View the latest insights from the Global Innovation team.

View NowKey takeaways

- This was a period defined by accelerating fundamentals across our core AI infrastructure and software holdings, from networking fabrics and chip design to enterprise automation and data platforms.

- Q3 top contributors: Astera Labs, Oracle and Broadom. Q2 detractors: C3.ai, Intuit and Lasertec.

- As we enter Q4 and look towards 2026, we see the improving fundamentals of these companies as the key driver of future returns Performance overview.

Performance

The Liontrust Global Technology Fund returned 16.9% in Q3, placing it in the first quartile of peers, ahead of the IA Technology & Telecommunications sector average return of 14.3% and the MSCI World IT Index return of 11.4% (both comparator benchmarks).

Longer-term performance remains strong, the Fund having returned 112.8% since manager inception (08.02.2023), placing it 2nd in the IA Technology & Telecommunications sector where the average return was 69.3% and the MSCI World IT Index return of 94.7%.

Fund commentary

This was a period defined by accelerating fundamentals across our core AI infrastructure and software holdings, from networking fabrics and chip design to enterprise automation and data platforms. The unifying theme was the broadening of demand beyond hyperscalers into enterprises, governments and new builders of AI‑driven systems.

Arista exemplified this shift – once confined to front‑end networking, it is now becoming a leading player in the AI data‑centre fabric that connects and scales GPU clusters. The company’s back‑end AI networking revenues are set to exceed $1.5 billion this year, with $750 million in back‑end deployments expected in 2025, a market that did not exist three years ago. Crucially, Arista’s customer base is expanding rapidly beyond a handful of hyperscalers to include 25–30 enterprise and sovereign AI builders, with deployments extending to non‑NVIDIA silicon. As training workloads grow, networking, once a background component, has become a critical determinant of GPU efficiency, and Arista is now the clear beneficiary.

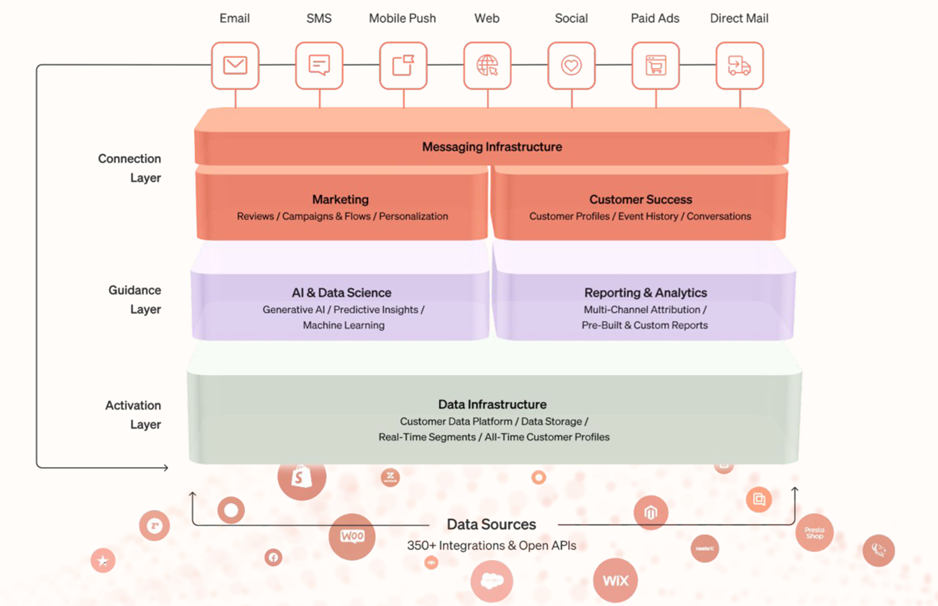

This theme of data, connectivity and orchestration carried through to Klaviyo, a company we discovered on a research trip to Boston. Klaviyo’s platform unifies customer data, activation and analytics, replacing the patchwork “Frankenstack” that burdens most marketing teams. Its architecture allows for real‑time, schema‑flexible integration across 400+ systems, enabling brands to execute AI‑driven personalisation natively across email, SMS and social. The result is a virtuous cycle of better targeting and higher returns, with Q2 revenues up 32% year on year and a 37% earnings beat. Klaviyo demonstrates how AI‑native design, rather than bolt‑on functionality, creates lasting customer advantage.

