View the latest insights from the Global Innovation team.

View NowKey takeaways

- Our investments share a simple thread – AI is moving from experimentation to deployment across commerce, finance, healthcare and industry.

- Q3 Top contributors: Oracle, Planet Labs and Tesla. Detractors: Novo Nordisk, Sweetgreen and Maplebear.

- As we enter Q4 and look towards 2026, we expect improving company fundamentals to drive returns.

Performance overview

The Liontrust GF Global Innovation Fund returned 4.9% in US dollar terms in Q3, compared with the 7.6% return of the MSCI All-Country World Index comparator benchmark.

Fund commentary

Our investments share a simple thread – AI is moving from experimentation to deployment across commerce, finance, healthcare and industry. Shopify is a clear example. It is turning its brand catalogue and full stack commerce tools into rails that AI shopping agents can use. New releases such as Catalog, Universal Cart, Checkout Kit 2.0, Sidekick and the AI Store Builder reduce integration work and meet demand wherever it starts. Execution remains strong. Q2 revenue grew 31% to $2.7 billion and GMV rose 29% to $88 billion. Guidance went up. With rapid product cadence, we see scope for compound growth above 20% and rising free cash flow.

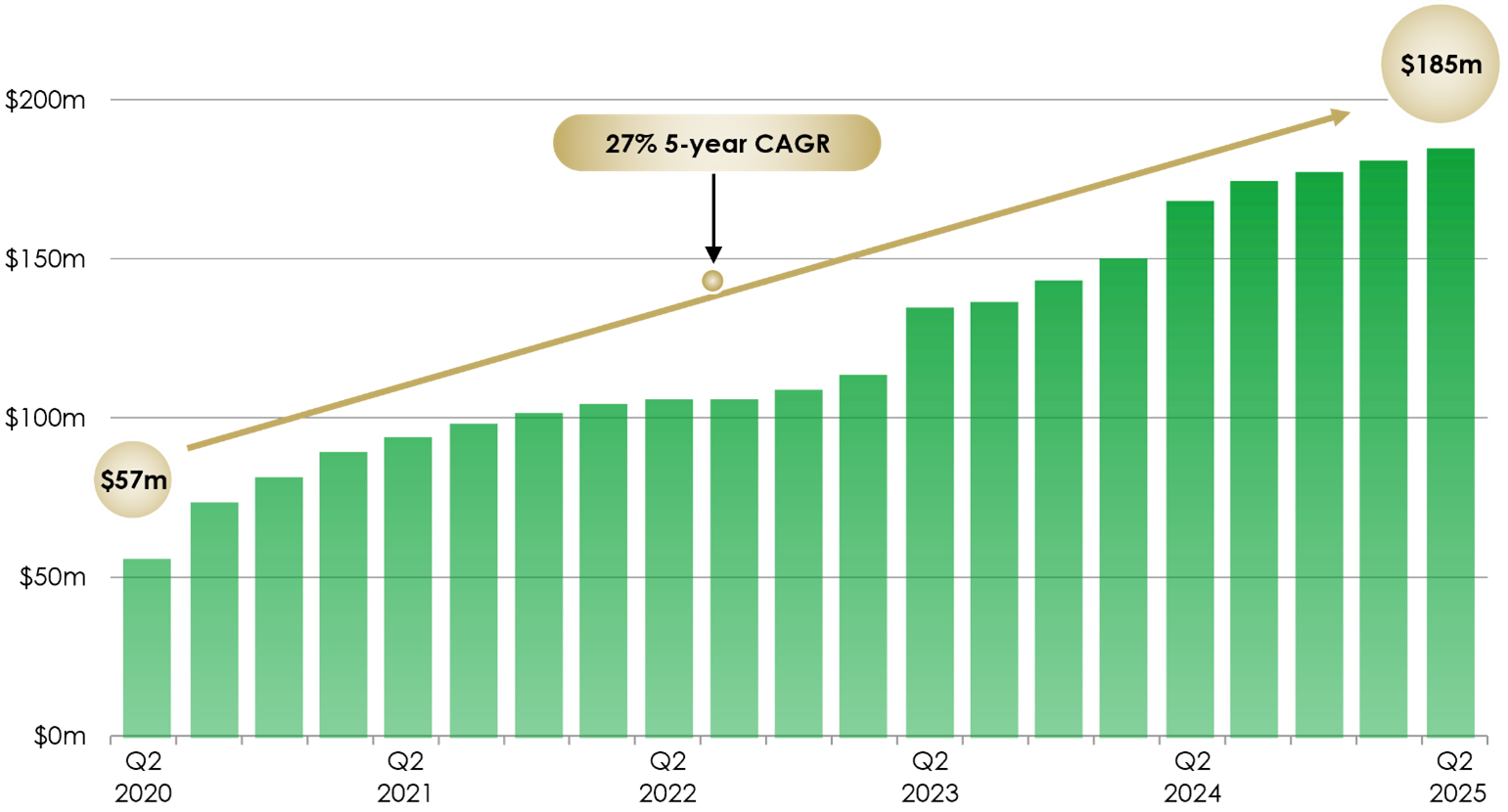

Monthly recurring revenue* continues to grow over time

Source: Shopify, August 2025. Note: * Monthly Recurring Revenue, or MRR, is the aggregate value of all subscription plans, excluding variable platform fees, in effect on the last day of the period, assuming merchants maintain their subscription the following month and is used by management as a directional indicator of subscription solutions revenue going forward.

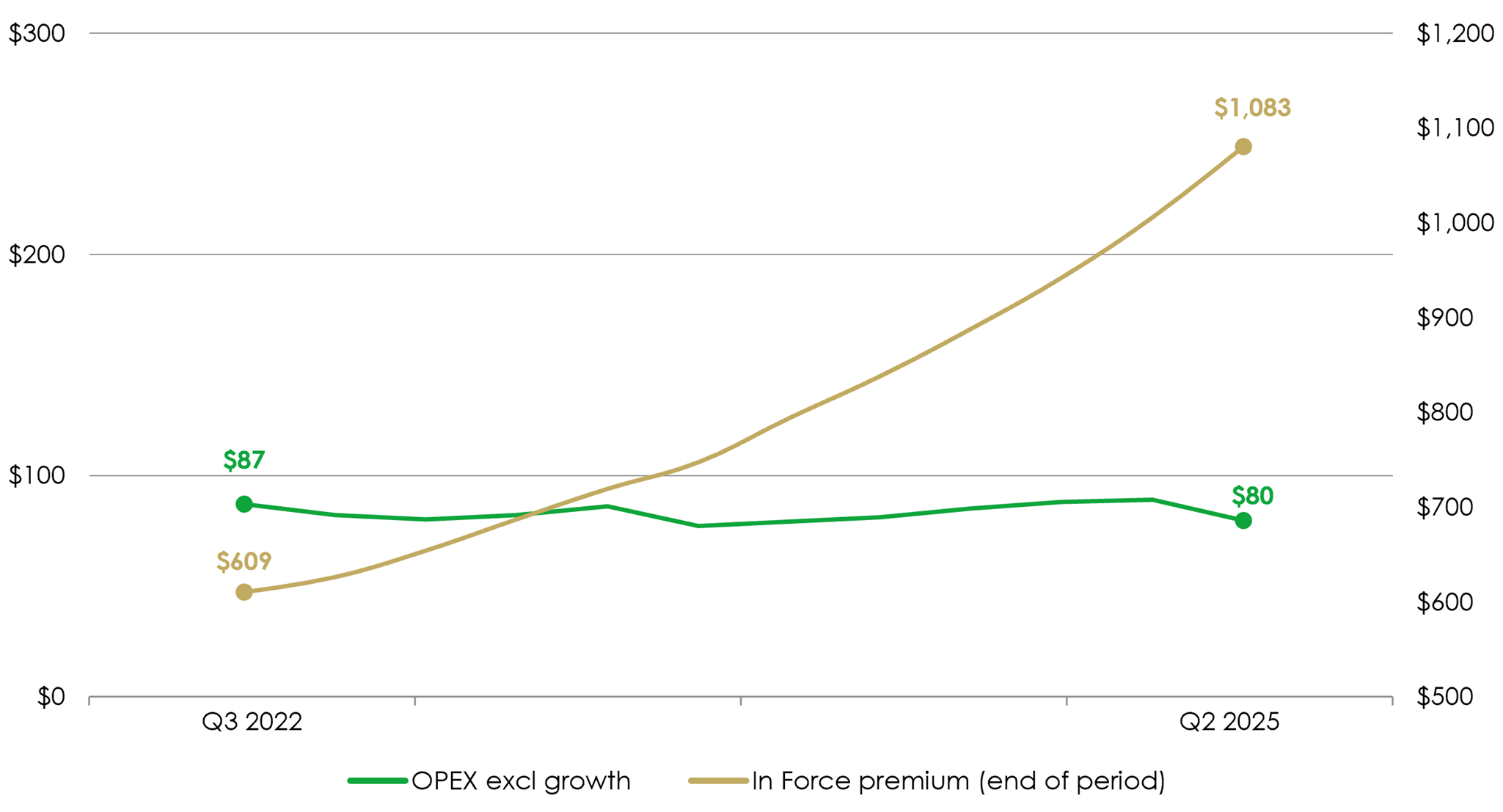

The same flywheel is appearing in insurance – Lemonade’s AI handles quoting, claims and fraud in seconds, which improves conversion and pricing and then feeds better data back into the model. Q2 revenue rose 35% to $164 million. In force premium rose 29% to $1.08 billion. Gross profit more than doubled and the loss ratio improved to about 70%. The company generated $25 million of adjusted free cash flow. Cutting the quota share from 55% to 20% should lift retained economics as loss ratios normalise over 2025–26.

