View the latest insights from the Global Innovation team.

View NowKey takeaways

- The quarter’s narrative was one of broadening fundamentals across healthcare, industrials, digital platforms and energy infrastructure.

- Q3 top contributors: Oracle, Alibaba and TSMC. Detractors: Novo Nordisk, Intuit and Atlas Energy Solutions.

- As we enter Q4 and look towards 2026, we expect improving company fundamentals to drive Fund returns.

Performance overview

The Liontrust GF Global Dividend Fund returned 5.2% in Q3 in US dollar terms, versus the 7.3% from the MSCI World Index comparator benchmark.

Fund commentary

The quarter’s narrative was one of broadening fundamentals across healthcare, industrials, digital platforms and energy infrastructure. We continue to favour cash generative leaders with rising reinvestment runways and disciplined capital allocation.

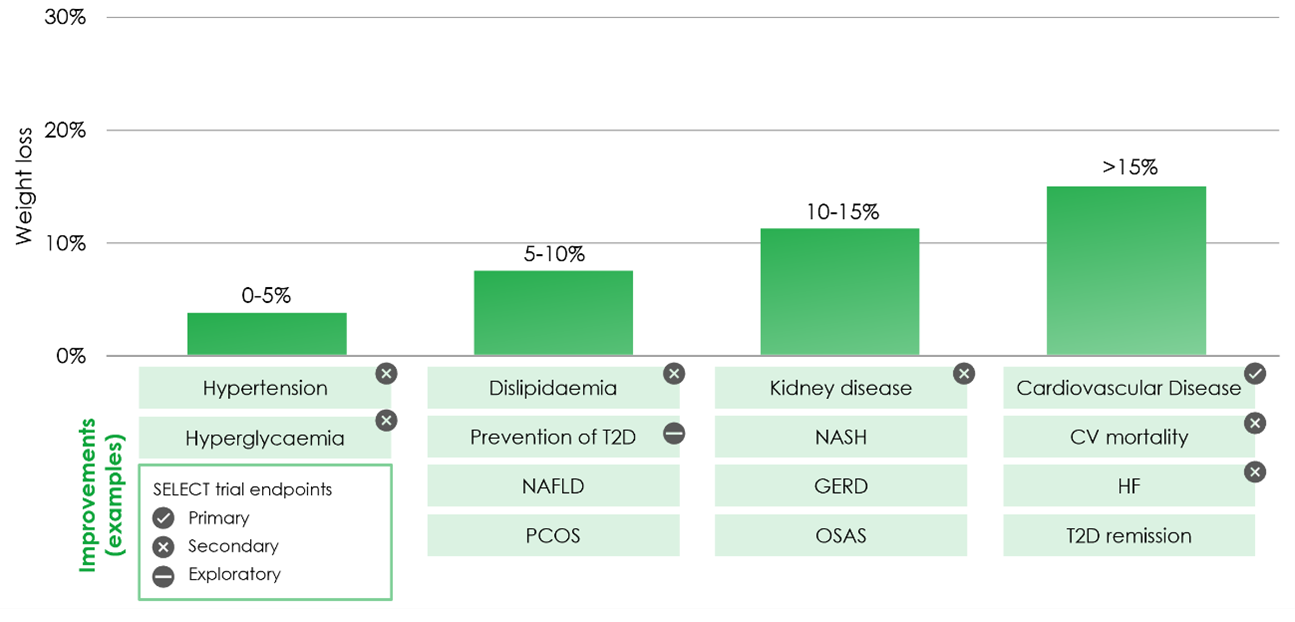

In healthcare, Eli Lilly and Novo Nordisk are building the industrial and clinical backbone of the GLP 1 era. The debate after recent share weakness is not whether GLP 1s work, but how far first mover advantages can reach. Evidence keeps widening the addressable market: semaglutide now carries an FDA label for reducing major cardiovascular events; FLOW (a major kidney-outcomes study) showed renal and cardiovascular benefit; Tirzepatide is approved for obstructive sleep apnoea. Together these expand eligibility, strengthen payer support and shift the narrative beyond weight loss. Credible forecasts see annual GLP 1 sales exceeding $100 billion by 2030 with upside towards $150 billion as insurance coverage broadens, oral agents arrive and adjacent indications scale.

The moat is industrial as much as clinical: complex peptide synthesis, sterile fill finish, autoinjector assembly and global cold chain logistics. Both companies have invested for years to entrench this capability. Execution remains strong: Lilly’s Q2 revenue grew 38% year on year to $15.6 billion with gross margin at 84.3%; Zepbound reached $3.38 billion and Mounjaro $5.2 billion. Novo’s diabetes and obesity care rose 18% year on year, with obesity care up 58% to DKK 38.8 billion and Wegovy up 78% to DKK 36.9 billion, approaching 280k weekly US prescriptions. We view recent volatility as sentiment driven; fundamentals continue to compound.

