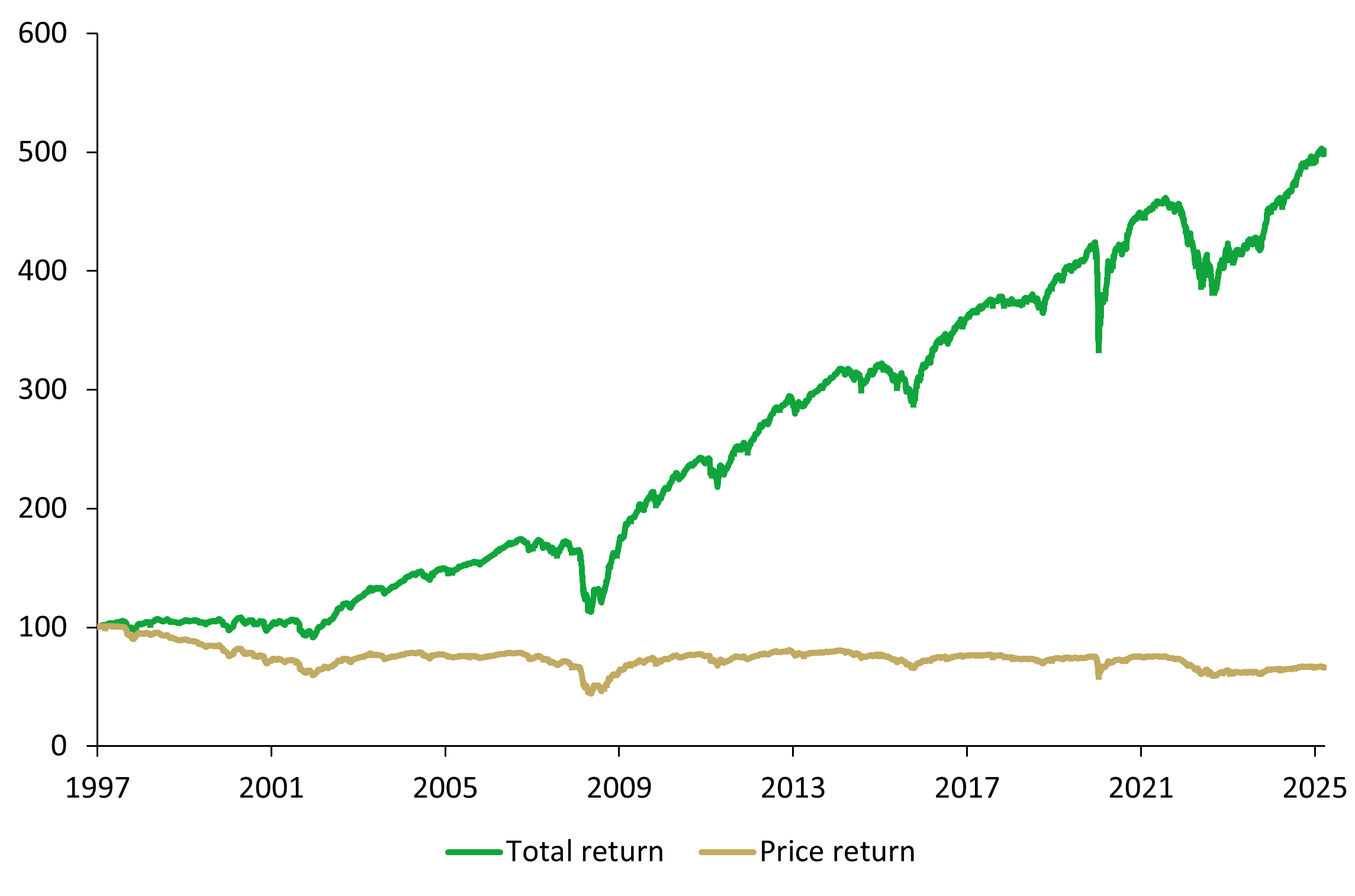

If held to maturity, the price return from high yield bonds as a group will be marginally negative due to the impact of a small number of issuers defaulting. However, not only can this negative price impact be alleviated by selecting high-quality issuers less likely to default, it is also massively outweighed in the long term by the large positive returns from coupon income. The chart below shows the difference between the ICE BofA Global High Yield Index’s moderately negative long-term price return and its impressively positive total return - a difference which is accounted for by income.

