View the latest insights from the Global Innovation team.

View NowKey takeaways

- Entering 2026, growth is resilient but uneven, with moderating inflation and easing rates supportive for investment and valuations, though volatility from geopolitics, energy and policy uncertainty remains elevated.

- Eli Lilly was the standout contributor, reflecting strong execution and accelerating GLP-1 growth, with Danaher and LVMH also contributing positively, while Oracle detracted as negative AI sentiment outweighed fundamentals and Ferrari was a detractor that offered an attractive entry point.

- The outlook remains positive for high-quality Global Leaders with strong balance sheets, pricing power and cash generation, where diversified structural growth drivers support sustainable dividend growth and long-term compounding.

Performance

The Liontrust Global Dividend Fund returned 1.0% in Q4, versus the 3.8% IA Global Equity Income sector average return and the MSCI World Index return of 3.4% (both comparator benchmarks).

Longer term performance remains strong, with the Fund having returned 149.5% since manager inception (31.08.17), the number two fund in the sector ahead of both the IA Global Equity Income sector return of 89.3% and the MSCI World Index return of 134.0%.

Fund commentary

As we enter 2026, the macro backdrop is characterised by resilient but uneven growth, moderating inflation and a declining global cost of capital, alongside persistent volatility driven by policy uncertainty and geopolitics. For income and dividend growth investors, the direction of inflation and interest rates remains the key variable. A more stable inflation outlook and easing borrowing costs can support corporate investment and capital market activity, while also reducing pressure on equity valuations.

At the same time, risks remain meaningful. Energy and commodity prices may remain volatile, with electricity prices a particular swing factor as investment catches up to structurally higher power demand. Elevated sovereign debt and shifting trade policy can keep term premia higher, amplify dispersion across sectors and reinforce the importance of balance sheet strength, pricing power and stock selection.

Against this backdrop, we see the most investable opportunities for dividend growth increasingly sitting in broad-based structural compounding across multiple sectors, rather than in narrow, single-theme narratives. The Fund is positioned accordingly, with exposure to Global Leaders benefiting from healthcare innovation, electrification and infrastructure investment, premium consumer franchises and selective financial compounders.

The top performer for Q4 was pharmaceutical giant Eli Lilly (+41%). We took advantage of the 20% pullback in Eli Lilly shares during July and August to increase our position, believing the extreme negative sentiment mis-evaluated the scale and longevity of the GLP-1 opportunity across obesity, diabetes, cardiovascular disease and broader cardiometabolic health. GLP-1s are the fastest-growing drug class in history and we remain in the early stages of this revolution, with the market widely expected to exceed $100 billion by 2030 and obesity patient penetration still below 1%, before considering label expansion into more than 200 chronic diseases associated with obesity.

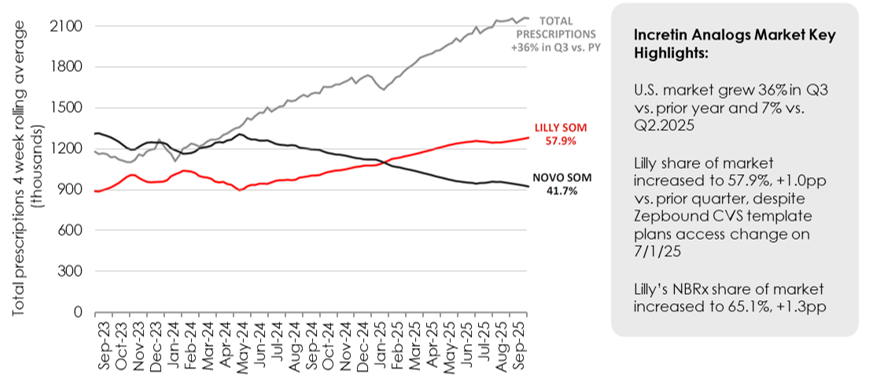

Lilly’s Q3 results were very encouraging: topline growth accelerated to 54% year-on-year, while earnings beat expectations by 23%. For the fifth consecutive quarter, the company gained market share in the US incretin analogues market and continued to take share internationally. Management has consistently emphasised the importance of execution at scale in a market that could ultimately reach tens or even hundreds of millions of patients, an area where Lilly’s manufacturing investment and operational discipline provide a clear competitive advantage.

US Incretin Analogs Market

Source: Eli Lily earnings update November 2025

After a lean period, Danaher (+16%) is re-emerging as a life sciences leader as sector conditions improve. The company’s bioprocessing business is recovering as post-pandemic destocking fades, with management expecting destocking in North America and Western Europe to be largely complete by mid-2024, supporting a return to mid-single-digit growth. Danaher has invested to shorten lead times and improve availability, expanding capacity across chromatography, filtration and single-use technologies in multiple geographies.

