What food is healthy and what to avoid has been a topic of conversation for decades. Time to add another concept to think about when you walk into the supermarket: ultra-processed food, or UPF.

This term is very much in vogue – what does it mean, how do we think about it, how do we assess evidence of health outcomes?

Needless to say, our view in the Sustainable Future (SF) team is to generally agree that UPF is playing a role in creating an obesogenic environment and many subsequent health issues we see in the modern world.

We do however acknowledge that an obesogenic environment is also a very complicated, multi-faceted issue that is inherently hard to pin down to one specific factor.

Obesity and us

It’s not new information that the world is becoming more obese. All one needs to do is to track BMI (body mass index) over decades to clearly reveal this trend in developed countries. In the US, obesity rates have climbed from 19% in 1990 to 43% in 2022. This side of the Atlantic is no different – UK obesity rates track from 12% to 28% over the same period.

Obesity in adults, 1990 to 2022

Source:1- World Health Organisation 2025, Obesity in Adults 1990-2022 Estimated prevalence of obesity, based on general population surveys and statistical modelling. Obesity is a risk factor for chronic complications, including cardiovascular disease, and premature death.

Obesity worsens health outcomes and raises healthcare costs. It is a major risk factor for type 2 diabetes, cardiovascular events (heart attacks, strokes), Alzheimer’s, osteoarthritis, and several cancers. Traditional management has ranged from the “calories in – calories out” model to exercise promotion and restrictive diets cutting sugar, fat, or carbs.

However, research shows that targeting a single ingredient rarely works long term; most weight loss and cardiovascular benefits vanish after 12 months. Experts at the Harvard School of Public Health note a growing consensus that the quality of food matters more than the number of calories consumed. This has shifted focus toward a holistic approach, assessing overall dietary quality rather than blaming one nutrient.

Obesity is increasingly viewed as a form of malnutrition: consuming calorie-dense, nutrient-poor food that lacks key vitamins and minerals, yet contributes heavily to energy intake. Many obese individuals show deficiencies in nutrients such as vitamin A, B1, and iron.

Low-quality foods – particularly snacks and ultra-processed products – are often less satiating, prompting people to eat more in search of fullness. This cycle drives excess calorie consumption while failing to meet nutritional needs. Research is beginning to show that in order to address obesity, therefore, we must improve access to and consumption of high-quality, nutrient-rich foods, not merely reducing calorie counts or eliminating single ingredients.

Ultra processed foods: what are they?