Improvements per weight loss bracket – Eli Lily

Source: Eli Lily Earnings Report, August 2025.

From health outcomes to operational excellence, Rational showed how a focused industrial can compound through the cycle. The company’s chef led, demo heavy route to market anchors a growing aftermarket of accessories, parts, service and ConnectedCooking software that now represents c.31% of sales. A >120 country footprint, c.4,000 partners and over 1,000 in house chefs build adoption and stickiness.

Q2 was the second best quarter in the company’s history, with North America and Europe ex Germany offsetting a softer Asian market. Management continues to invest in sales capacity and R&D while holding firm on discipline. Looking forward, guidance is for an EBIT margin around 26% and mid single digit growth, supported by steady gross margins, tight working capital and a strong equity ratio.

As AI capex accelerates, the “picks and shovels” are winning. Amphenol delivered record results, with sales up 57% year on year (41% organically) and EPS up 84%. IT datacom grew 133% organically, now 36% of group sales, as the company ships high speed interconnects, power and fibre optic products into next generation data centres. Orders rose 36% to $5.52 billion and margins reached 25.6%. A broad portfolio across autos, aerospace, industrial and defence, plus targeted RF acquisitions, positions Amphenol to dominate the interconnect layer of the electronics build out.

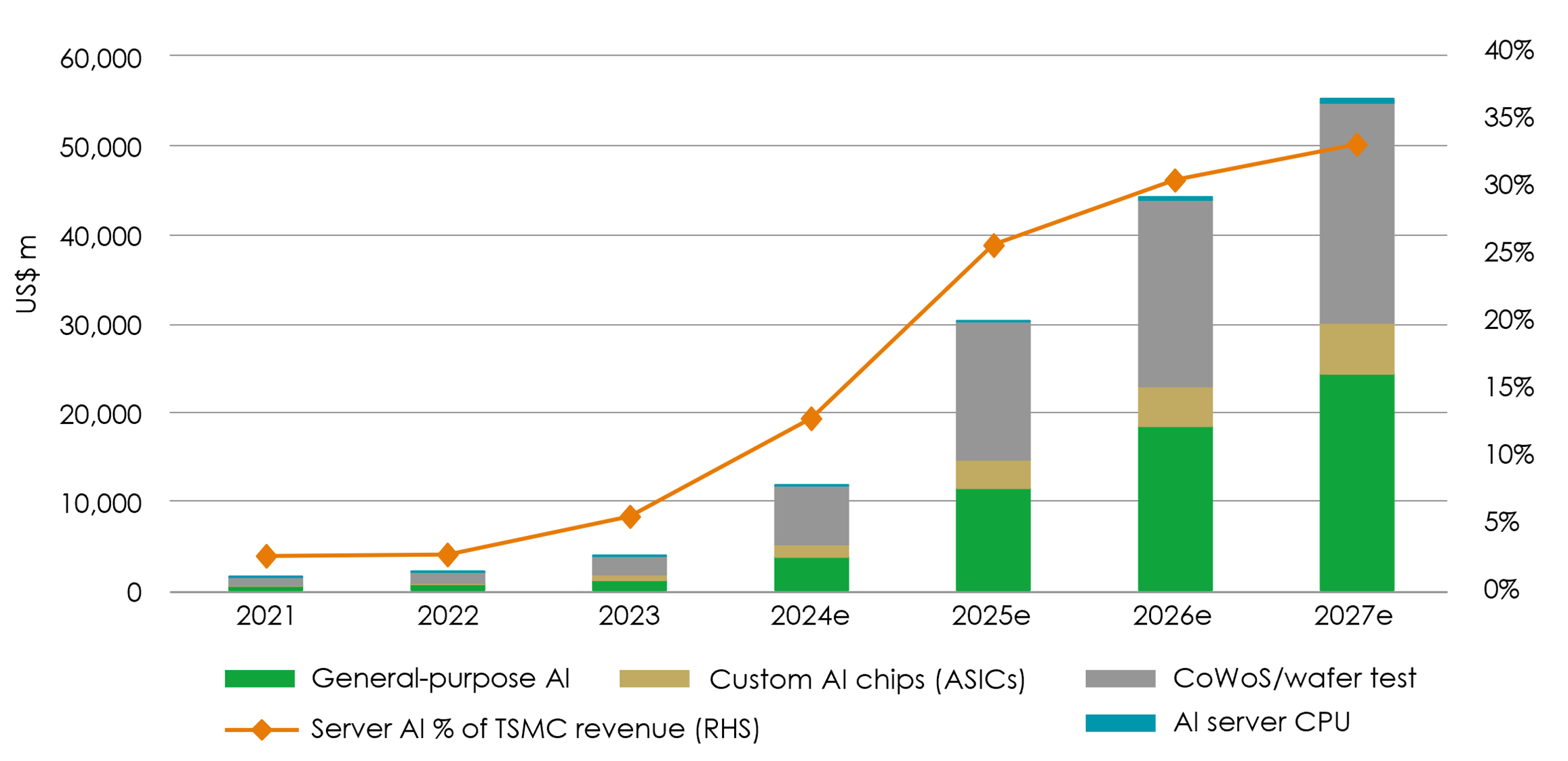

The same demand for scale and energy efficiency underpinned results from TSMC, which continues to be the cornerstone of the AI hardware stack. Having added to our position ahead of earnings, we benefited as the company reported 30% projected revenue growth for 2025 and confirmed that high performance computing now represents 60% of its business. TSMC’s upcoming N2 node, due in the second half of next year, promises a 15% speed gain and 30% power saving – critical for the world’s expanding AI infrastructure. Once reliant on Apple’s smartphone cycle, TSMC is now leveraged to the largest compute build out in history.

TSMC AI revenue breakdown

Source: TSMC Earnings Update, July 2025

Within life sciences, Danaher is turning the corner after a cyclical downturn. Q2 core revenue rose 1.5% and EPS grew 5%, with free cash flow of $1.1 billion and 143% conversion as Danaher Business System productivity and $150 million of structural savings take hold. Biotechnology grew 6% core, driven by consumables strength across big pharma and CDMOs; Diagnostics grew 2% core; Life Sciences should improve into H2 as new instruments and stimulus support demand. With >80% recurring consumables and an innovation pipeline spanning proteomics, cell and gene, Danaher remains a resilient enabler of precision medicine.

