This article is featured in the Q3 2025 Future Strategist newsletter, you can read the rest of the newsletter here.

With so much investor bandwidth being devoted to the development of AI on Earth, we thought it would be good to look further afield at more futuristic themes and Space in particular.

The rapidly evolving opportunity in Space economics was given a huge boost by the October 2024 ‘chopsticks’ moment when M was successfully recovered on landing. This created a step change in rocket transport economics with the ability to reuse significant parts of the infrastructure. In the third quarter of 2025, the stock market fielded the IPO of Firefly, one of the commercial launch companies that competes in this fast-growing market to commercialise the Space economy.

Source: Mechazilla Chopsticks lift Starship Super Heavy Booster 7. (Credit: Elon Musk / SpaceX via Twitter.)

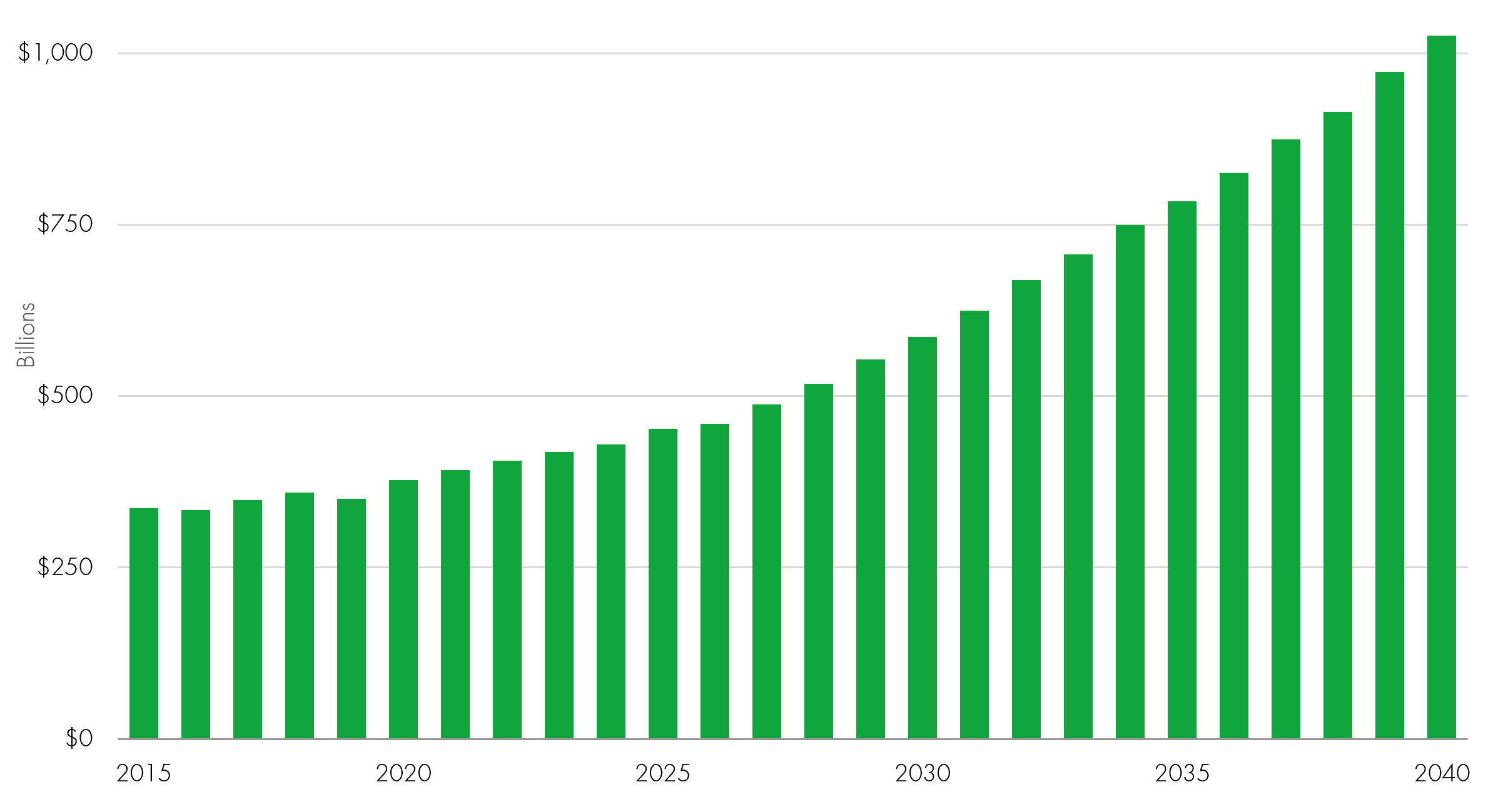

Global space economy forecast

Source: June 2021, Morgan Stanley Research, Haver Analytics. Past performance does not predict future returns.

As the chart above shows, the Space economy is expected to grow to over $1 trillion by 2040, with some research suggesting this milestone will be reached far earlier. Within the overall economy, the rocket launch market could take as much as a 10% share or $100 billion of revenue opportunity.

