This week’s quarter-point US interest rate cut to a 4.0% - 4.25% range was widely anticipated, and the likelihood of further cuts had already been rapidly priced into bond markets via higher prices and lower yields.

The catalyst for this re-pricing has been mounting concern around US labour market trends, where signs of weakening have eclipsed inflation concerns in policymakers’ priorities. While upside risks to inflation and downside risks to employment have conflicting implications for the direction of interest rates – the US Federal Reserve has opted for a rate cut which US Federal Reserve chair Jay Powell has characterised as a risk management move.

Both Federal Reserve forecasts and financial market pricing are pointing to two further insurance rate cuts later this year.

Labour market concerns take priority

Analysis of US labour market conditions has intensified in recent months, with disappointing data from the US Bureau of Labor Statistics early this month providing a focal point. This suggested only 22,000 jobs were created in August, below the 75,000 forecast by economists and the 79,000 added in July.

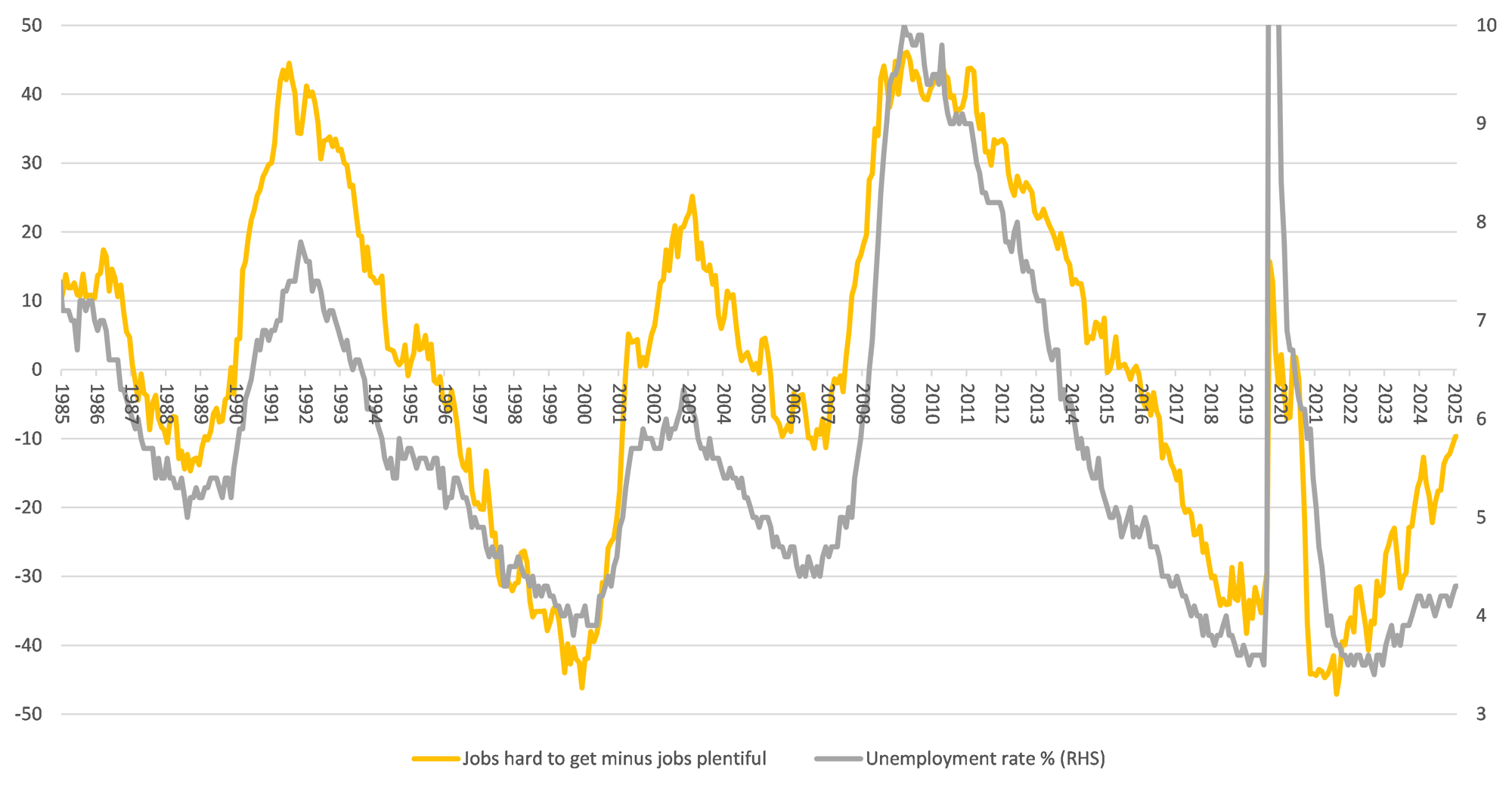

Softening in labour market conditions has been an ongoing trend since the extreme post-lockdown hiring spree, as shown in the chart below:

Job availability versus unemployment rate

Source: Conference Board, BLS, Bloomberg, Liontrust; 18.09.25.

This shows, in orange, the difference between the jobs hard to get and the jobs plentiful data series, with a lower net number illustrating a buoyant employment market. As expected, this is loosely tracked by the official unemployment rate (in grey). With the orange series showing that jobs are increasingly tipping towards “hard to get” rather than “plentiful”, it does imply that unemployment is likely to be rising soon (albeit this is complicated somewhat by an abrupt slowdown in US net immigration).

