View the latest insights from the Economic Advantage team.

VIew NowKey highlights

- Pockets of excess drove market returns in Q3, as low-quality rally continues.

- The Fund’s focus on high-quality businesses led it to lag.

- Many of the AI beneficiaries on this year’s small cap rally are unprofitable and unproven, and therefore uninvestable under our long-term quality compounding framework.

Performance

The Liontrust Global Smaller Companies Fund returned -0.3% in Q3, compared with the 10% return of the MSCI ACWI Small Cap Index and an average return of 7.3% in the IA Global sector, its comparator benchmarks.

Commentary

Equity markets saw strong performance in Q3, with the US stock market hitting record highs, supported by resilient corporate earnings and easing tariff uncertainties. The US Federal Reserve cut its Fed Funds interest rate by 0.25% in September, driving a further rally particularly in rate-sensitive sectors. US small caps outperformed US large caps.

In Europe, small cap performance lagged the US, impacted by political uncertainties in France, mixed macro data, and the German equity rally running out of some steam. In Japan, small caps continued to rally despite political volatility, as corporate reform continues to deliver improved shareholder outcomes.

Emerging market small caps saw healthy gains, particularly in China where the market is beginning to regain enthusiasm in the context of supportive policy stimulus, low valuations, and a trade truce with the US. Taiwanese small caps also continued their run of strong performance year to date as the extensive semiconductor supply chain there benefits from the global AI capacity build out.

The Fund underperformed in Q3. In our view, the market has been characterised by high levels of retail investor speculation, a low-quality rally since the tariff volatility earlier in the year, and significant ebullience around the duration of an AI build out. As a result, we have seen some pockets of excess that have helped drive market returns over the quarter. As one may expect from the Economic Advantage process, our focus on investing in high quality businesses, with valuation discipline and a long term perspective, has meant our style has lagged significantly in this market environment.

For example, strong retail investor participation in rather speculative stocks has led to Goldman Sachs’ ‘memes’ basket of stocks (up +73% YTD*) now once again outperforming the S&P 500 since the basket’s inception*:

*Source: Bloomberg, data from 1 Feb 2020 to 7 Oct 2025.

Since the ‘Liberation Day’ lows in April, we have seen the lowest quality stocks lead the recovery. In Q3, the low-quality rally continued alongside exceptional returns for anything linked to AI, data centres and the localised energy infrastructure needed to power them. The MSCI ACWI Small Cap Index includes just under 6000 stocks. The top 100 performers in Q3 delivered a +131% return on average (in GBP), yet the average ROE (return on equity) for that subset is -10.6% and 61 of those 100 companies are free cash flow negative. The table below highlights the headwind to quality-conscious investors in the current market; the best performing quintile of stocks in the MSCI ACWI Small Cap Index also had the lowest average ROE, whilst the worst performing quintile of stocks had the highest average ROE.

Stock Return Quartile | Average ROE | Average Stock Return in Q3 |

1 | 11.51% | 39.53% |

2 | 16.28% | 11.03% |

3 | 16.01% | 0.85% |

4 | 17.40% | -14.43% |

Source: MSCI, Bloomberg, Liontrust calculations, total returns.

The Economic Advantage process consists of four key pillars that enable us to identify and own the highest quality companies capable of long-term compounding: (1) a focus on unique intangible assets difficult to replicate for any competitor, leading to (2) high cash flow return on invested capital – greater than of the cost of capital and enabling excess profits to be reinvested at consistently high returns, (3) valuation discipline at both entry point and throughout equity ownership, and (4) alignment of incentives by only investing in small caps where management own 3% or more of the stock.

This has led us to invest in businesses that have demonstrated track records of winning in their fields and allocating capital sensibly over time, operate in secular growth industries, and are in our view undervalued for their long term compounding potential.

Our disciplined process has led us to invest in some companies that are indirectly benefitting from the AI capacity build out. Chroma ATE in Taiwan is the market leader in system-level testing machines for AI semiconductor chips. Inficon in Switzerland is the global leader in leakage detection systems for cleanrooms (extremely clean and controlled areas where semiconductors are made). Tri-Chemical Labs in Japan is a chemicals supplier to memory and logic chip makers with a focus on niche categories it can dominate. However, many of the AI beneficiaries driving global small cap returns this year are unprofitable with unproven track records, and therefore un-investable within our long-term quality compounding framework.