Klaviyo’s data-first platform approach is a competitive advantage

Source: Klaviyo 08.05.25

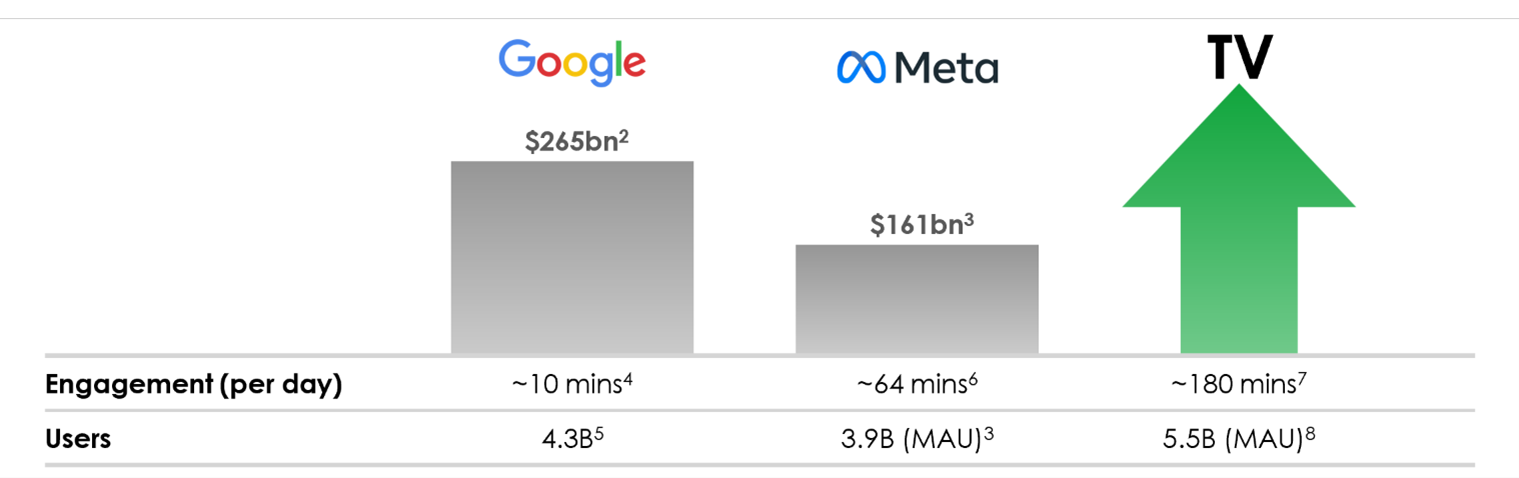

While Klaviyo reshapes marketing technology, Mountain is rewriting the economics of TV advertising. By reducing the minimum campaign budget to just $500, Mountain has opened connected TV to small and medium‑sized businesses, with $0.97 of every dollar on the platform representing new spend for the industry. As streaming consumption continues to outpace ad budgets, Mountain’s self‑serve model, attribution engine and AI‑driven creative tools are scaling rapidly. Customers rose 85%, revenues 34%, and margins expanded to 77%. We see clear parallels to the early days of Google Ads, with connected TV emerging as the next frontier for measurable performance marketing.

TV has greater engagement and scale than search and social but is undermonitised¹

Source: mntn earnings report, August 2025

The same demand for scale and energy efficiency underpinned results from TSMC, which continues to be the cornerstone of the AI hardware stack. Having added to our position ahead of earnings, we benefited as the company reported 30% projected revenue growth for 2025 and confirmed that high‑performance computing now represents 60% of its business. TSMC’s upcoming N2 node, due in the second half of next year, promises a 15% speed gain and 30% power saving, critical for the world’s expanding AI infrastructure. Once reliant on Apple’s smartphone cycle, TSMC is now leveraged to the largest compute build‑out in history.

In digital platforms, Meta continues to pair stronger ad performance with heavy AI investment. Proprietary engagement data across 3.4 billion users gives Meta a differentiated training asset. In Q2 the company invested $17 billion (36% of sales) in AI infrastructure and lifted full‑year guidance to $66-72 billion, with multi‑gigawatt clusters such as Prometheus, Hyperion and Titan slated to come online. The build‑out is matched by talent and product focus through Meta Superintelligence Labs. We see these outlays as extending the company’s advantage while supporting cash‑flow durability.

