Anyone who has ever queued for dinner in Paris knows that the longest lines usually form outside places with a “secret sauce” you can’t quite define, but everyone agrees is worth waiting for. On a recent research trip to the city, I found myself thinking the same thing about Interparfums. Much like a great neighbourhood bistro, Interparfums has quietly built something enduring through craft, consistency and an expertise competitors struggle to imitate.

Interparfums is not a household name, yet most people will recognise many of the brands it develops fragrances for: Jimmy Choo, Coach, Montblanc and, more recently, Lacoste. It is a business that has quietly compounded for decades, building the kind of tacit knowledge, distribution reach and partner trust that is very difficult to replicate. In other words, it’s exactly the sort of global small cap we like to uncover.

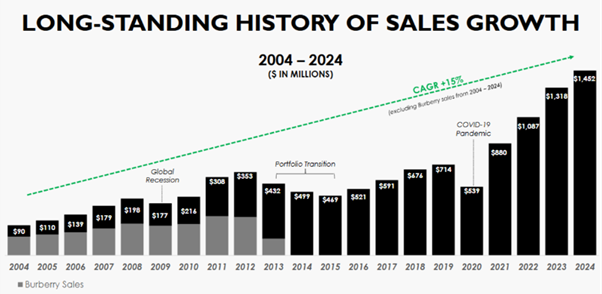

Source: Interparfums investor update, November 2025. All use of company logos, images or trademarks are for reference purposes only.

Founders and culture: the “secret sauce” you can’t model

What also became clear on the visit is how much of Interparfums’ character still reflects its origins. The company was founded in the early 1980s by two business-school classmates, Jean Madar and Philippe Benacin, who drafted the first iteration of Interparfums’ business plan as a student project before deciding to build it for real. That entrepreneurial beginning remains visible today.

Both founders are still deeply involved, and the organisation retains the pragmatism, curiosity and long-term orientation of a firm shaped by operators rather than financiers. With only around 350 employees worldwide, the business acts more like a focused creative studio than a billion-dollar corporation: decisions are made patiently, investments follow evidence rather than hierarchy, and relationships — with retailers, distributors and brand partners — are nurtured over decades.

This cultural continuity is extremely difficult for larger competitors to imitate and forms a meaningful part of the company’s economic moat. The founders still hold a 44% stake valued at several billion dollars.

Distribution: an underrated moat

Prestige fragrance requires an intricate network: department stores, specialist beauty chains, travel retail, online partners and market-specific distributors. A fashion house might operate a few dozen boutiques; a leading fragrance needs 20,000-plus points of sale.

Interparfums has patiently built this network over decades. In core markets such as France, Italy, Spain and the US, it sells directly to retailers. Elsewhere it works with long-standing exclusive distributors who understand local consumer behaviour and retailer dynamics. What struck me most on the visit was how mutually reinforcing these relationships are – many partners have worked with Interparfums for decades, giving it privileged access and insight.

Distribution scale is not glamorous, but it is a very real competitive advantage. For a brand owner weighing whether to internalise fragrance or partner with a specialist, the value of this global reach is clear.

A portfolio with both stability and optionality

Interparfums’ brand portfolio blends mature franchises with emerging opportunities.

Long-standing licences such as Montblanc, Jimmy Choo and Coach continue to anchor the business. These franchises have shaped consumer expectations globally and remain highly resilient. Their scale provides the base from which newer brands can be nurtured.

The most interesting current opportunity is Lacoste. Historically, Lacoste’s fragrance line had lost momentum, but, since acquiring the brands licence, Interparfums has relaunched it with more disciplined stock-keeping management, a refreshed design language and stronger distribution execution. Early indications show positive retailer uptake, and the relaunch has clearly re-energised the brand. While it is still early in the process, the scale of Lacoste’s global recognition means that, if execution continues along the current trajectory, there is meaningful scope for the franchise to become a much more material contributor to the group over time.

Alongside this, the company is expanding into premium niche fragrance with its own proprietary brand, Solférino. During our visit to Paris we had the chance to see the early range in-store, and it immediately felt distinct from the licensed portfolio: more artisanal, more elevated and clearly aimed at the fast-growing luxury segment. This push into owned IP has been reinforced by the recent acquisition of Goutal, another respected high-end fragrance house with strong heritage. Importantly, Solférino and Goutal sit directly on Interparfums’ balance sheet — and owning fragrance IP can create significant long-term value. Recent transactions in the premium-fragrance market, most notably the valuation achieved by Creed, shows how valuable well-executed luxury brands can become when scaled successfully. If Solférino and Goutal develop as intended, they offer meaningful strategic and financial upside, with structurally higher margins and more optionality than the licensing model alone provides.

Industry trends that favour specialists

Even after a post-pandemic surge, the fragrance category remains structurally attractive. Penetration in the US is still well below Europe, suggesting room for long-term growth. In China, fragrances remain underdeveloped relative to skincare and colour cosmetics, particularly among younger consumers who are increasingly exploring global brands.

Premiumisation continues to shape demand: consumers are trading up to longer-lasting eau de parfums and expanding their fragrance “wardrobes”. This trend benefits players with strong design capabilities, disciplined marketing and broad distribution — exactly Interparfums’ strengths.

While consumer sentiment can soften in difficult macroeconomic conditions, the fragrance sector has historically shown more resilience than many other discretionary categories, partly due to its role as an “affordable indulgence”.

Source: Interparfums investor update, November 2025

The kind of durable compounding we look for

Interparfums isnot a flashy business, nor is it widely discussed in mainstream investment circles. But from an Economic Advantage perspective, it displays many of the attributes we look for: durable intangible assets, distinctive culture, high barriers to entry and a thoughtful, long-term approach to growth.

Most importantly, it is a reminder that competitive advantage does not only reside in disruptive technology firms or dominant industrial platforms. Sometimes it sits within a small team in Paris, quietly building global brands through craftsmanship, patience and expertise.

These are exactly the sorts of hidden strengths we aim to uncover — the foundations of sustainable long-term compounding.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds managed by the Economic Advantage team:

- May invest in smaller companies and may invest a small proportion (less than 10%) in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, a fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause a fund to defer or suspend redemptions of its shares. May invest in companies listed on the Alternative Investment Market (AIM) which is primarily for emerging or smaller companies. The rules are less demanding than those of the official List of the London Stock Exchange and therefore companies listed on AIM may carry a greater risk than a company with a full listing.

- May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- May invest in companies predominantly in a single country which maybe subject to greater political, social and economic risks which could result in greater volatility than investments in more broadly diversified funds.

- Outside of normal conditions, may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

The risks detailed above are reflective of the full range of Funds managed by the Economic Advantage team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

Alex Wedge

Alex Wedge joined the Economic Advantage team in March 2020 and became a co-manager at the start of 2021. Alex moved from Singer Capital Markets, one of the largest dedicated small cap brokers in London, where he had spent over seven years, latterly as a senior member of the equity sales team.