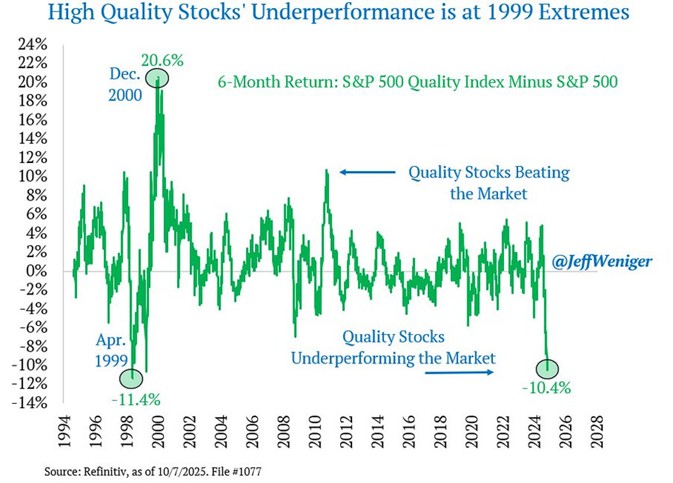

Quality as a style has therefore underperformed in the current market environment. We think the chart below from Jeff Weniger (Head of Equity Strategy at WisdomTree) highlights the current paradigm effectively. (The S&P 500 Quality Index is calculated based on ROE, accruals ratio and financial leverage ratio).

Top contributors:

- Medpace Holdings (+67% total return in sterling terms) – Despite continued funding difficulties for many small biotech firms, Medpace delivered a very strong set of results and order book, given its niche focus on helping biotech customers take new drugs through trial phases. This indicates it has continued to gain market share. We visited Medpace’s management team and major ImmunoDx lab at their HQ in Cincinnati in August. The long-term oriented culture and partnership-driven sales approach made us confident in Medpace’s growth runway for many years to come. Medpace also bought back c.5% of their share count in the quarter at low prices – demonstrating exceptional capital allocation.

- Installed Building Products (+39%) – Shares rose as signs of stabilisation emerged in the US housing cycle. Q2 earnings showed insulation installation volumes holding firm despite still-challenging mortgage affordability. We recently wrote about our visit to IBP HQ in Ohio and reasons for ownership.

- Advanced Drainage Systems (+23%) - ADS reported strong quarterly results well ahead of expectations, as despite challenging conditions in construction end markets, the business proved its quality credentials via ongoing efficiency gains, pricing stability, and innovation in higher-margin product lines supporting demand.

Largest detractors:

- Interparfums (-23%) - Reported second-quarter results that highlighted short-term challenges to consumer spending. However, full-year guidance was reiterated. The company continues to invest in and expand its portfolio of fragrance brands, as evidenced by recent agreements with Longchamp and Off-white. The founders, who collectively hold over 40% of the company's equity and have more than forty years of expertise in the fragrance sector, not only view temporary setbacks as opportunities but also lead the management team with confidence and experience, guiding the company through challenging periods.

- Progess Software (-28%) - Despite quarterly results that beat sales and earnings expectations, organic growth was underwhelming. In late July, it was announced that a class action lawsuit against Progress and other defendants relating to the large 2023 Moveit data breach proceeded to trial on a number of counts. We exited the position in August.

- Sysmex (-27%) - Sysmex is the world’s leading blood-testing machine maker, with incredible IP and leading expertise in haematology, haemostasis and also urology. It has more than 50% global market share in haematology analysers. More than 60% of its sales come from reagents, which are the one-time-use components required to run blood tests on its machines, and therefore are largely recurring items, and support a very stable revenue base. Sales growth is driven by global blood testing volumes, market adoption particularly in fast growing regions such as India and LatAm, and innovation (we are particularly excited about the new XR series of haematology analysers Sysmex has just released). However, Sysmex’s China sales (around a quarter of total revenue) were hit by a change to set testing procedures and government procurement policies aimed at controlling medical costs given the country’s aging population and higher healthcare needs. Over the long term, Sysmex’s business in China will grow given these higher healthcare needs, but policy changes will certainly create volatility.

Discrete years' performance* (%) to previous quarter-end:

| Sep-25 | Sep-24 | Sep-23 | Sep-22 | Sep-21 |

Liontrust Global Smaller Companies C Acc | -3.1% | 14.7% | 7.4% | -24.9% | 25.0% |

MSCI ACWI Small Cap | 12.4% | 13.4% | 5.4% | -9.2% | 34.8% |

IA Global | 12.1% | 16.2% | 7.8% | -8.9% | 23.2% |

Quartile Ranking | 4 | 3 | 3 | 4 | 2 |

* Source: FE Analytics, as at 30.09.25, total return, net of fees and income reinvested. The current fund managers’ inception date is 14.01.25.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

- Overseas investments may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of the Fund.

- The Fund, may in certain circumstances, invest in derivatives but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

- Credit Counterparty Risk: outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

- Liquidity Risk: as the Fund is primarily exposed to smaller companies there may be liquidity constraints from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares. In addition the spread between the price you buy and sell units will reflect the less liquid nature of the underlying holdings.

- Emerging Markets Risk: the Fund may invest in emerging markets which carries a higher risk than investment in more developed countries. This may result in higher volatility and larger drops in the value of the fund over the short term.

- ESG Risk: there may be limitations to the availability, completeness or accuracy of ESG information from third-party providers, or inconsistencies in the consideration of ESG factors across different third party data providers, given the evolving nature of ESG.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.