Beyond bioprocessing, the company continues to strengthen its mix of recurring revenues through consumables and services, supported by disciplined capital allocation. Recent initiatives, including automation in diagnostics and the integration of Abcam’s antibodies and reagents portfolio, enhance cross-selling opportunities and support durable cash conversion. For a dividend strategy, these characteristics — visible end demand, recurring revenue streams and strong execution — provide a clear pathway to sustainable dividend growth.

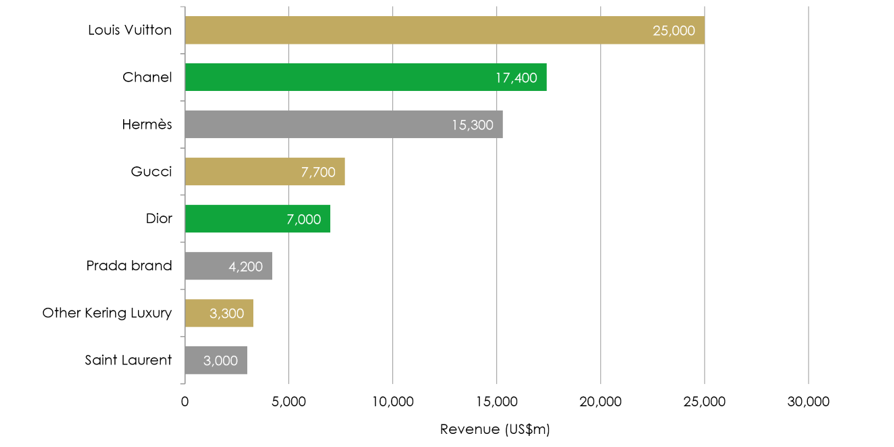

LVMH (+25%) rebounded strongly after entering the Q3 earnings season with very low expectations. Consensus had anticipated a 4% organic revenue decline; instead, revenues grew 1%, driven by volume rather than price, prompting a sharp recovery in the shares. While the company has faced well-documented headwinds, including softer Chinese demand and pressure on Western middle incomes, these risks were already reflected in the valuation.

Importantly, LVMH has continued to invest through the downturn. The group has refreshed creative direction, innovated across product, partnerships and distribution, and leveraged its scale to sustain brand investment that smaller peers struggle to match. These actions are beginning to show through, with organic growth improving sequentially across all divisions in Q3. Enduring brand equity, scale advantages and scarcity-driven pricing power support premium margins and long-term resilience, reinforcing LVMH’s position as a Global Leader capable of defending cash flows through more volatile macro environments.

Scale matters in an industry where innovation is driven on fixed costs

Key soft luxury brands by revenue 2024 - based on publicly report sales figures

Source: Bernstein, Liontrust, October 2025

Turning to the detractors, market sentiment towards Oracle (-31%) has turned sharply negative over the past two months, following its blowout guidance last quarter. Oracle’s credit default swaps (CDS) has increasingly been used as a proxy for bearish positioning on AI infrastructure and OpenAI, given Oracle’s sizeable AI-related deal wins. In our view, this has created a meaningful disconnect between fundamentals and sentiment. We trimmed Oracle across our funds in September after shares rose c.40% post Q2 results.

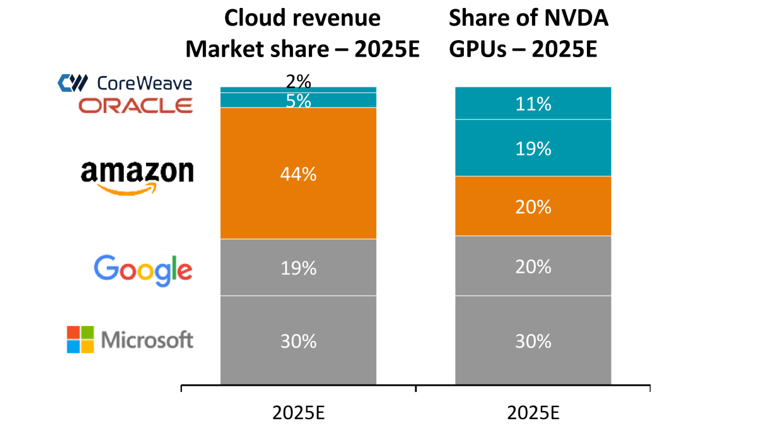

We see Oracle as a structural winner in the AI era. Technology platform shifts consistently reshuffle competitive dynamics, and Oracle is emerging as a disruptor in cloud infrastructure, particularly for AI workloads. While it holds only ~5% of global cloud revenue share, Oracle accounts for a far larger share of Nvidia GPU deployments, highlighting its strength in accelerated compute. This reflects a broader decoupling in AI, where purpose-built infrastructure is displacing legacy cloud architectures.