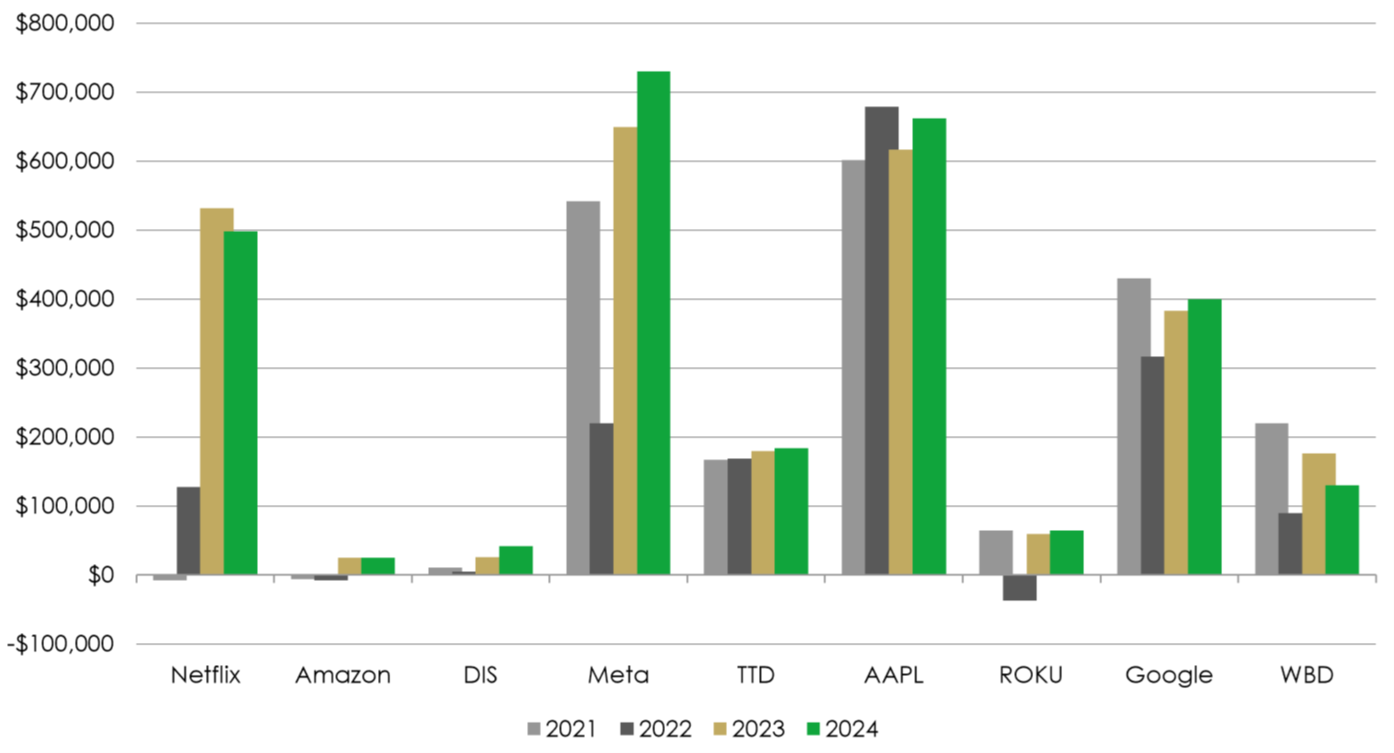

In digital platforms, Meta continues to pair stronger ad performance with heavy AI investment. Proprietary engagement data across 3.4 billion users gives Meta a differentiated training asset. In Q2 the company invested $17 billion (36% of sales) in AI infrastructure and lifted full year guidance to $66-72 billion, with multi gigawatt clusters such as Prometheus, Hyperion and Titan slated to come online. The build out is matched by talent and product focus through Meta Superintelligence Labs. We see these outlays as extending the company’s advantage while supporting cash flow durability.

Free cash flow per full time employee growth from 2021 to 2024

Source: Meta Platforms, earnings report July 2025

Alibaba continues to execute. The group is simplifying its structure, prioritising core commerce and Cloud, and improving operating discipline. Taobao and Tmall remain the cornerstone, with better tools for merchants and stronger user engagement, while Cainiao enhances fulfilment quality and monetisation. Alibaba Cloud is concentrating on higher value workloads and AI services, supporting a steadier growth and margin profile. Balance sheet strength and ongoing buy backs provide additional support to the investment case.

Consumer staples with genuine innovation also contributed – L’Oréal is emerging as the leading beauty tech platform, integrating AI across R&D, personalisation and go to market. Its pipeline added c.300 basis points to new product growth, with launches such as Lancôme’s Absolue Longevity Cream and Helena Rubinstein’s Replasty performing strongly. Tools like Beauty Genius have supported over 500,000 customer conversations, while targeted acquisitions bolster premium positioning. We expect like for like growth to remain healthy with margin expansion towards c.21% as AI tools improve productivity.

The energy transition underpins many of these trends. Brookfield Renewable is building a diversified, inflation linked platform across hydro, wind, solar, storage and nuclear services. Q2 funds from operations rose 10% to $371 million, with hydro FFO (a financial metric for real estate) up over 50% and distributed energy/storage up nearly 40% as 2.1GW of new capacity was commissioned. Westinghouse continues to outperform on core services to two thirds of the world’s nuclear fleet while new build momentum improves in Europe and the US. Liquidity stands at $4.7 billion and capital recycling of $1.5 billion supports a pipeline through 2029. Management targets 12–15% total returns with 5–9% distribution growth over time.

Outlook

As we enter Q4 and look towards 2026, we expect improving company fundamentals to drive Fund returns. Short term macro conditions are likely to introduce volatility. We intend to use that volatility to add to high conviction positions where cash flows, dividends and competitive moats continue to strengthen.

