View the latest insights from the Sustainable Investment team.

View NowKey takeaways

- Since launch in July 2023, the strategy has faced macro headwinds including mega-cap dominance, healthcare sector pressures, and economic weakness outside the AI trade.

- After a challenging couple of years, the healthcare sector performed strongly towards the end of the year, with three of the Fund’s top five contributors coming from the sector.

- We added positions in Cintas and Progressive, while exiting holdings in Morningstar and Bright Horizons.

Performance

The Liontrust GF Sustainable Future US Growth Fund returned 1.4% in US dollar terms in Q4, compared with the 2.3% return from the MSCI USA Index (its comparator benchmark). This takes the full year performance to 9.3%, considerably behind the MSCI USA Index at 17.3%.

2025 marks the second year where the Fund failed to match the returns of the benchmark – we share your frustration with this development. In this update, we will cover the usual updates on key attribution and trading activity for Q4, and then conclude with a summary of the current state of the macro headwinds that the strategy has faced since launch and where we stand at the end of 2025.

Q4 attribution

After a challenging couple of years, the healthcare sector performed strongly towards the end of the year, with three of the Fund’s top five contributors coming from the sector. Demand across the global healthcare system is normalising after two years of post-pandemic destocking. US political pressure also eased after several large pharmaceutical companies signed agreements to expand domestic manufacturing capacity and it would appear that investors are reassessing their low levels of exposure – given the uncertainty generated by AI, we believe healthcare should offer a sensible place to allocate incremental capital in the coming years.

The Fund’s overweight position in healthcare contributed positively, with Iradimed (+38%), Intuitive Surgical (+27%) and Thermo Fisher Scientific (+20%) ranking among the period’s top performers. Iradimed in particular is worth highlighting when it comes to the benefits of being able to invest in smaller, less liquid names; 35% of the company’s shares are still held by the CEO and the company entered the year with a market capitalisation below $700 million. Intuitive Surgical was also pleasing for us, as we added 50 basis points to the position at the start of the quarter as the shares had come off considerably. It turns out that management also believed there was value in the shares, with the company executing an aggressive buyback during the third quarter to the tune of $1.9 billion.

Alphabet (+29%) was also a top contributor for the quarter, taking the total return in 2025 to +66%. We will confess to being more than a little frustrated that we failed to outperform the benchmark despite beginning the year with our largest position in what proved to be the best performing name in the Magnificent 7. Since the launch of Chat GPT in November 2022, Alphabet’s moat around Search, the company’s core profit driver, has been in question. We long believed that the rare combination of a scaled cloud business (GCP), custom silicon (called ASICS) and its own large language model (called Gemini) would prove to be a stronger hand than the market was giving them credit for. The release of Gemini 3.0, Alphabet’s latest model was met with a positive reception, and the recognition that the model was trained solely on Alphabet’s own ASICs, helped propel the shares to new highs during the quarter.

Turning to the detractors, Cadence Design Systems (-11%) was the largest detractor, primarily reflecting the size of the holding, which stood at 3.5% at the start of the quarter. There was nothing in particular to note from its Q3 results, rather we think the share price weakness was more due to the broader weakness in software, driven by sentiment of how AI will impact the broader sector. It remains a key position for us and a true ‘picks and shovels’ business to the semiconductor industry.

Trex (-32%) shares fell after the composite wood decking specialist reported disappointing Q3 earnings, cutting guidance for 2025 and 2026. Management cited continued weakness in repair-and-remodel demand and expected distributor destocking.

The company also mentioned competitive pressures, as its main competitor, Azek was acquired earlier in the year by a much larger company (James Hardie) and have apparently been considerably more aggressive at trying to take share. We therefore decided to exit our position in Trex due deteriorating fundamentals from these competitive pressures combined with a challenged end-market. Without an imminent rebound in the Repair & Remodel construction cycle, we believe Trex is likely to struggle to deliver meaningful revenue or earnings growth over the next two years, and we therefore reallocated capital to more attractive opportunities.

Trading activity

During the quarter we exited three positions and added two – the exits summed to 3% of the Fund and the new positions totalled 4%.

We added a position in Cintas, the leading US provider of uniform rental, operating at more than three times the scale of its nearest competitor and benefiting from a clear cost advantage. Cintas has built a reputation for reliability and high-quality service, enabling it to deepen customer relationships and expand into adjacencies such as facilities services and safety solutions. The core uniform rental model is a strong fit with our Delivering a circular materials economy theme, given the reuse and lifecycle management embedded in the service. We view Cintas as a high-quality, dependable growth compounder, and we added exposure following a valuation derating driven by market concerns around the outlook for the labour market given the potential impact from AI.