There is now a fragile calm with low hiring and firing rates but a minor pickup in the latter would quickly feed through to increases in unemployment.

When will tariffs affect inflation, and by how much?

The Fed’s dual mandate to promote employment and price stability is currently challenged by a high degree of uncertainty around the impact of trade tariffs on both elements.

In August, headline consumer price inflation (CPI) was 2.9%, up from 2.7% as tariff impacts wash through to goods prices with lags. More tariff sensitive sectors such as autos have already seen increases, but I expect tariff effects to continue to filter through to goods prices for most of this year.

What is more important to the Federal Reserve is whether these goods price rises affect inflation expectations, and therefore impact services inflation via the transmission mechanism of wage rises. Services remain the dominant part of the inflation basket.

A delicate balancing act

This uncertain and fragile economic outlook is reflected in the Federal Reserve’s latest set of economic forecasts – its summary of economic projections (SEP).

It’s rare that a rate cut is accompanied by growth estimate upgrades, but this is what this week’s Fed update delivered – illustrating the lack of confidence over the likely direction of the economy. The 2026 forecasts jump out, with growth estimates revised up by 0.2 percentage points, headline and core inflation also up 0.2%, and unemployment down 0.1%. Powell has been very open about the uncertainty around the variables influencing the forecasts.

Source: SEP, Liontrust. June 2025 forecasts in brackets

The Fed’s rate-setting committee made clear that while inflation is currently “somewhat elevated”, it is the risks around the trajectory of labour market conditions that have tipped its hand: “…the Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment have risen.”

