This article is featured in the Q3 2025 Future Strategist newsletter, you can read the rest of the newsletter here.

2012 saw the release of Google Glass, a futuristic looking smart glass equipped with a built-in camera, voice control and heads-up display. Although an early pioneer in the wearable tech space, this experimental prototype was undeniably ahead of its time – both technology-wise and in consumer readiness.

Fast forward to today and we are one step closer to Artificial General Intelligence. We have seen AI fundamentally transform our environment from interaction through voice command processing and immersive context-aware features with object recognition. Meanwhile, attitudes toward public camera use have also shifted dramatically and now largely normalised. Yet the true inflection point for smart glasses was not a radical reinvention – it was a subtle evolution of glasses design currently worn by billons.

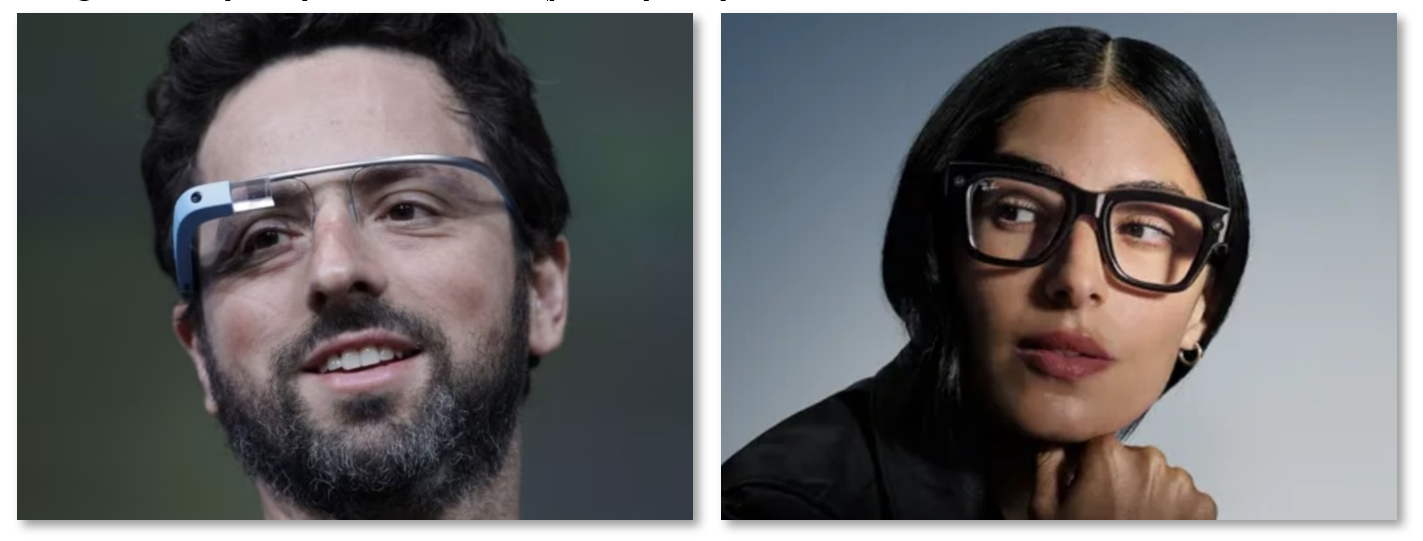

Google Glass (2012) versus Meta Ray Ban (2025)

Source: Google unveils prototype ‘smart’ glasses

Sources: Meta Ray-Ban Display: Breakthrough AI Glasses

Meta’s smart glasses success is the result of a strategic partnership with EssilorLuxottica, the global eyewear group behind Ray-Ban and Oakley. EssilorLuxottica manages manufacturing, retail and logistics across 18,000 stores, while Meta supplies the software and AI models. This partnership is redefining the eyewear industry.

By embedding advanced AI into the iconic Ray-Ban frames, we get eyewear that looks like normal premium glasses but features a 12-megapixel camera, Meta’s powerful AI engine, open-ear audio and seamless connectivity. Demand for their smart glasses has surged well beyond expectations, with Mark Zuckerberg even admitting the company “dramatically underestimated” interest. For context, one million units were sold in 2024, with sales of Ray-Ban Meta sunglasses tripling in the first half of the year. They are now racing to scale production to 10 million units annually by 2026, with analyst estimates expecting to ship around 35 million units by 2028.

However, despite the impressive momentum, three significant challenges remain:

- Battery life: Most models struggle to last beyond a few hours, and adding Augmented Reality displays only accelerates power drain.

- Processing and power: Much of the computing still relies on smartphones, limiting responsiveness.

- Apps and memory: Native apps are still in their infancy, with many smartphones lacking the bandwidth to support richer, more immersive experiences without hardware upgrades.

Even with these constraints, smart glasses are rapidly emerging as the next everyday computing platform. As we stand at this inflection point, the question is no longer whether they will succeed, but which companies will lead how we interact with the world around us.

Meta’s approach to shipping early, iterating publicly, and bending the cost curve stands in contrast to slower, perfection-first rivals. Yet even Apple is shifting gears, reportedly accelerating development of its own AI-powered glasses and pausing work on its next-gen Vision Pro headset to prioritise this shift. First-mover advantage does not guarantee long-term dominance, however.

As hardware becomes increasingly commoditised, the true battleground is software. Competitors like Xiaomi and RayNeo V3 are already matching Ray-Ban Meta’s core functions, signalling that differentiation will hinge on AI capabilities, ecosystem integration and user experience. Google has also unveiled Android XR, a dedicated operating system for smart glasses and headsets, offering contextual AI assistance and seamless integration with its existing services.

The trajectory of smart glasses is following that of smartwatches: initially a tied accessory to your phone, they have since evolved into standalone platforms. If this pattern holds, the most important screen of the next decade may be the one you barely notice – lightweight, voice first and worn on your face.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds managed by the Global Equities Team:

- May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund.

- May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares.

- May have a concentrated portfolio, i.e. hold a limited number of investments or have significant sector or factor exposures. If one of these investments or sectors / factors fall in value this can have a greater impact on the Fund's value than if it held a larger number of investments across a more diversified portfolio.

- May invest in emerging markets which carries a higher risk than investment in more developed countries. This may result in higher volatility and larger drops in the value of a fund over the short term.

Certain countries have a higher risk of the imposition of financial and economic sanctions on them which may have a significant economic impact on any company operating, or based, in these countries and their ability to trade as normal. Any such sanctions may cause the value of the investments in the fund to fall significantly and may result in liquidity issues which could prevent the fund from meeting redemptions. - May invest in companies predominantly in a single country which maybe subject to greater political, social and economic risks which could result in greater volatility than investments in more broadly diversified funds.

- May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay.

- May, in certain circumstances, invest in derivatives but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

The risks detailed above are reflective of the full range of Funds managed by the Global Equities Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID."

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

Pieran Maru

Pieran Maru is a Fund Manager in the Global Equities team. Pieran joined Liontrust in 2024 from GAM where he covered software and hardware companies in GAM’s Global Equity team.