- OSI Systems is the global leader in cargo and border inspection with over 50% market share.

- Border security is transforming into a structural growth sector.

- OSI’s unique IP, strong distribution network, growing recurring revenue, and founder ownership align with our Economic Advantage approach.

Have you travelled through an airport or crossed a border recently? It’s rarely glamorous. One minute you’re trying to juggle your passport, shoes and laptop, the next you’re standing barefoot on a cold floor wondering if your bottle of water will trigger a security incident. We laugh about it afterwards, but those awkward moments are part of something much larger: governments are spending record sums on border security.

Behind much of this infrastructure is OSI Systems. When we sat down with their management in Boston this summer, they emphasised just how central border security has become to the company’s future. OSI positions itself as the global leader in cargo and border inspection, with over 50% global market share and a $1.8 billion order backlog that underscores how critical this area has become to its growth.

Rapid growth in US border spending

Since the creation of the Department of Homeland Security in 2003, US Customs and Border Protection (CBP) and US Immigration and Customs Enforcement (ICE) budgets have more than tripled to nearly $30 billion annually, now accounting for almost two-thirds of federal law enforcement funding. This steady expansion reflects enduring pressures: migration, trade, and drug enforcement. The One Big Beautiful Bill Act (H.R. 1) of 2025 added another $6.2 billion, with about $1 billion for non-intrusive inspection systems like OSI’s. Additionally, many airport scanning devices currently in use are over ten years old, indicating an impending wave of replacements that will generate opportunities for both hardware sales and sustained service revenue.

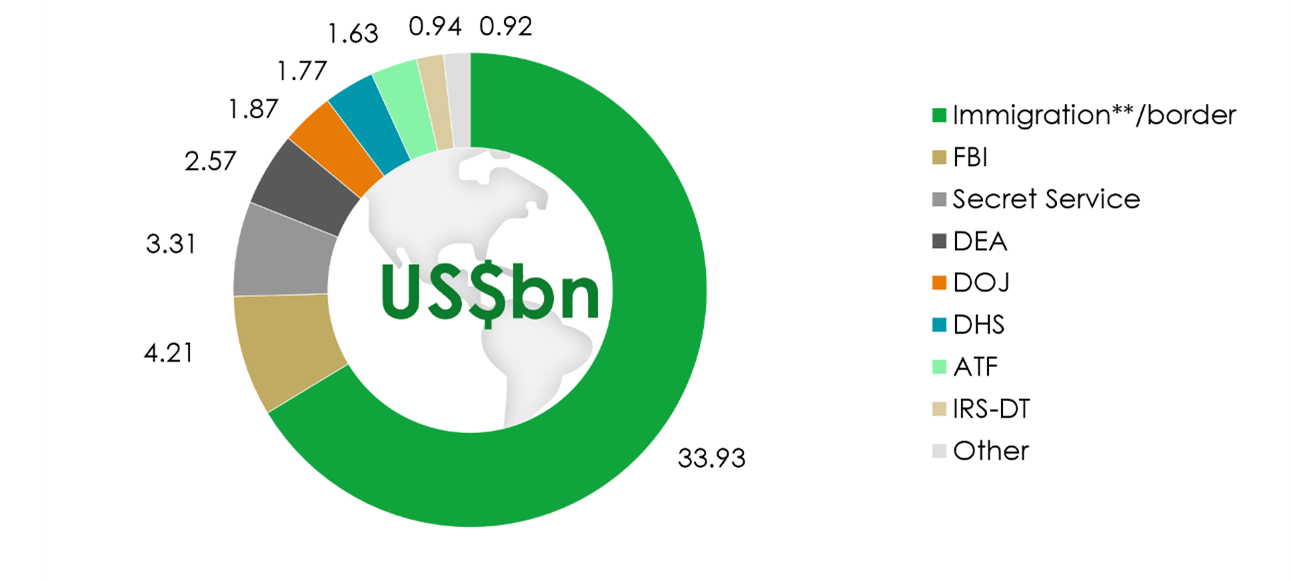

Allocation of US federal law enforcement spending in FY2025, by federal entity (in billion US dollars)

*Before H.R 1. ** includes appropriated discretionary budget authority for CBP, ICE, USCIS, DHS general offices and 20 percent of the Coast Guard. Source: Congressional Budget Office via CATO Institute; Statista. July 2025.

Tariffs and geopolitical instability among the key customs drivers globally

Outside the US, the same themes are playing out. Europe’s latest aviation cycle is ending, but customs spending continues to rise. Emerging markets such as Mexico and Brazil are building port and border infrastructure as they continue to grow exports. For governments with tighter budgets, OSI’s turnkey model – where it operates scanning systems and charges fees linked to customs receipts – provides an attractive alternative. Puerto Rico is a proven case, running successfully for more than a decade.

Geopolitics add urgency. When conflicts end, new borders need inspection systems – Ukraine was cited as a clear opportunity. Rising tariffs also increase scrutiny of cargo, making OSI’s CertScan platform – which reconciles inventory, images, and data across multiple systems – increasingly valuable.

Economic Advantage

OSI’s edge lies in engineering and software. For example, the OSI airport scanners rotate the signal instead of the sensor, reducing maintenance and downtime. In cargo inspection, it offers both backscatter and transmission imaging, often written into tenders as requirements that limit the field to a handful of suppliers. The bigger shift is digital. CertScan is becoming the backbone of customs operations, integrating scanner data, documentation, and reporting into a single interface. Because it works with third-party equipment too, it locks in customers and drives high margin, recurring revenue.

Hardware still dominates, but services, software and turnkey contracts now represent up to 30% of sales. These long-term agreements embed OSI deeply into customs operations, strengthening customer relationships and creating resilience through cycles.

We believe OSI is a great demonstration of the Economic Advantage process applied globally. Proprietary technology and regulatory approvals create barriers to entry; global reach embeds its products in critical infrastructure; growing recurring revenues improve earnings quality; and founder-CEO Deepak Chopra and his team hold around 5% equity ($200m equity value), ensuring alignment with shareholders. Returns on capital have continued to improve, underscoring the company's robust distribution network and intellectual property advantages.

Here we are at the Rapiscan HQ (OSI’s main security business)!...

Border spending is no longer cyclical – it is structural. For OSI, this means growth in near-term hardware sales and, more importantly, an expanding base of sticky software and ongoing service revenues. For investors, it represents exactly what we seek: a founder-led business with strong intangible assets, high returns on capital, and alignment with shareholders — well placed to compound value as border spending breaks new ground.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds managed by the Economic Advantage team:

- May invest in smaller companies and may invest a small proportion (less than 10%) in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, a fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause a fund to defer or suspend redemptions of its shares. May invest in companies listed on the Alternative Investment Market (AIM) which is primarily for emerging or smaller companies. The rules are less demanding than those of the official List of the London Stock Exchange and therefore companies listed on AIM may carry a greater risk than a company with a full listing.

- May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- May invest in companies predominantly in a single country which maybe subject to greater political, social and economic risks which could result in greater volatility than investments in more broadly diversified funds.

- Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

The risks detailed above are reflective of the full range of Funds managed by the Economic Advantage team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

Alex Wedge

Alex Wedge joined the Economic Advantage team in March 2020 and became a co-manager at the start of 2021. Alex moved from Singer Capital Markets, one of the largest dedicated small cap brokers in London, where he had spent over seven years, latterly as a senior member of the equity sales team.

Bobby Powar

Bobby Powar joined the Economic Advantage team as a fund manager in 2024, and in January 2025 became co-manager of the Liontrust Global Smaller Companies Fund. Bobby moved from Artemis Investment Management, where he was a Global Equity Analyst.