The outlook for the rest of 2025 offers an exciting opportunity for active management and alternative equity strategies. As we outlined in the review section of the first half of 2025, the path to the best returns will likely continue to lie outside the concentrated (passive) S&P trade of the last few years.

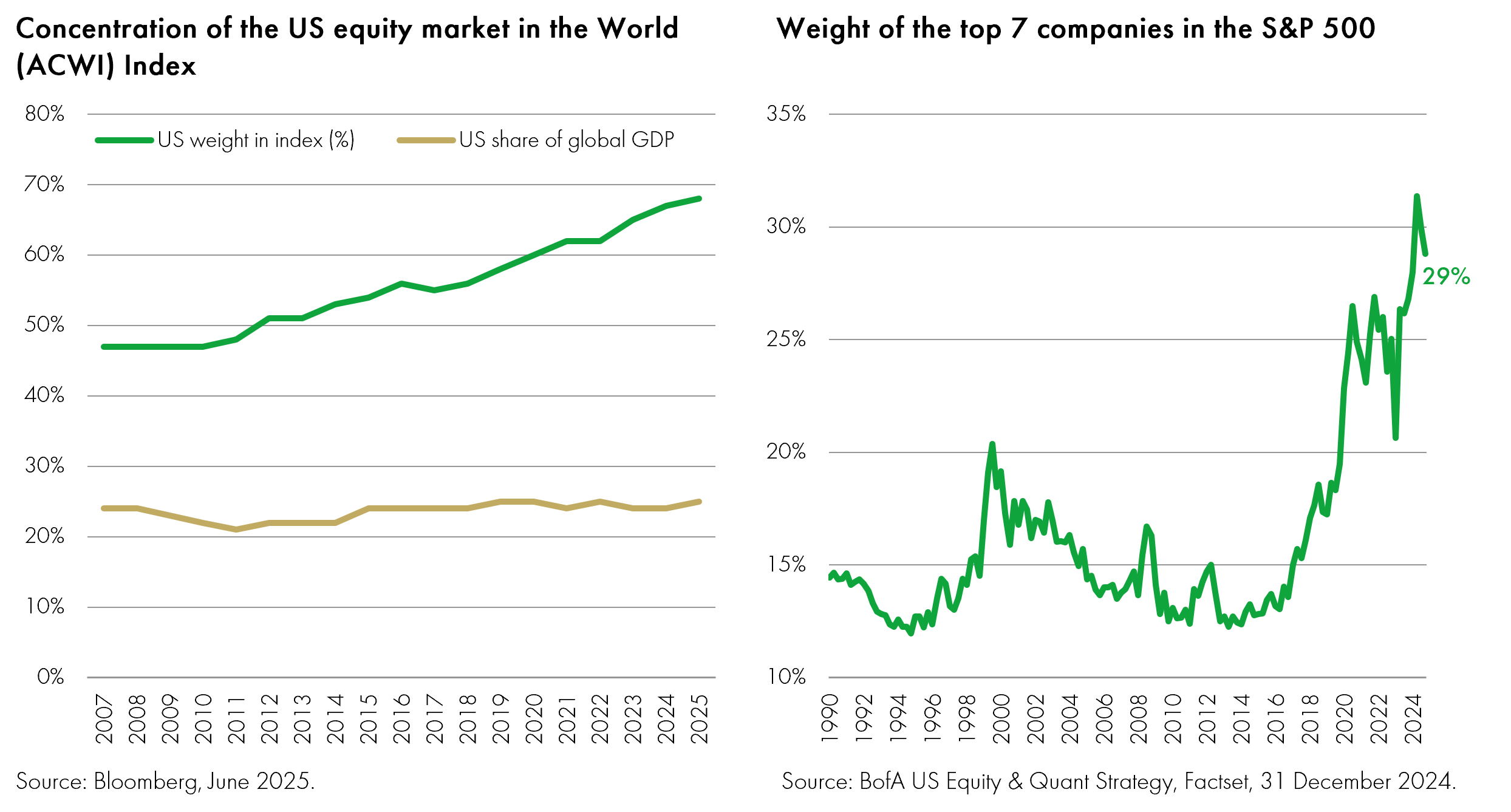

The charts below show how the consensus trade has raised the level of US concentration in the World Index, rising from 47% in 2010 to 68% in 2025. Within the S&P 500 itself (being a proxy for US concentration), the Magnificent 7 represent 29% of that index, levels barely seen in the last 100 years. With concentration risk, valuation and profit margins all sitting at record high levels over many years, overall equity returns are going to be harder to achieve.

This means that the way to generate acceptable returns will require more creative and thoughtful portfolio creation and stock picking. This might be in a long only context but we believe it will also shine a light again on long/short equity investing that has been sidelined by a combination of easy gains over the last 10 years as well as the rise of private equity as a portfolio diversifier.

The world today is filled with higher levels of geopolitical risk, led by a US administration that is putting America first and rushing headlong into strategies that support onshoring and the development of its independence in all critical resources from energy to AI.

The reserve currency status of the US dollar has been called into question with some of the highest foreign exchange volume days ever since April’s Liberation Day tariff announcements. From corporates to pension funds, investment teams have been mulling over the rise of economic nationalism and the impact this will have on the US dollar. Investment teams, realising that so much of their risk has been tied up in US dollar longs of various flavours, have moved from a SAA (Strategic Asset Allocation) approach to a total portfolio approach placing more emphasis on the risks inherent in the underlying assets. All of this is music to the ears of highly risk aware active managers. The status quo of the last 10 to 15 years is set to change.

This backdrop requires a much more careful assessment of risk v reward. We believe that risk adjusted returns will be front and centre of investors’ minds running through the second half of the year and this will translate into a demand for strategies that both diversify risk and reduce volatility – again a potential recipe for the resurgence of long/short investing alongside carefully curated funds.

Thematically, we remain positive about the potential for AI to drive significant benefits across all industries and work on identifying winners in the use cases that trump investing in the infrastructure providers which run a risk of running into a capacity glut.

We have waited patiently for the crypto world to unfold, and the IPO of Circle Internet could act as a Chat GPT moment for stablecoins. This will benefit the entire blockchain/crypto supply chain and, together with fintech, remains a key theme for the rest of this year.

Our base case is that equity markets globally remain little changed in the second half of 2025 but the polarisation of winners and losers will remain significant. For the first time in many years, geographical diversification will matter, as will stock selection outside the very biggest companies in the world. In this environment, the overall market returns matter less, but we worry that many investors will remain stranded in the trades that led the last 10 years rather then those that will lead over the next 10, leaving portfolios vulnerable to underperformance. Active equity strategies both long and long/short will play a vital role in cementing return profiles as well as risk mitigation.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

Non-UK individuals: This document is issued by Liontrust Europe S.A., a Luxembourg public limited company (société anonyme) incorporated on 14 October 2019 and authorised by and regulated as an investment firm in Luxembourg by the Commission de Surveillance du Secteur Financier (“CSSF”) having its registered office at 18, Val Sainte Croix, L-1370 Luxembourg, Grand Duchy of Luxembourg and registered with the Luxembourg trade and companies register under number B.238295.

UK individuals: This document is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

Mark Hawtin

Mark Hawtin is head of the Global Equities team. Mark joined Liontrust in 2024 from GAM, where he was an Investment Director running global long-only and long/short funds investing in the disruptive growth & technology sectors. Before joining GAM in 2008 he was a partner and portfolio manager with Marshall Wace Asset Management for eight years, managing one of Europe’s largest technology, media and telecoms hedge funds.