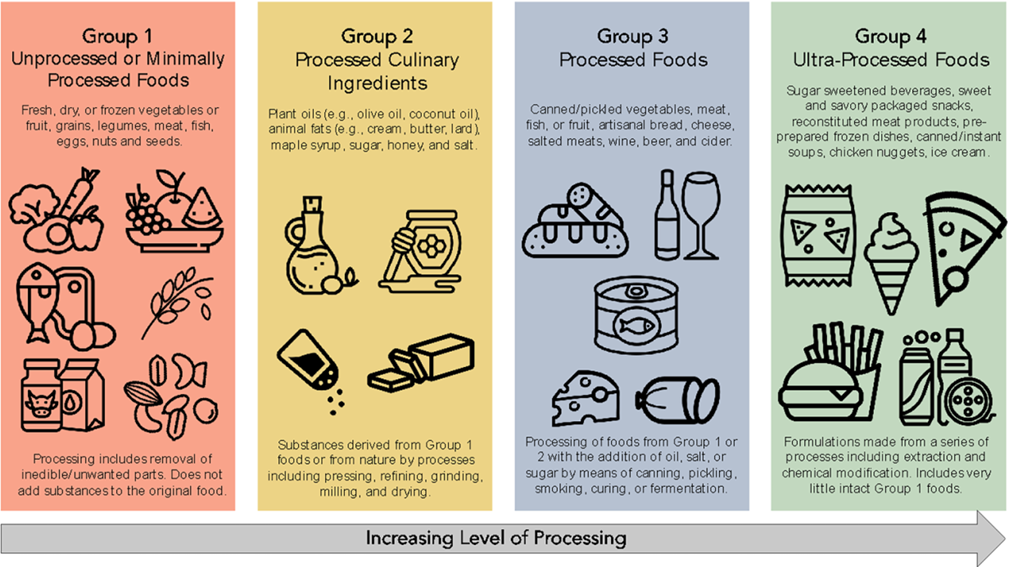

Ultra-processed food refers to “multi-ingredient industrial formulations” often created through modification or chemical extraction. These products typically contain ingredients absent from a home pantry, signalling large-scale processing – such as preservatives, emulsifiers, sweeteners, and artificial colours or flavours, according to the British Heart Foundation.

It is this processing of reformulation/modification of basic food molecules where ultra processed food is alleged to lose its nutritional value.

The reformulation of basic food molecules in UPFs is thought to diminish nutritional value. A 2019 study matched fat, sugar, and macronutrients between minimally processed and ultra-processed diets, finding that those on the UPF diet gained more weight, consumed more, and had higher overall energy intake.

The health risks are drawing growing attention. At the European Society of Cardiologists conference in August 2023, research showed that the highest consumers of UPFs were 39% more likely to develop high blood pressure. Another large study linked UPF intake to a 24% higher risk of serious heart events. A meta-analysis found that 80% of studies on obesity and UPFs showed a positive association – the more UPF in the diet, the greater the obesity risk.

In the UK, UPFs account for 51% of the average diet; in the US, 61%; and in Norway, 49%. This shift means that ultra processed food is displacing whole, nutritious food.

Impacts on our Delivering healthier foods theme and how we invest

This work has helped the Liontrust Sustainable Future team redefine how we think and invest behind companies aligned to our theme Delivering healthier foods. Shifting awareness and scientific evidence has helped inform our understanding of healthier foods and identified companies enabling people to eat fresh, whole ingredients that are nutritionally balanced and rich, and avoid additives, preservatives, emulsifiers etc.

As a result, we have made a number of investment decisions to align our portfolios within this theme. We reviewed our sustainability matrix to identify what products constituted As or Bs on our product rating depending on how a company enables fresh, whole ingredients to be cooked as close to first principles as possible – ideally at home, so the customer is doing the processing themselves, rather than at an industrial scale.

Cava: dishing up fresh mediterranean cuisine in a bowl

Cava is a US$10 billion restaurant chain serving fresh Mediterranean cuisine across the US. Its walk-through counter format allows customers to build meals from freshly cooked vegetables, proteins, and minimally processed whole foods – an appealing proposition in a country where nearly 75% of adults are overweight or obese.

The Mediterranean diet is associated with positive health outcomes and longevity, yet remains underpenetrated in the US. Cava is still early in its expansion, with 367 locations at the end of 2024 and a goal of 1,000 by 2032.

Its success stems from strong brand positioning around healthy, fresh ingredients delivered quickly and conveniently, driving robust same-store sales and market-leading margins. Cava also enjoys a high net promoter score, strong Google reviews (4+), and high repeat intention among customers (Bernstein Survey 2024).

With our focus on companies enabling healthier eating through whole, balanced meals, Cava fits squarely within this theme and is well-placed to benefit from growth tailwinds as consumers move away from ultra-processed foods.

The SF team started a position in Cava in the Liontrust SF Global Growth and GF SF US Growth Funds in July 2025.

Compass Group: outsourcing kitchens

We have held Compass Group for well over a decade in our Liontrust SF UK Growth Fund and SF Managed fund range. A £45 billion market cap UK-based company, Compass generates 86% of its revenue from catering – feeding people in permanent outsourced kitchens at their customer’s location. Its largest customer markets are in-office canteens (35% of revenue), hospital and healthcare catering (24%), and feeding children at school (18%). Our team’s prior understanding of healthy food meant that because Compass could not provide an underlying breakdown of ingredients and nutritional information, we rated the company a ‘C’ (modest positive).