Free cash flow per full time employee growth from 2021 to 2024

Source: Meta Platforms, earnings report July 2025

Oracle was a notable contributor, we view Oracle Cloud Infrastructure and the database franchise as a bridge between data gravity and AI workloads. Its network design and high‑performance interconnects allow cost‑efficient training and inference, while partnerships across the AI ecosystem broaden access to advanced accelerators. Fusion and NetSuite are embedding generative features across finance, supply chain and HR, deepening adoption within the installed base. For regulated industries, Oracle’s sovereign‑cloud and data‑residency options align with compliance requirements. As customers consolidate databases and bring mission‑critical workloads closer to their data, we expect Oracle to keep gaining share within AI‑enabled enterprise stacks.

Automation is the final link, Keyence, a leader in factory‑automation sensors. Revenue grew 6% year-on-year and operating margin stayed at 49.5%. The purchase of CADENAS adds a high‑margin software pillar that fits its installed base. Management sees a route to about ¥100 billion of incremental recurring revenue this decade while keeping operating margins above 50%. This positions Keyence as an enabler of physical‑AI adoption on the factory floor.

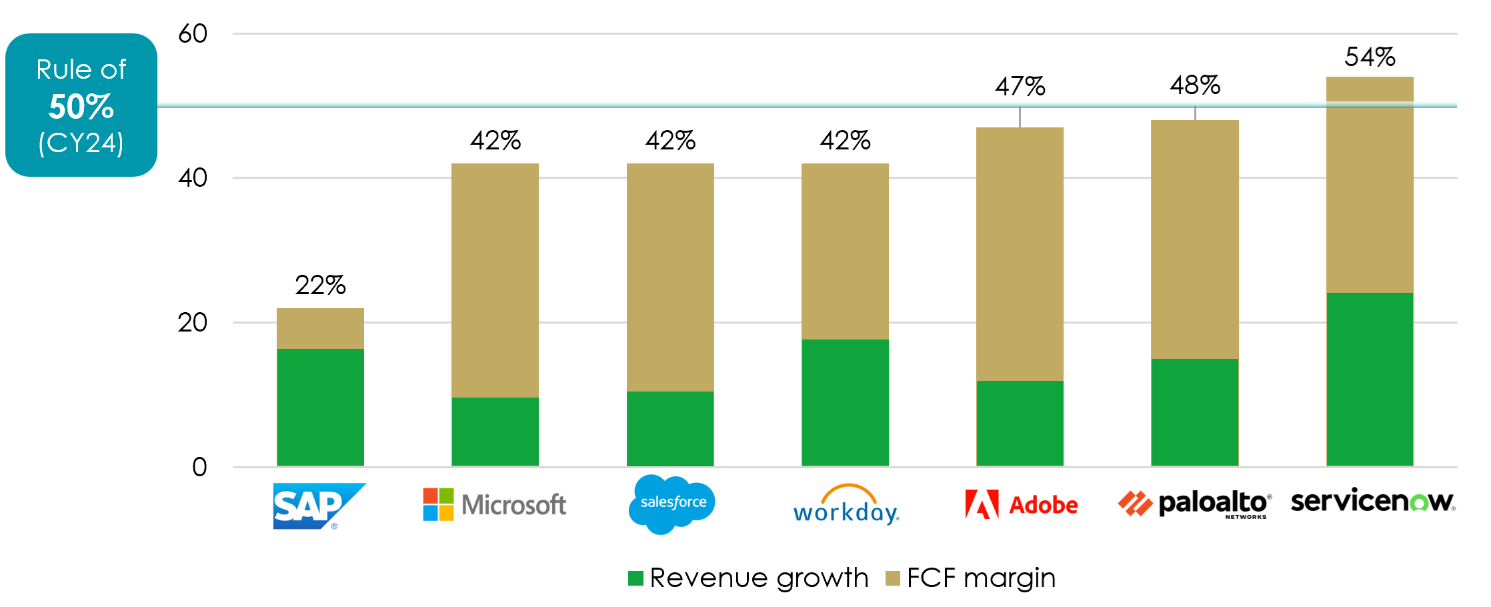

Further up the software stack, ServiceNow is positioning itself as the operating system for the “agentic enterprise”. Its platform integrates all systems and data, structured or unstructured, on‑prem or cloud, into one unified AI model capable of automating workflows across departments. Adoption of its agentic‑AI control tower has been rapid, reaching its full‑year target within 60 days. Beyond workflow automation, ServiceNow is expanding into CRM and workforce management, encroaching on traditional incumbents. With over 450,000 internal AI agents now active and more than 20% top‑line growth, ServiceNow is redefining how enterprises operationalise AI.

