It isn’t hard to find commentary highlighting the apparent expensive valuations in credit markets. Equally, it doesn’t take long to find a high yield manager encouraging investors to take the view “spreads may be expensive, but the all-in yield is attractive.”

As a credit investor, I’ve always found one part of equity investing mysterious: the difficulty of knowing when markets are “too expensive.” In equities, valuation tools – price/earnings ratios, cyclically-adjusted multiples – are hotly debated but rarely decisive. In credit, by contrast, commentators have a cleaner metric; spread – the excess yield above government bond yields – serves as a yardstick of whether markets are cheap or rich. When spreads are wide, credit looks attractive; when spreads are tight, it looks expensive. As an aside, I have always been a little surprised that many investors use high yield in their funds only on this basis, effectively 'renting' the asset class for capital upside, and not using it for long term income.

So which is it, yield or spread? To answer this question I thought I’d use our favourite new (robot) colleague, ChatGPT. I gave it the data and asked the question: which is the better predictor of long-term returns, spread or yield?

The results were useful for my confirmation bias. Spread did a respectable job on its own, explaining about 62% of the variation in subsequent five-year returns. But yield was far more powerful. Starting yield explained close to 87% of the variation in returns. Put simply: spreads contain useful information, but yield is the anchor.

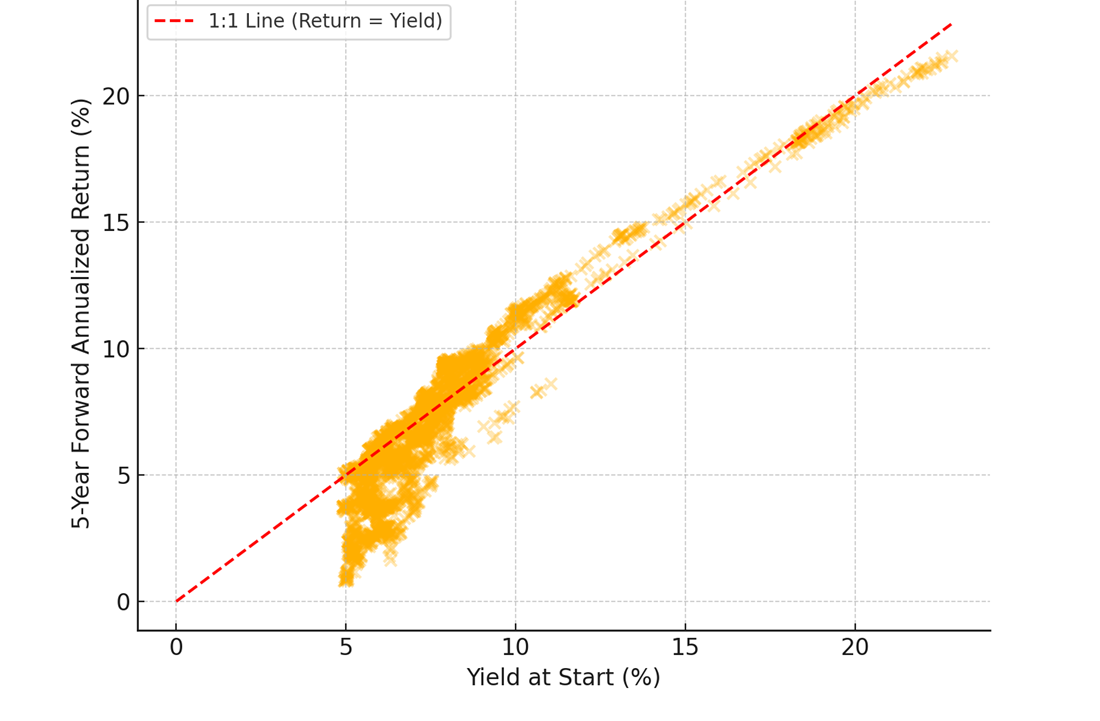

While I was at it, I asked ChatGPT to make me a chart to emphasise the predictive power of starting yield. The scatter plot below makes the same point visually. Each dot shows the market’s starting yield against the actual five-year return which followed. The red dashed line is the simple “what you yield is what you earn” relationship. Based on ChatGPT's analysis, the clustering around that line tells its own story: yield today could be a remarkably good guide to the return you get tomorrow.

Global high yield bonds: starting yield versus subsequent five-year investment returns.

Source: ICE BofA, Liontrust, August 2025. Chart plot via ChatGPT. Past performance does not predict future returns.

So what does this mean for today’s market? With global high yield offering an all-in yield of around 7%, that figure shouldn’t be dismissed as just another statistic. History suggests it’s a pretty good anchor for what investors are likely to earn over the medium term. And to put it in perspective: the long-run return on equities has been about 7–10% per year in the US, and 6–7% globally.

In other words, high yield today offers prospective returns in line with equities, while sitting higher in the capital structure and having very rarely delivered negative outcomes over five-year horizons.

So yes, spreads may be tight. Yes, the cycle will ebb and flow. But the evidence is clear: yield is the best predictor of long-term credit returns. And right now, 7% is not just attractive—it’s a guidepost.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The single strategy funds managed by the Multi-Asset team:

- May consider environmental, social and governance ("ESG") characteristics of issuers when selecting investments for the Funds.

- May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund.

- Holds Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay.

- May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- May, under certain circumstances, invest in derivatives, but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. The use of derivative instruments that may result in higher cash levels. Cash may be deposited with several credit counterparties (e.g. international banks) or in short-dated bonds. A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

- May invest in emerging markets which carries a higher risk than investment in more developed countries. This may result in higher volatility and larger drops in the value of the funds over the short term.

- May target an absolute return. There is no guarantee that an absolute return will be generated over the time period stated in the fund objective or any other time period.

The risks detailed above are reflective of the full range of single strategy funds managed by the Multi-Asset team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

Donald Phillips

Donald Phillips is head of credit in the Liontrust Multi-Asset team. He joined Liontrust in February 2018 from Baillie Gifford. Previously, Donald had been co-managing the European high-yield strategy at Baillie Gifford since 2010.