Key Features of the Liontrust GF Global Dividend Fund

The Fund aims to achieve income with the potential for capital growth over the long-term (five years or more). The Fund aims to deliver a net target yield in excess of the net yield of the MSCI World Index each year.

There can be no guarantee that the Fund will achieve its investment objective.

The Investment Adviser will seek to achieve the investment objective of the Fund by investing at least 80% of the Fund’s Net Asset Value in shares of companies across the world. The Fund may also invest up to 20% of its Net Asset Value in other eligible asset classes. Other eligible asset classes include collective investment schemes (which may include funds managed by the Investment Adviser), cash or near cash, deposits and Money Market Instruments.

In addition the Fund may invest in exchange traded funds (“ETFs”) (which are classified as collective investment schemes) and other open-ended collective investment schemes. Investment in open-ended collective investment schemes will not exceed 10% of the Fund’s Net Asset Value. The Fund may invest in closed-ended funds domiciled in the United Kingdom and/or the EU that qualify as transferable securities. Investment in closed-ended funds will be used where the closed-ended fund aligns to the objectives and policies of the Fund. Investment in closed-ended funds will further be confined to schemes which are considered by the Investment Adviser to be liquid in nature and such an investment shall constitute an investment in a transferable security in accordance with the requirements of the Central Bank. Investment in closed-ended funds is not expected to comprise a significant portion of the Fund’s Net Asset Value and will not typically exceed 10% of the Fund’s Net Asset Value.

* As specified in the PRIIP KID of the fund.

6

** SRI = Summary Risk Indicator. Please refer to the PRIIP KID for further detail on how this is calculated.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

- Overseas investments may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of the Fund.

- The Fund, may in certain circumstances, invest in derivatives but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

- Credit Counterparty Risk: outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties (e.g.international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

- Liquidity Risk: the Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- ESG Risk: there may be limitations to the availability, completeness or accuracy of ESG information from third-party providers, or inconsistencies in the consideration of ESG factors across different third party data providers, given the evolving nature of ESG.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.