However, with our evolving understanding of ultra processed food, we have re-allocated Compass Group into Delivering healthier foods and upgraded its product rating to a ‘B’. Fresh ingredients freshly cooked from first principles on location is deemed likely to be healthy, and because Compass is operating kitchens where food is freshly prepared, we believe this is likely to be providing healthy food. Further, as a team we discussed Compass Group’s impact in providing fresh food globally, including to children and in healthcare settings, and decided Compass’s contribution to a healthy, sustainable economy was likely net positive.

HelloFresh: delivering healthier foods to your door

HelloFresh is a Berlin-based global meal kit company delivering fresh raw ingredients via meal kit boxes directly to your door. We hold HelloFresh in our Sustainable Future European Growth Fund. Recipes are chosen and the ingredients required – like fresh vegetables, protein and carbs – are delivered raw and cooked at home with minimal processed ingredients. Given HelloFresh enables home cooking with these ingredients, it is rated highly within our Delivering healthier foods theme; in our sustainability matrix product rating the company receives the highest score of A.

HelloFresh is operationally excellent across its distribution sites that management have iterated over time. Incremental improvements in efficiency have led to the company’s ability to scale effectively. Running a fresh food logistics network that connects food suppliers, boxes ingredients, and distributes direct to customers is difficult to replicate – and no other competitor has been successful at scale globally. For example, HelloFresh has nearly 25x the revenue of the nearest meal kit competitor in 2024 and operates globally – other competitors focus on niche regions.

Divesting Kerry Group: enabling ultra processed foods

The team has also divested from a long-held company we thought was on the wrong side of this trend: Kerry Group. Our original thesis on the company was that Kerry was enabling healthier foods via the reduction of calories, sugar, salt, and fat in food. However, an outcome of this work and refreshing our understanding of healthier foods meant addressing the company’s exposure selling food additives, flavourings, preservatives, and emulsifiers into the food and beverage industry.

We concluded that nearly 100% of Kerry’s revenues were derived from selling ingredients and services to the ultra-processed food industry. These ingredients are used for the purposes of ultra processing – you don’t need an emulsifier to cook fresh broccoli at home.

There is growing scientific research on the harm of these ingredients. Many emulsifiers, like carrageenan, gums, and DATEM, have been linked to a degrading gut microbiome and inflammation[1]. Another study posited that alongside an increased inflammatory response in gut and body you would expect to see increased weight gain[2].

Therefore, we exited our position in Kerry after refreshing our theme, believing the company was negatively exposed to this area and the delivering healthier foods theme.

[1] Naimi,S. et al 2021, ‘ Direct impact of commonly used dietary emulsifiers on human gut microbiota’, Microbiome

[2] Miclotte, L et al 2020, ‘Dietary Emulsifiers Alter Composition and Activity of the Human Gut Microbiota in vitro, Irrespective of Chemical or Natural Emulsifier Origin’, Frontiers in Microbiology

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds managed by the Sustainable Investment team:

- Are expected to conform to our social and environmental criteria.

- May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund.

- May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares. May invest in companies listed on the Alternative Investment Market (AIM) which is primarily for emerging or smaller companies. The rules are less demanding than those of the official List of the London Stock Exchange and therefore companies listed on AIM may carry a greater risk than a company with a full listing.

- May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- May invest in companies predominantly in a single country which maybe subject to greater political, social and economic risks which could result in greater volatility than investments in more broadly diversified funds.

- Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

The risks detailed above are reflective of the full range of Funds managed by the Sustainable Investment team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

Sarah Nottle

Sarah is an investment analyst, having joined Liontrust in 2021 on the Sustainable Investment Equities team. Prior to this, she worked within the asset management industry in an operations role.