ServiceNow continues to be in a league of its own

The infrastructure enabling these workloads continues to evolve. SK Hynix, the global leader in high‑bandwidth memory (HBM), remains central to AI scalability. HBM is now the single largest cost component in Nvidia’s AI systems, and SK Hynix’s technology, stacking DRAM to achieve terabytes‑per‑second throughput, has turned memory into a value‑add rather than a commodity product. Revenues climbed 35% year-on-year in Q2 and are on track to more than double again this year. As AI moves from data‑centre training to real‑world inference and robotics, bandwidth, not compute, will be the constraint.

As AI capex accelerates, the “picks and shovels” are winning. Amphenol delivered record results, with sales up 57% year on year (41% organically) and EPS up 84%. IT datacom grew 133% organically, now 36% of group sales, as the company ships high‑speed interconnects, power and fibre‑optic products into next‑generation data centres. Orders rose 36% to $5.52 billion and margins reached 25.6%. A broad portfolio across autos, aerospace, industrial and defence, plus targeted RF acquisitions, positions Amphenol to dominate the interconnect layer of the electronics build‑out.

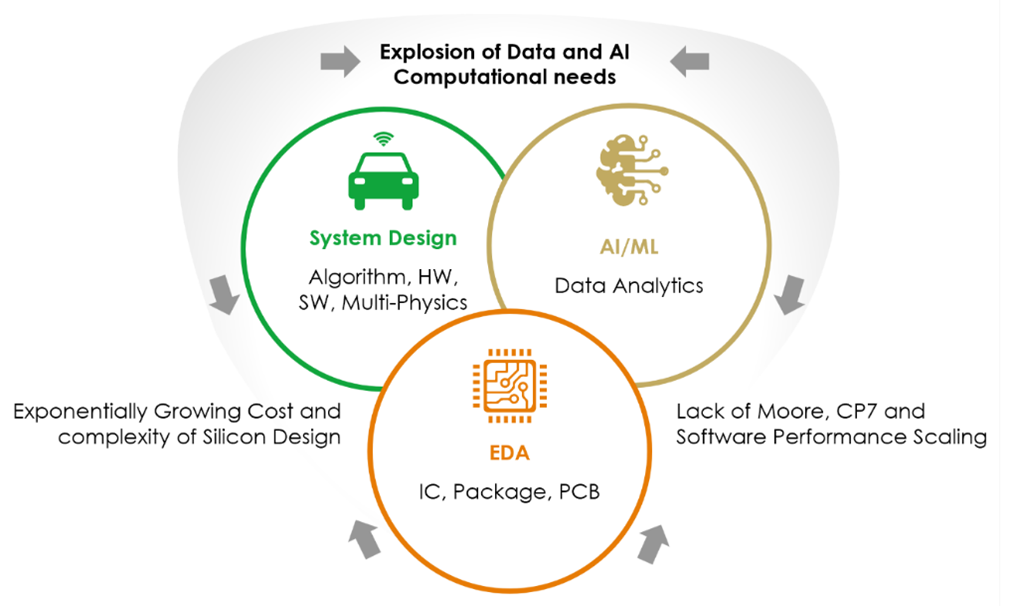

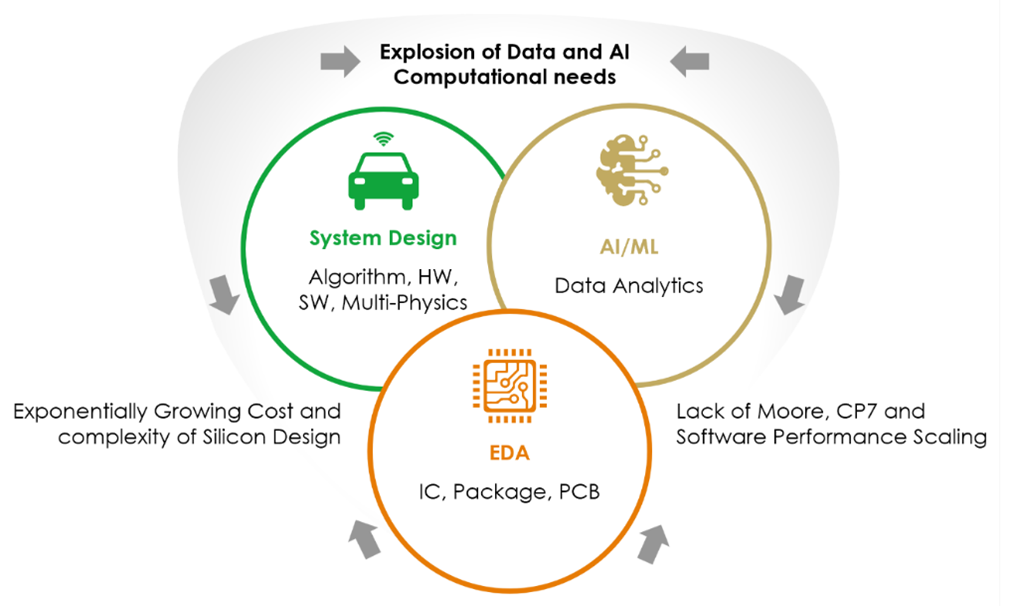

That same shift towards physical AI is creating a tailwind for Cadence Design Systems, whose software tools and IP sit at the heart of semiconductor design. Cadence delivered 20% revenue growth and a 29% EPS beat in Q2, supported by record backlog and rising demand for multi‑die packaging tools. Its Cerebrus AI Studio allows engineers to design chips up to 10× faster with 20% better performance and power efficiency, a crucial leap as the industry targets a 30× productivity gain by 2030. We expect margins to continue expanding beyond 44% as AI‑assisted automation scales across its customer base.

