Executive orders and new regulations from the US president, many diametrically opposed to the core values of sustainable investors (diversity and inclusion, equality, the need to combat climate change), have been coming thick and fast. This has affected the prospects for renewables and the energy transition to a much lower carbon economy over the next three to five years.

The biggest impact comes from the reversal, or the abrupt curtailing, of many renewable tax incentives for wind, solar, electric vehicles and green hydrogen which were included in Biden’s Inflation Reduction Act (IRA). A combination of executive orders as well as the so called One Big Beautiful Bill Act (OBBBA) – signed into law on 4th July 2025 – have been used to do this.

There will be an accelerated phase out of key tax credits, with solar and wind projects needing to be in service by the end of 2027, rather than 2032 previously. However, projects that begin construction within one year of the OBBBA’s enactment will qualify so long as they are in service by 2030 and show evidence of continuous construction.

The market has punished renewable energy stocks since President Trump won the election in late 2024, but the final bill is considered to be much more benign for the sector than the worst-case scenario many feared. The fact that projects can be completed by 2029 or 2030 and still qualify for tax credits is better than the market was expecting.

US wind favours onshore vs. offshore

We believe that the US onshore wind industry will see a significant pull forward in demand between now and 2026, where industry participants are incentivised to begin projects that qualify for the legacy tax credits and the returns on investment are highest. This is confirmed by management teams such as Vestas, who expect installation of onshore wind in the US to be strong in the next year or so. We then expect a demand lull post 2026 in the US. Demand outside the US generally remains strong over next five years and beyond.

This is unhelpful as it puts a strain on the supply chains which have to cope with super-normal demand followed by more muted demand.

Offshore wind in the US has stalled as a technology option. The Trump administration has mounted legal challenges to offshore wind projects which are planned to be built, as well as legal challenges to projects close to completion. Whilst offshore wind is likely to double in Europe in the coming years, it’s not a viable technology in the US at present given the position of the US administration.

Renewable energy remains economically competitive over the longer term

If we instead look at the prospects for renewables over a longer-term horizon, given these subsidies won’t be a factor in the US beyond 2030, the economic viability of renewable energy remains very compelling.

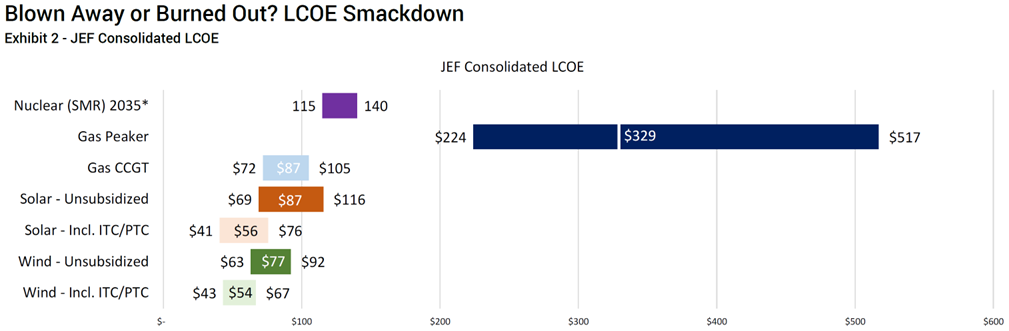

The relative economics of different electricity generation technologies is often measured by working out the levelized cost of energy (LCOE). This includes the cost of building, funding and operating that generation type over the life of the asset and is measured in a cost per unit of energy produced ($/MWh). The most cost competitive technology has the lowest LCOE and the most expensive form of electricity generation has the highest LCOE.

Even after the complete removal of the tax credits, wind and solar are still economically competitive versus all other generation types. So there is a future for them in the US but the economics for developers and operators will be lower, while industrial consumers of this electricity will likely pay more.

Source: Jefferies Research, NEE (Nuclear), June 2025. Figures within each bar graph represent JEF midpt. Estimates. The low end of Solar/Wind ITC/PTC represent the highest potential value from either ITC or PTC. Nuclear LCOE is based on NEE estimates.

Solar underpinned by data centre demand

If we consider solar energy in greater detail, this sector is likely to benefit from huge demand from developers of data centres. There is 9GW of data centres currently under construction and with capital expenditure in this area elevated, the demand for electricity to power data centres used to house AI architectures is expected to remain elevated as well.

Owners and operators of these data centres want three main things from their electricity supplies: power delivered soon, available all the time, and with low carbon impact.

No single energy source ticks all these boxes without caveat, but solar is the clearest winner on these metrics – it can be constructed quickly and is cost competitive. When storage is added the cost is higher, but these customers are less price sensitive.

We therefore expect solar to see a lot of demand growth in the next five years from the AI-led build out.

If we look at the hyper-scalers in Amazon, Microsoft, Google, Meta, Oracle and Apple, they are expected to spend more than $2 trillion on data centre capex between 2025-2030. To put this into context, according to Bloomberg, AI and data centre power demand will increase from 4.4% of US power demand to 17% by 2030.

Despite all the negative press around renewables in the US, growth rates for the solar industry in the US are set to accelerate, providing an attractive backdrop for these companies.

Conclusion and investment impacts

Trump’s bonfire of green taxes has had a very negative effect on the US energy transition. Supply chains will be placed under strain this year due to super-normal demand from renewable projects brought forward to qualify for credits before they are removed. It is then expected that renewable energy build out in the US will slow through to 2030.

While the outright energy winners are areas retaining the previous tax incentives – like exploration and production of fossil fuels – which we don’t invest behind, there are still sustainable options such as utility scale solar and battery storage whose attractions are largely unaffected by recent legislation.

Importantly, the removal of tax subsidies is less aggressive than originally feared and the longer-term economics underpinning growth in renewables demand remain intact.

Even without subsidies, wind and solar projects are still viable and will inevitably provide much of the new electricity to meet rising demand for electricity in the US. Renewables in the US are down as a result of Trump’s actions but are far from out.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds managed by the Sustainable Investment team:

- Are expected to conform to our social and environmental criteria.

- May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund.

- May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay.

- May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares. May invest in companies listed on the Alternative Investment Market (AIM) which is primarily for emerging or smaller companies. The rules are less demanding than those of the official List of the London Stock Exchange and therefore companies listed on AIM may carry a greater risk than a company with a full listing.

- May, under certain circumstances, invest in derivatives, but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. There is a risk that losses could be made on derivative positions or that the counterparties could fail to complete on transactions. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead. The use of derivative instruments that may result in higher cash levels. Cash may be deposited with several credit counterparties (e.g. international banks) or in short-dated bonds. A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

- Do not guarantee a level of income.

The risks detailed above are reflective of the full range of Funds managed by the Sustainable Investment team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

Mike Appleby

Mike Appleby is an investment manager on the Liontrust Sustainable Investment team, with responsibility for the generation and integration of sustainable and responsible investment (SRI) research into the funds and portfolios.

Simon Clements

Simon Clements is a fund manager who joined Liontrust in 2017 as part of the acquisition of Alliance Trust Investments, where he had managed funds for five years. Prior to this, Simon spent 12 years at Aviva Investors (previously Morley Fund Management) where, most recently, he was head of global equities.