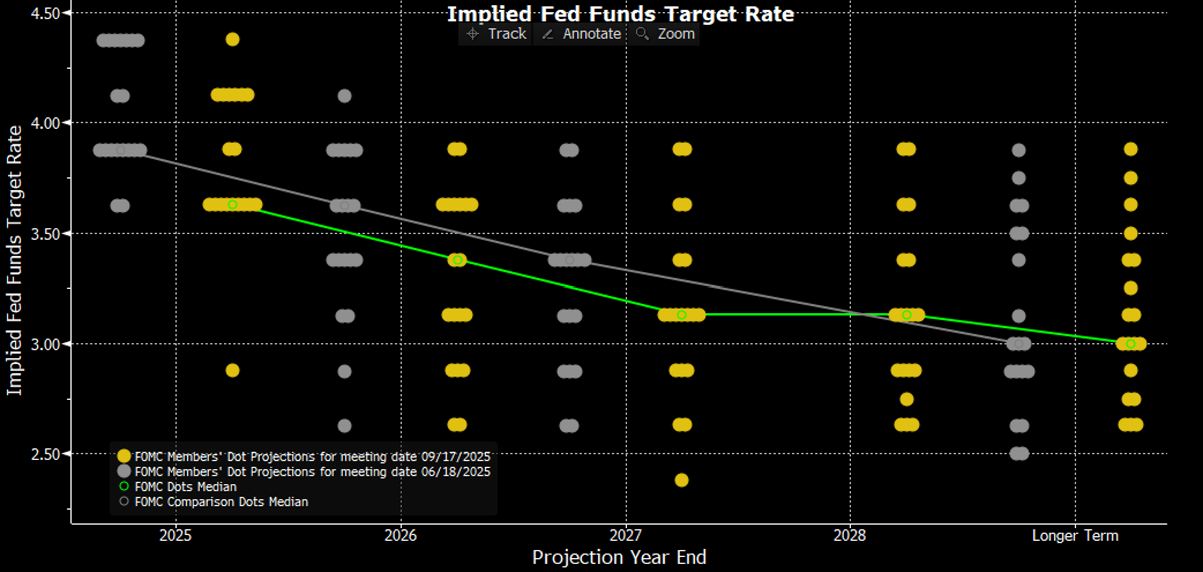

The SEP also contains the infamous dot plot of members’ projections of where they see rates over the coming years and the long term. The new September forecasts are in green/yellow and the prior June estimates in grey. The central case for this year is two more rate cuts.

Source: SEP, Bloomberg, 18.09.25

Rate cuts had already been priced into bond markets over the last month. Across the US government bond yield curve, we have seen rising prices and falling yields in anticipation of lower rates. At the 10 year maturity, for example, US bond yields have dropped from 4.33% a month ago to about 4.08% currently.

In our bond strategies, we have been moderately ‘long duration’, meaning we have higher-than-average interest rate exposure and therefore benefit from price rises, with a lot of this exposure coming via US bonds.

As a result of the recent strength in US bonds, we have moved to reduce the size of the long duration position and also switched some exposure to better value European government bonds.

We also continue to think the US yield curve will steepen – i.e. short-dated bond yields will fall relative to longer-dated ones – but we have now reduced the size of that position in order to lock in some gains.

As well as broad worries over fiscal stability, one of the factors behind recent curve steepening has been relative weakness in US long-dated bonds as investors price in risks associated with Trump’s apparent attacks on central bank independence – campaigning for lower rates and attempting to dismiss a member of the rate-setting committee.

Interestingly, September’s committee vote for a 25 basis point (bps) cut was split 11-1 behind the decision, with only Trump’s recent appointee Miran voting for a larger 50bps cut. Neither Waller nor Bowman, both of whom had previously voted for a cut when others had not, chose to vote for 50bps.

In the face of substantial pressure this year, this is a positive sign for Federal Reserve integrity; the odds of either Waller or Bowman being given the role of Chair have greatly decreased but they have put the institution’s needs ahead of their own ambition.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds and Model Portfolios managed by the Multi-Asset team may be exposed to the following risks:

- Credit Risk: There is a risk that an investment will fail to make required payments and this may reduce the income paid to the fund, or its capital value;

- Counterparty Risk: The insolvency of any institutions providing services such as safekeeping of assets or acting as counterparty to derivatives or other instruments, may expose the Fund to financial loss;

- Liquidity Risk: If underlying funds suspend or defer the payment of redemption proceeds, the Fund's ability to meet redemption requests may also be affected;

- Interest Rate Risk: Fluctuations in interest rates may affect the value of the Fund and your investment. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result;

- Derivatives Risk: Some of the underlying funds may invest in derivatives, which can, in some circumstances, create wider fluctuations in their prices over time;

- Emerging Markets: The Fund may invest in less economically developed markets (emerging markets) which can involve greater risks than well developed economies;

- Currency Risk: The Fund invests in overseas markets and the value of the Fund may fall or rise as a result of changes in exchange rates;

- Index Tracking Risk: The performance of any passive funds used may not exactly track that of their Indices.

The risks detailed above are reflective of the full range of Funds managed by the Multi-Asset team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

Phil Milburn

Phil Milburn is head of rates in the Liontrust Multi-Asset team. He joined Liontrust in January 2018 from Kames Capital. Phil had spent over 20 years at Kames Capital, launching one of the market’s first strategic bond funds in 2003 and developing a leading high-yield franchise.