IFP vs OPEX excluding growth spend ($m)

Source: Lemonade, Q2 25 Note: Q2 25 OPEX includes a one time benefit from a tax refund in the quarter of $11.7m

In healthcare the focus is workflow, not scale. Doximity’s AI Scribe now shows 75% weekly retention and is moving into telehealth. This supports usage without hurting margins because unit costs are now pennies per visit. Q1 revenue rose 15% to $145.9 million. EBITDA grew 21% at a 55% margin and free cash flow rose 52% to $60.1 million. Net revenue retention is 118% and guidance increased. The balance sheet is strong and buybacks continued.

Bringing tech to medicine

Source: Doximity, August 2025. All use of company logos, images or trademarks in this presentation are for reference purposes only.

Innovation also demands power – GE Vernova is benefiting from the largest grid and generation build out in decades, much of it linked to data centres. Gas power orders lifted the backlog and slot reservations to 54GW. Electrification backlog reached $24 billion. Services remain the high margin core. Management now guides to 8-9% EBITDA margins and $3-3.5 billion of free cash flow. We see durable growth as backlog converts and grid upgrades scale.

L’Oréal is emerging as the leading beauty tech platform, integrating AI across R&D, personalisation and go to market. Its pipeline added c.300bps to new product growth, with launches such as Lancôme’s Absolue Longevity Cream and Helena Rubinstein’s Replasty performing strongly. Tools like Beauty Genius have supported over 500,000 customer conversations, while targeted acquisitions bolster premium positioning. We expect like for like growth to remain healthy with margin expansion towards c.21% as AI tools improve productivity.