Oracle’s advantage stems from its Generation 2 data centres, designed from the ground up for AI. Being late to cloud proved beneficial, giving Oracle a blank canvas to engineer GPU-dense, RDMA-linked clusters that deliver materially better price-performance, scalability and reliability than incumbents. This enables faster time-to-value for customers, a critical differentiator for AI labs, enterprises and sovereigns, and explains Oracle’s recent large contract wins.

Beyond AI infrastructure, Oracle has three durable growth engines: OCI, its core database franchise and strategic SaaS. The underappreciated driver is databases, where migrations from on-prem to Oracle Cloud can deliver a 4–5x revenue uplift, with attractive margins and strong customer lock-in.

Concerns around rising leverage and AI capex have driven CDS wider, but we see these fears as overstated. Capex is front-loaded yet supported by long-dated, contracted demand and a highly cash-generative software base. Rating agencies have reaffirmed Oracle’s investment-grade status. In our view, the share price moves reflect AI scepticism rather than deteriorating fundamentals.

Estimated share of NVDA GPUs and share of Cloud revenue

Source: Oracle, CoreWeave and Liontrust 2025. All use of company logos, images and trademarks in this document are for references purposes only.

Ferrari (-23%) share price weakness during the quarter gave us the opportunity to build a position in this scarcity-led luxury franchise with high barriers to entry and long order visibility. Short-term volatility can create attractive entry points into Global Leaders, and Ferrari’s long-term strategy remains firmly intact.

The company is executing against a clearly defined roadmap designed to preserve exclusivity while managing the powertrain transition. Its flexible manufacturing platform supports a balanced mix of internal combustion, hybrid and battery electric vehicles, while maintaining targeted margins and disciplined volume growth. Order visibility now extends into 2027, and recent results showed no evidence of demand softness, with growth driven by mix and personalisation rather than volumes. In a world of more frequent macro “air pockets”, Ferrari’s scarcity, pricing power and innovation-led strategy support its ability to compound cash flows and dividends through the cycle.

Outlook

Entering 2026, we expect global growth to remain resilient, with inflation continuing to moderate and policy rates easing. For income and dividend-growth investors, a more stable inflation profile and lower borrowing costs can support corporate investment and capital market activity, while also improving the backdrop for equity valuations.

The opportunity set is supported by several constructive dynamics. As financing conditions normalise, companies with strong balance sheets and clear reinvestment pathways should be well placed to sustain earnings momentum and dividend growth. Structural demand drivers remain intact across healthcare innovation, electrification and infrastructure investment, premium consumer franchises and selective financial compounders.

We therefore continue to see a positive outlook for Global Leaders with durable competitive advantages, pricing power and high free-cash-flow conversion, where earnings are underpinned by visible demand and disciplined capital allocation. The portfolio’s diversified structural exposures provide multiple independent engines of compounding, supporting both income delivery and long-term capital growth.

Implementation remains valuation-aware. We seek to allocate capital to high-quality franchises when prospective returns are attractive, while recycling capital selectively to maintain portfolio quality and support long-term dividend growth.

Overall, we believe 2026 offers a supportive environment for disciplined ownership of high-quality global leaders with the capacity to compound cash flows and grow dividends through the cycle.

Discrete years' performance (%) to previous quarter-end:

| Dec-25 | Dec-24 | Dec-23 | Dec-22 | Dec-21 |

Liontrust Global Dividend C Acc GBP | 11.8% | 14.0% | 17.9% | -7.8% | 16.1% |

MSCI World | 13.9% | 19.6% | 15.3 | -8.1% | 19.6% |

IA Global Equity Income | 12.8% | 11.0% | 9.2% | -1.2% | 18.7% |

Quartile | 3 | 2 | 1 | 4 | 4 |

*Source: FE Analytics, as at 31.12.25, C accumulation share class, total return, net of fees and income reinvested. Fund inception date is 31.12.01; the current fund managers’ inception date is 31.07.17.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

- Overseas investments may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of the Fund.

- The Fund, may in certain circumstances, invest in derivatives but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

- Credit Counterparty Risk: outside of normal conditions, the Fund may hold higher levels of cash which may be deposited with several credit counterparties (e.g.international banks). A credit risk arises should one or more of these counterparties be unable to return the deposited cash.

- Liquidity Risk: the Fund may encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- ESG Risk: there may be limitations to the availability, completeness or accuracy of ESG information from third-party providers, or inconsistencies in the consideration of ESG factors across different third party data providers, given the evolving nature of ESG.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.