We also added Progressive, a market-leading US provider of insurance products, helping ensure individuals and businesses can cover costs associated with accidents, injury, and damage. While the name originally reflected the founders’ belief in taking a more innovative approach, we believe this still holds true nearly 100 years later – particularly in the company’s focus on technology, operating discipline, and employee management. Progressive has consistently outperformed the industry in returns on capital and growth, and its higher level of digital sophistication should allow it to continue capturing scale benefits and widening its competitive edge relative to peers.

With regards to exits, We sold our position in Morningstar on signs of deteriorating fundamentals, exacerbated by the emergence of a potentially disruptive AI competitor following the launch of Anthropic’s “Claude for Financial Services.” While we expect several of Morningstar’s market-leading franchises to retain strong positions, we are increasingly concerned about the potential impact on pricing power and margins as competitive intensity rises. Following engagement with the company, we were disappointed by the strength and urgency of its response to these emerging threats, which reinforced our decision to sell.

We sold our holding in Bright Horizons as the core childcare business appears to have plateaued in enrolment growth, limiting improvements in occupancy. The company’s footprint is not optically positioned for hybrid working patterns, with childcare demand increasingly shifting closer to the home rather than workplaces. As a result, the investment case has become more dependent on the continued outsized success of back-up care, and we are less confident in the durability of that growth profile going forward despite recent strength.

Macro headwinds

Since the Fund’s launch in July 2023, the strategy has faced a number of macroeconomic headwinds. Below, we outline these challenges and explain how the Fund has been positioned.

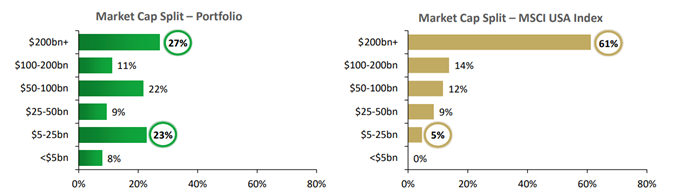

- Mega cap dominance – the Fund is materially overweight both mid and small caps compared to the benchmark.

- Healthcare sector – c. 20% of the Fund invested in Healthcare vs. c. 10% for the index.

- Economic weakness outside of the AI trade– the Fund is managed using a multi thematic process ensuring diversity of exposure to macro trends.

Let’s take a look at each of these and how 2025 shaped in up in the broader context.

Mega cap dominance

From launch, the Fund has had a significant overweight to small and mid-sized businesses and a notable underweight to the mega caps when compared to the benchmark. Below is how the Fund looked at the end of 2025.

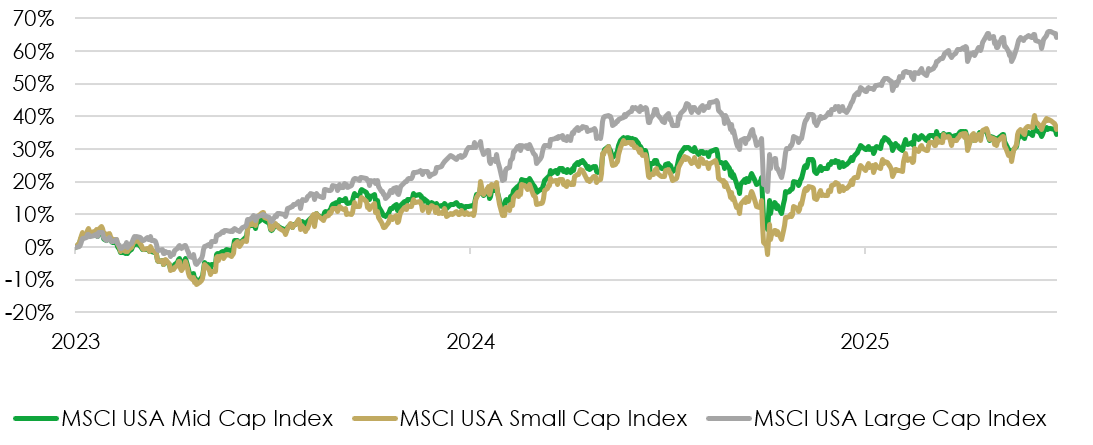

From launch, this has been one of the largest headwinds to performance, with the MSCI USA Large Cap index returning 64%, compared to the Small and Mid-cap indices that returned 36% and 34%, respectively.

The trend very much continued throughout 2025, with the Large cap index returning 18.6%, more than double the Small cap index at 8.9% and substantially higher than the Mid cap index at 11.6% [1]. Long term however, we remain confident that small and medium-sized companies will offer superior investment returns, as they have typically done in the past.