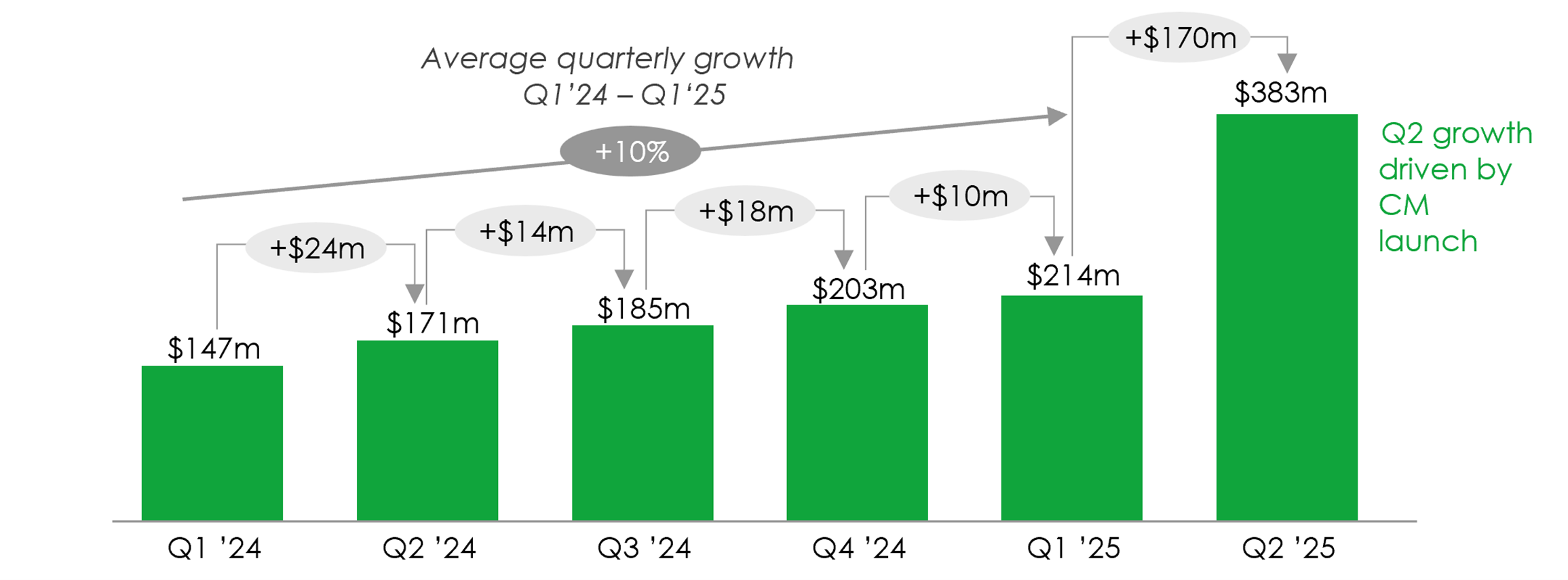

The energy transition underpins many of these trends. Brookfield Renewable is building a diversified, inflation linked platform across hydro, wind, solar, storage and nuclear services. Q2 funds from operations rose 10% to $371 billion, with hydro FFO up over 50% and distributed energy/storage up nearly 40% as 2.1GW of new capacity was commissioned. Westinghouse continues to outperform on core services to two thirds of the world’s nuclear fleet while new build momentum improves in Europe and the US. Liquidity stands at $4.7 billion and capital recycling of $1.5 billion supports a pipeline through 2029. Management targets 12-15% total returns with 5-9% distribution growth over time.

Mobility and energy storage sit at the same junction – Tesla’s operating metrics stabilised after a weak start to the year. Deliveries rose 14% quarter on quarter to 384,000. Free cash flow held at $0.1 billion and cash ended at $36.8 billion to fund more than $9 billion of capex. Robotaxi pilots launched in Austin and FSD adoption increased after version 12. The energy business delivered a record $846 million gross profit despite tariff headwinds, helped by vertical integration.

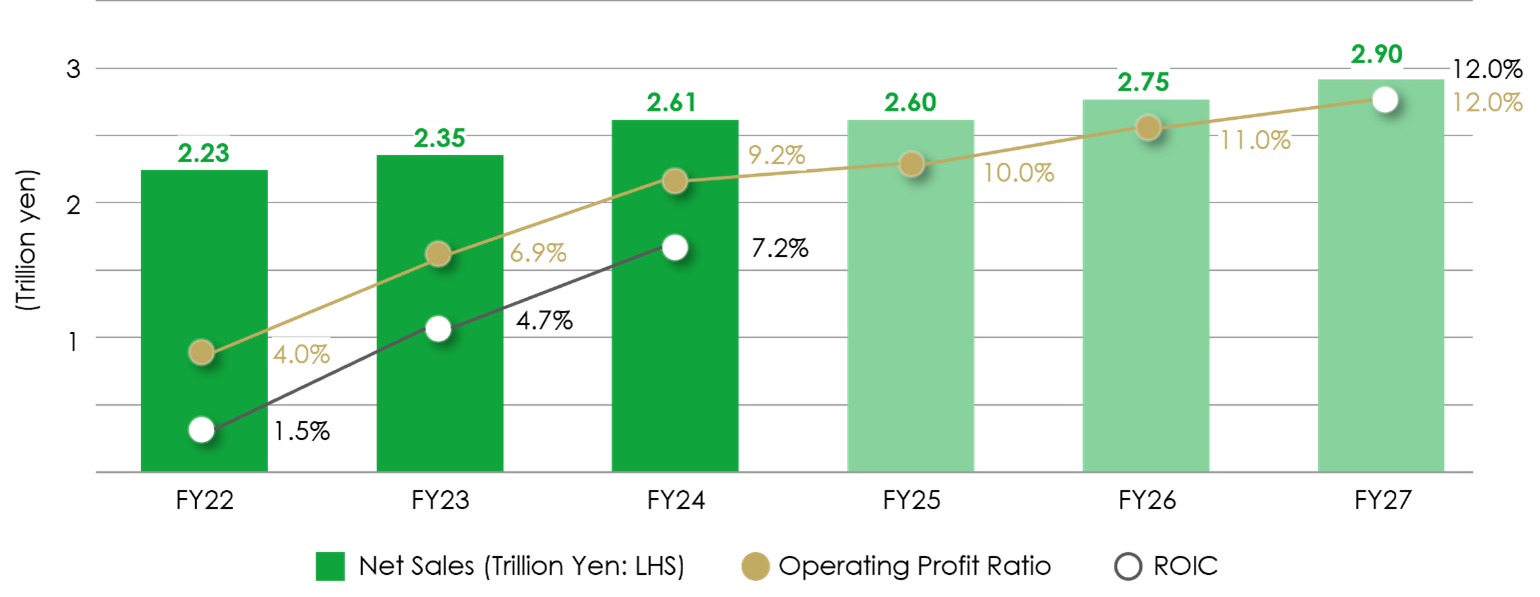

The hardware side of AI is widening from chips to motion – Nidec is pivoting from autos to industrial drives, energy systems and data centre power. Operating margin is near 10% with a path above 12% as low return programmes close. Exposure to collaborative robot gearboxes, grid scale storage and HDD spindle motors ties growth to both physical AI and cloud capex.