Drivers of convergence of semiconductor, system, and intelligence design

Source: Cadence earnings report, July 2025

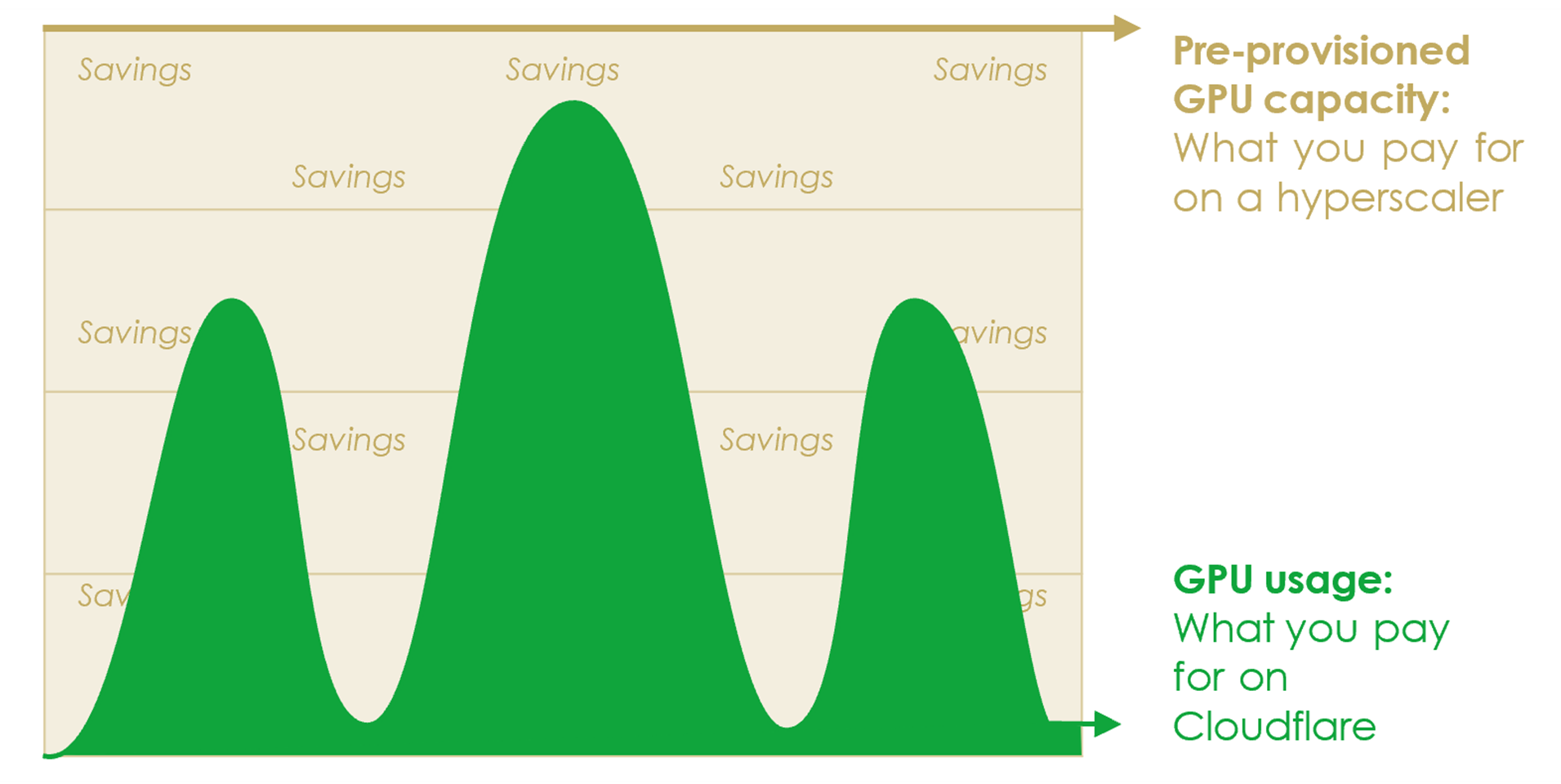

At the network edge, Cloudflare is positioning itself as the “fourth cloud”, a neutral, usage‑priced infrastructure that connects users, devices and agents to data and applications anywhere in the world. Its 330 data‑centre points of presence already sit in front of 20% of global web traffic, enabling sub‑50ms latency for 95% of the world’s population. On this foundation, Cloudflare is layering payment and permission rails for the emerging agentic internet, where machines transact directly with each other. Quarterly revenues rose 28%, ARR passed $2 billion, and its first eight‑figure customer shifted inference workloads entirely from a hyperscaler to Cloudflare’s Workers AI platform, citing cost savings of up to 70%. We believe Cloudflare could become the de‑facto cloud for AI inference over the next three to five years.

GPU utilisation is on average only 30% – Cloudflare’s usage-based serverless inference is up to 70% cheaper vs. renting from hyperscalers

Finally, Arm continues to benefit from the AI revolution’s demand for energy‑efficient compute. Its designs now underpin 99% of smartphones and an increasing share of data centres, automotive systems and edge devices. Quarterly revenue exceeded $1 billion, up 40%, with royalties surging 50%. Over 70,000 enterprises are now running workloads on Arm Neoverse chips, with adoption spreading across hyperscalers and device manufacturers alike. Following share‑price weakness after results, we increased our weighting — fundamentals have strengthened materially while valuation has become more attractive.

Outlook

As we enter Q4 and look towards 2026, we see the improving fundamentals of these companies as the key driver of future returns. While short‑term macro factors may inject volatility, we view such dislocations as opportunities to add to high‑conviction positions within what remains one of the most powerful innovation cycles in modern history.