ICE BofA Global High Yield Index Total Return versus Price Return

Source: Bloomberg, ICE BAML, Liontrust. As at 31.03.2025.

The asset class is also attractive from a risk perspective – investors need not accept equity-like volatility in order to access the enhanced return profile they offer relative to government bonds. The high yield market has a long track record of producing less than half the drawdown of the equity market.

Buying the index – an approach with too much concentration of risk

When averaged across the market, defaults have a fairly small impact on annual total returns when compared with price fluctuations due to changes in interest rates and credit spreads.

But for the areas they do affect, defaults clearly have a large negative impact on portfolio returns as investors lose chunks of capital on companies unable to make interest or capital repayments.

An oddity of high yield index construction is that they will usually suffer a negative risk bias; value-weighted indices will be dominated by the sectors and companies which borrow the most. By following index weightings, this can actually mean taking on more risk in the form of lending to heavily indebted areas.

When they do occur, defaults are often concentrated in certain areas of the market. The turmoil at the beginning of the century, for example, had a problem child in the form of the telecoms sector, the great financial crisis hit the banking sector hardest, and the 2015 selloff saw defaults focused on energy and commodities.

These sectors can represent significant risks, particularly if they are cyclical, and this shouldn’t be ignored in the name of managing index relative risk. For example, energy is a big component of the market (around 13% of the US index). There is a high correlation amongst all constituents to one external factor – the oil price. It is not good diversification, in our view, to run a passive or index-hugging portfolio on this basis.

Seek diversity through avoiding large systemic risks

The key to unlocking the best returns from the asset class is to avoid companies that default on their debts. We target a quality bias towards the more creditworthy borrowers through a combination of fundamental research of individual corporate bonds and avoidance of thematic, cyclical sector risks.

We also believe that seeking out companies with idiosyncratic risk and avoiding large accumulations of thematic, cyclical risk is the best way to achieve good long-term outcomes within high yield. We look at global developed market high yield which gives us a universe of over 3,000 to choose bonds from.

We seek true diversification, and we are happy to ignore what the index is telling us to own. Not only does this empower a strong focus on stock picking, but it also helps avoid behavioural investment mistakes. During any period of shorter-term market volatility, one does not want to feel overexposed to one part of the market – it might make you want to sell at exactly the wrong time. Getting “topped and tailed” during periods of market volatility can destroy as much capital as defaults, and our investment approach is designed to avoid this mistake.

Starting from a position of robust balance sheets, the outlook for high defaults remains benign. We expect corporate earnings to come under pressure as tariff impacts ripple through, but these will not be large enough to provide an existential threat to bond issuers. With a yield of over 7%, and easily manageable clouds on the horizon, we believe that high yield is in a sweet spot for the upcoming year with its evergreen income properties looking increasingly appealing in these uncertain times.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds and Model Portfolios managed by the Multi-Asset team may be exposed to the following risks:

- Credit Risk: There is a risk that an investment will fail to make required payments and this may reduce the income paid to the fund, or its capital value;

- Counterparty Risk: The insolvency of any institutions providing services such as safekeeping of assets or acting as counterparty to derivatives or other instruments, may expose the Fund to financial loss;

- Liquidity Risk: If underlying funds suspend or defer the payment of redemption proceeds, the Fund's ability to meet redemption requests may also be affected;

- Interest Rate Risk: Fluctuations in interest rates may affect the value of the Fund and your investment. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result;

- Derivatives Risk: Some of the underlying funds may invest in derivatives, which can, in some circumstances, create wider fluctuations in their prices over time;

- Emerging Markets: The Fund may invest in less economically developed markets (emerging markets) which can involve greater risks than well developed economies;

- Currency Risk: The Fund invests in overseas markets and the value of the Fund may fall or rise as a result of changes in exchange rates;

- Index Tracking Risk: The performance of any passive funds used may not exactly track that of their Indices.

The risks detailed above are reflective of the full range of Funds managed by the Multi-Asset team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

Donald Phillips

Donald Phillips is head of credit in the Liontrust Multi-Asset team. He joined Liontrust in February 2018 from Baillie Gifford. Previously, Donald had been co-managing the European high-yield strategy at Baillie Gifford since 2010.