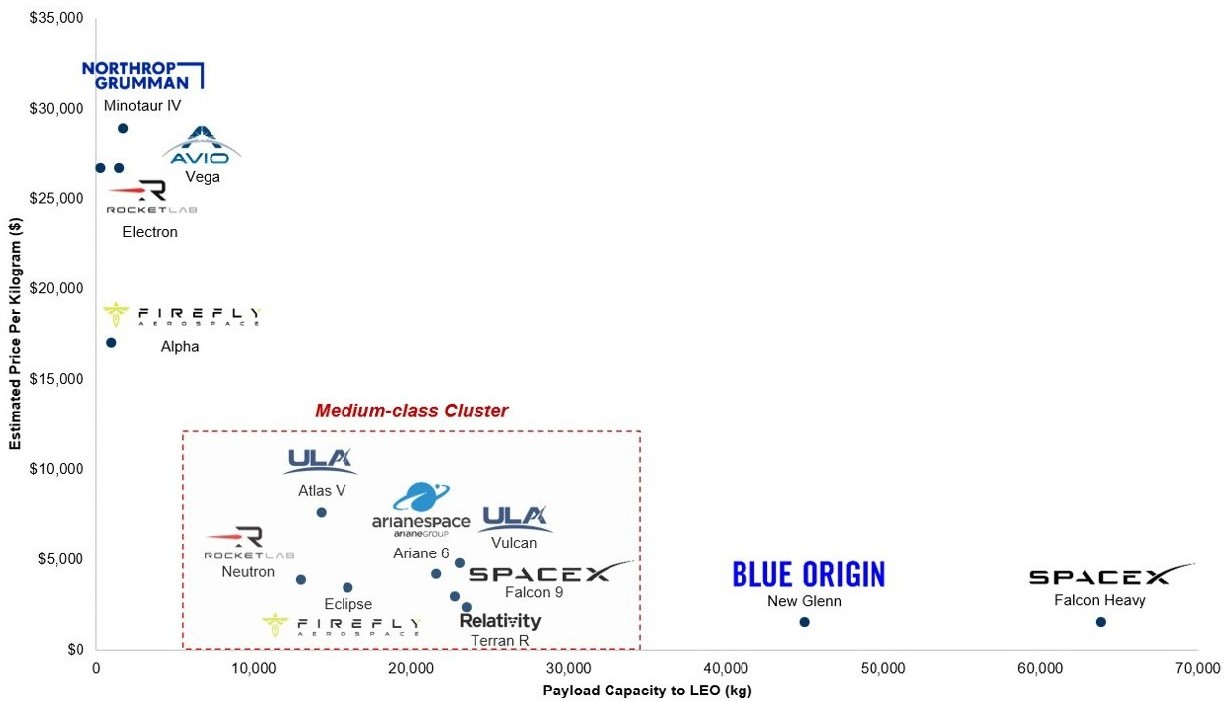

This is the primary way to access the investment opportunity in today’s public markets, with Firefly and Rocket Labs as the two leading quoted contenders, in our view. The market overall is divided into three primary segments defined by payload capacity. At the highest end of the market in heavy payloads, SpaceX dominates with its Falcon 9 rocket.

Space Launch Ecosystem

Source: August 2025, Company Data/Filings, Morgan Stanley Research.

SpaceX is expected to have about 175 to 180 launches in 2025 but 80-85% of the payloads will go to internal projects, Starlink in particular. Blue Origin’s New Glenn only plans 8 to10 launches so is significantly smaller than SpaceX, with most capacity going to commercial partners.

The medium and small payload market is where other quoted players – Firefly and Rocket Labs – operate. Both companies have had varying degrees of success with their launches and both have aggressive launch ramps for 2025. SpaceX is seen as the world’s most expensive private company today with a market value estimated at $400 billion while Firefly and Rocket Labs are much smaller with quoted market values of $5 billion and $25 billion, respectively.

Investing in the Space economy is not for the faint-hearted. Individual launch successes or failures can impact share prices dramatically (see the 20%+ fall in Firefly’s share price following a recent rocket failure on the testing launchpad). But we believe there is a tremendous long-term growth opportunity in Space and one that will inevitably capture the imagination of investors as the launch schedules ramp up and as we see more technology defined moments like that of the SpaceX chopsticks rocket capture.

While government-backed agencies in the US and China still command a significant portion of Space spending, commercial companies are coming to the forefront as preferred partners. At the same time, the possible winners are extending beyond the oligarch-backed companies like SpaceX and Blue Origin and this provides an off ramp for companies like Northrop Grumman, Lockheed and NASA to outsource launch activity to more commercial sources. In fact, Northrop is a direct shareholder in Firefly as part of its diversification strategy.

It may be too early to invest in the Space economy via the quoted markets but the opportunities are beginning to emerge in what will clearly be a huge market. In the words of Captain James T. Kirk of the Starship Enterprise, “You know the greatest danger facing us is ourselves, an irrational fear of the unknown. But there’s no such thing as the unknown — only things temporarily hidden, temporarily not understood.” The journey to understanding Space, while light years long, is well underway!

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds managed by the Global Equities Team:

- May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund.

- May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares.

- May have a concentrated portfolio, i.e. hold a limited number of investments or have significant sector or factor exposures. If one of these investments or sectors / factors fall in value this can have a greater impact on the Fund's value than if it held a larger number of investments across a more diversified portfolio.

- May invest in emerging markets which carries a higher risk than investment in more developed countries. This may result in higher volatility and larger drops in the value of a fund over the short term.

Certain countries have a higher risk of the imposition of financial and economic sanctions on them which may have a significant economic impact on any company operating, or based, in these countries and their ability to trade as normal. Any such sanctions may cause the value of the investments in the fund to fall significantly and may result in liquidity issues which could prevent the fund from meeting redemptions. - May invest in companies predominantly in a single country which maybe subject to greater political, social and economic risks which could result in greater volatility than investments in more broadly diversified funds.

- May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay.

- May, in certain circumstances, invest in derivatives but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

The risks detailed above are reflective of the full range of Funds managed by the Global Equities Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID."

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

Mark Hawtin

Mark Hawtin is head of the Global Equities team. Mark joined Liontrust in 2024 from GAM, where he was an Investment Director running global long-only and long/short funds investing in the disruptive growth & technology sectors. Before joining GAM in 2008 he was a partner and portfolio manager with Marshall Wace Asset Management for eight years, managing one of Europe’s largest technology, media and telecoms hedge funds.