Pivoting the business is feeding through to financials

Source: Nidec Earnings Update, July 2025

Digital engagement is also compounding – Spotify’s scale is now matched by improving unit economics. Monthly active users reached 696 million and Premium subscribers 276 million. AI features are lifting session length and turning engagement into first party intent that should support advertising once the stack rebuild completes. We trimmed earlier in the year and added after the results day pullback. We see advertising regaining share in 2025 and a path to mid 30s group margins with 20% plus top line growth.

In food retail, Sweetgreen remains early in a digital first rebuild. The Infinite Kitchen format aims to increase throughput and consistency while reducing waste. Shares detracted in the period, but the direction of travel is towards stronger unit economics as the format scales and loyalty engagement deepens. Still exposed to a cyclical downturn, the company is well positioned to execute as lower interest rates stimulate consumer confidence. We exited, Novo Nordisk, the other poor performer for the period as we had better opportunities on the watchlist.

Healthcare innovation remains a second engine. Alnylam’s launch of AMVUTTRA for ATTR cardiomyopathy moved revenue up 64% year on year to $672 million and drove a 27% guidance upgrade for 2025. Rapid US adoption with broad payer coverage gives the TTR franchise multi year visibility and funds a wider late stage pipeline in cardio renal, CNS and metabolic disease.

A step-change in TTR revenue run rate

Source: Alnylam Pharmaceuticals earnings report, July 2025

Automation is the final link. We initiated a new position in Keyence, a leader in factory automation sensors. Revenue grew 6% year on year and operating margin stayed at 49.5%. The purchase of CADENAS adds a high margin software pillar that fits its installed base. Management sees a route to about ¥100 billion of incremental recurring revenue this decade while keeping operating margins above 50%. This positions Keyence as an enabler of physical AI adoption on the factory floor.

Outlook

As we enter Q4 and look towards 2026, we expect improving company fundamentals to drive returns. Short term macro factors are likely to create volatility. We plan to use that volatility to the Fund’s advantage.

Key Features of the Liontrust GF Global Innovation Fund

The Fund aims to achieve income with the potential for capital growth over the long-term (five years or more). The Fund aims to deliver a net target yield in excess of the net yield of the MSCI World Index each year.

There can be no guarantee that the Fund will achieve its investment objective.

The Investment Adviser will seek to achieve the investment objective of the Fund by investing at least 80% of the Fund’s Net Asset Value in shares of companies across the world. The Fund may also invest up to 20% of its Net Asset Value in other eligible asset classes. Other eligible asset classes include collective investment schemes (which may include funds managed by the Investment Adviser), cash or near cash, deposits and Money Market Instruments.

In addition the Fund may invest in exchange traded funds (“ETFs”) (which are classified as collective investment schemes) and other open-ended collective investment schemes. Investment in open-ended collective investment schemes will not exceed 10% of the Fund’s Net Asset Value. The Fund may invest in closed-ended funds domiciled in the United Kingdom and/or the EU that qualify as transferable securities. Investment in closed-ended funds will be used where the closed-ended fund aligns to the objectives and policies of the Fund. Investment in closed-ended funds will further be confined to schemes which are considered by the Investment Adviser to be liquid in nature and such an investment shall constitute an investment in a transferable security in accordance with the requirements of the Central Bank. Investment in closed-ended funds is not expected to comprise a significant portion of the Fund’s Net Asset Value and will not typically exceed 10% of the Fund’s Net Asset Value.KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

- Overseas investments may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of the Fund.

- The Fund, may in certain circumstances, invest in derivatives but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

- Credit Counterparty Risk: Outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties (e.g.international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

- Liquidity Risk: The Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- ESG Risk: there may be limitations to the availability, completeness or accuracy of ESG information from third-party providers, or inconsistencies in the consideration of ESG factors across different third party data providers, given the evolving nature of ESG.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

A collective redress mechanism by consumers in respect of infringements of applicable Irish or EU laws is available under the Representative Actions for the Protection of the Collective Interests of Consumers Act 2023 which transposes Directive (EU) 2020/1828 into Irish law. Further information on this collective redress mechanism is available from Representative Actions Act - DETE (enterprise.gov.ie).