Healthcare exposure

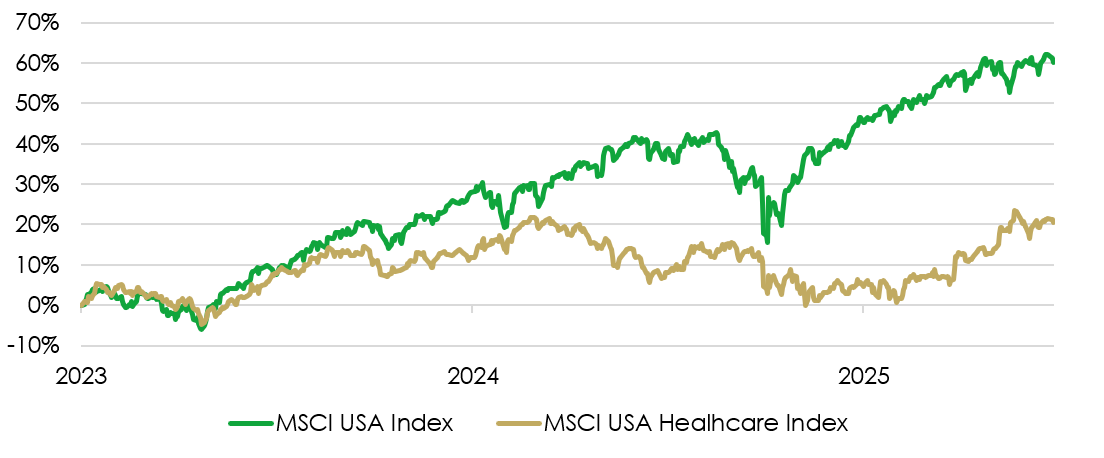

Our healthcare exposure has ranged from 16% of the Fund at its low point in October 2023 to approximately 22%, where it stands at the end of 2025. Over the same period, the MSCI USA Index’s healthcare weighting declined from 11% in October 2023 to 10.4% today. As a result, the Fund has remained consistently overweight healthcare since inception. This positioning has been a headwind overall, as the MSCI USA Healthcare Index has underperformed the MSCI USA Index by 36% since July 2023.

Source: Liontrust, Bloomberg as at 31/12/2025

It should be noted however, that in the calendar year of 2025, the Healthcare Index nearly caught up with the broader index, ending the year just 3.1% behind. [2]

We believe this strong performance in the final quarter of 2025 could portend a continuation of this trend into 2026 and beyond. As noted above, the Fund is positioned to benefit strongly from this should this prove to be the case.