Discrete years' performance (%) to previous quarter-end:

| Sep-25 | Sep-24 | Sep-23 | Sep-22 | Sep-21 |

Liontrust Global Technology C Acc GBP | 39.3% | 32.0% | 24.2% | -21.8% | 23.7% |

MSCI World Information Technology | 27.0% | 35.8% | 25.3% | -9.9% | 24.1% |

IA Technology & Telecommunications | 26.7% | 24.8% | 19.0% | -21.1% | 26.6% |

Quartile | 1 | 2 | 2 | 2 | 3 |

*Source: FE Analytics, as at 30.09.25, primary share class, total return, net of fees and income reinvested. Fund inception 15.12.15; current fund managers’ inception date is 08.02.23.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

- Overseas investments may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of the Fund.

- The Fund, may in certain circumstances, invest in derivatives but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

- Credit Counterparty Risk: outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties (e.g.international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

- Concentration Risk: the Fund may have a concentrated portfolio, i.e. hold a limited number of investments (35 or fewer) or have significant sector or factor exposures. If one of these investments or sectors / factors fall in value this can have a greater impact on the Fund's value than if it held a larger number of investments across a more diversified portfolio.

- Liquidity Risk: the Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- ESG Risk: there may be limitations to the availability, completeness or accuracy of ESG information from third-party providers, or inconsistencies in the consideration of ESG factors across different third party data providers, given the evolving nature of ESG.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.