Broader economic weakness

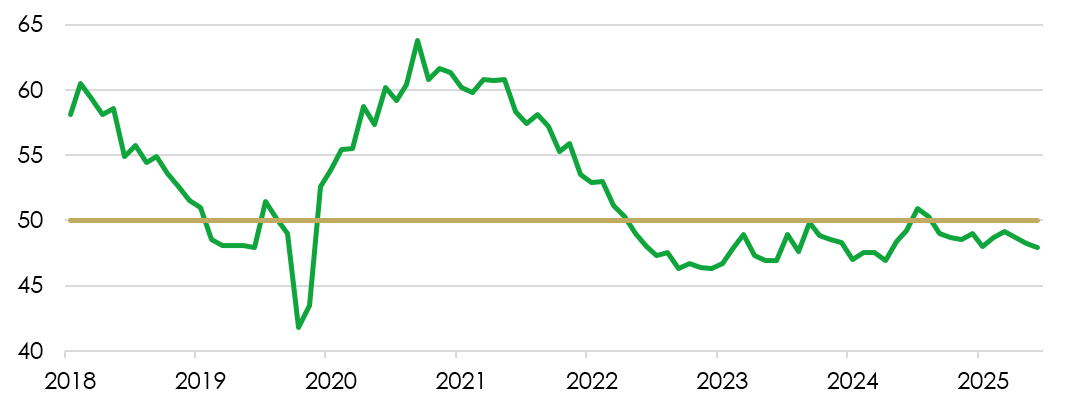

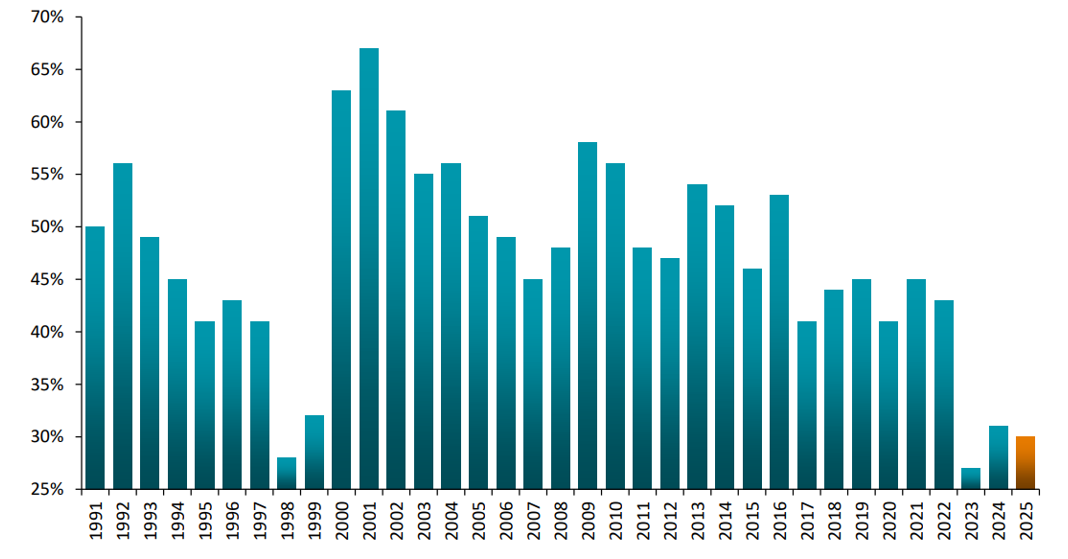

Aside from companies exposed to the build out of data centres and artificial intelligence, the broader economy has been weak for many years. The chart below shows the results of a monthly survey called the US ISM Manufacturing PMI. Essentially, a reading above 50 indicates that manufacturing is expanding and below 50, it is contracting.

The combination of mega caps outperforming, AI driving all the investment, and a weaker broader economy has resulted in the third year in a row of a very narrow market, with only c. 30% of the companies in the S&P 500 outperforming the index.

[2] Source: Liontrust, Bloomberg as at 31/12/2025

% of market capitalization, % of last 12 months' earnings

Source: Baird December 2025

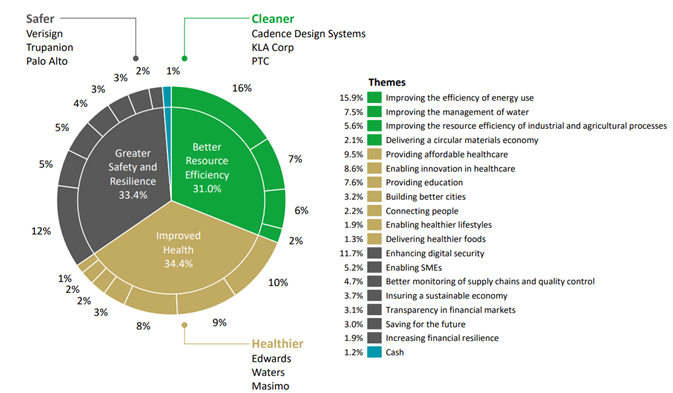

To have outperformed during this period would have required a highly concentrated portfolio centred around the theme of artificial intelligence. Our process is built around diversification, with the view that such diversification will deliver through different economic cycles. Here is the thematic wheel for the Fund as at the end of 2025.

[3] Source: Liontrust, Factset, as at 31.12.2025, GF US Growth Fund

The purpose of this section was not to blame the market for our underperformance, but rather explain some of the key dynamics at play. The decision to be overweight small and mid-caps, healthcare, and have a diversified portfolio was very much ours. So far, these decisions have been a headwind to performance, but we remain confident that long-term, they will prove successful.

Discrete years' performance (%) to previous quarter-end**:

| Dec-25 | Dec-24 |

Liontrust GF Sustainable Future US Growth B5 Acc USD | 9.3% | 10.7% |

MSCI USA | 17.3% | 24.6% |

*Source: FE Analytics, as at 31.12.25, primary share class (A5), in euros, total return, net of fees and income & interest reinvested. 10 years of discrete data is not available due to the launch date of the fund.

Key Features of the Liontrust GF SF US Growth Fund

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

- Overseas investments may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of the Fund.

- The Fund, may in certain circumstances, invest in derivatives but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

- Credit Counterparty Risk: outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties (e.g. international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

- Diversification Risk: the Fund is expected to invest in companies predominantly in a single country which maybe subject to greater political, social and economic risks which could result in greater volatility than investments in more broadly diversified funds.

- Liquidity Risk: the Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- ESG Risk: there may be limitations to the availability, completeness or accuracy of ESG information from third-party providers, or inconsistencies in the consideration of ESG factors across different third party data providers, given the evolving nature of ESG.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.