This article is featured in the Q4 2025 Future Strategist newsletter, you can read the rest of the newsletter here.

Prediction markets have rapidly gained prominence in 2025, generating around $40 billion in global trading volume and beginning to reshape how the world processes information and makes decisions. At their core, prediction markets aggregate the beliefs of large groups of individuals who are incentivised to be right, turning these contracts into real-time forecasts of future events that are often more accurate than traditional polls.

Underpinned by CFTC (Commodities Future Trading Commission) regulated derivative ‘event contracts’, prediction markets let participants trade on binary outcomes across a vast array of interests such as finance, sports, politics and media. What makes prediction markets powerful? It is information density, real-time signals and simplicity. In a world overloaded with narratives, prediction markets cut through the noise with one simple output: price.

Why are prediction markets taking off?

Why are prediction market platforms such as Kalshi and Polymarket suddenly taking off? This can be attributed to three key forces converging: Regulatory clarity, Distribution unlock and Sports.

1. Regulatory clarity

For years, prediction markets had operated in a legal grey zone area just like crypto; the turning point, however, came in 2024 when a US federal court allowed Kalshi to offer ‘event contracts’. These contracts were financial swaps subject to CFTC regulation, not gambling products subject to state regulation, and reshaped the entire landscape. The impact has been profound, with Kalshi successfully defending political contracts in court, while Polymarket re-entered the US market.

2. Distribution unlock

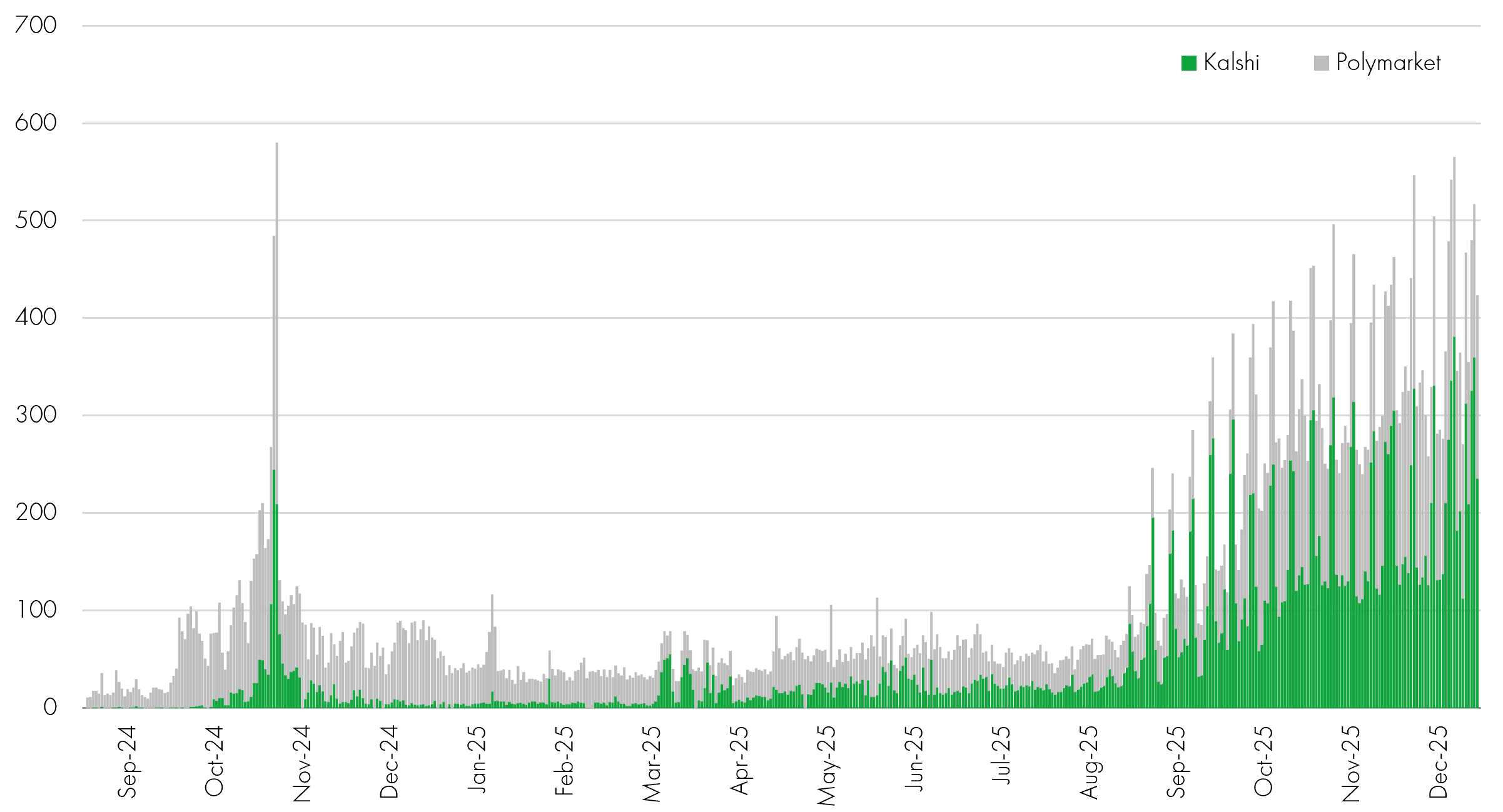

Distribution unlock has also been a key accelerant for prediction markets. Today, mainstream apps such as Robinhood, Coinbase and FanDuel have removed friction in unlocking demand. In December 2025 alone, Kalshi and Polymarket processed roughly $11.4 billion in notional volume, up double digits month-over-month, with weekly records driven largely by sports contracts. While for Robinhood, prediction markets have become its fastest-growing product line by revenue just a year after launch, with over 9 billion contracts traded by more than 1 million customers. Industry projections now forecast that prediction markets will reach $100 billion within the decade, with annual growth rates approaching 47% – the market is only just getting started.

Kalshi and Polymarket daily notional volume ($m)

Source: Piper Sandler, January 2026.

3. Sports

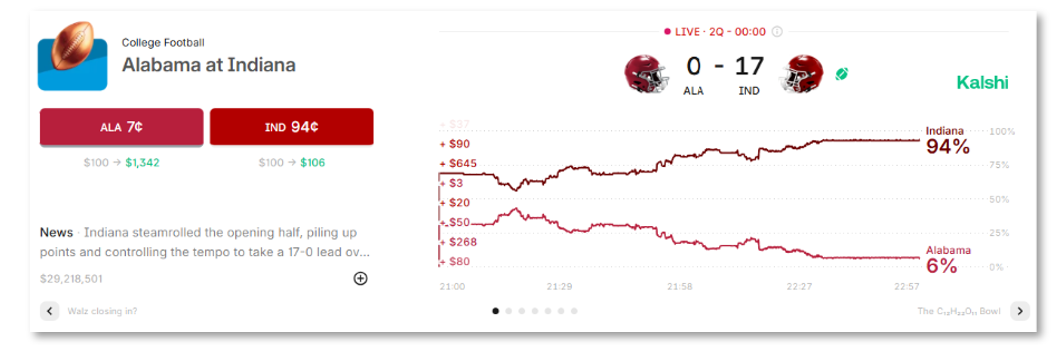

Third, sports are providing a major on-ramp for prediction markets through high-frequency and habit-forming trading behaviour. This can be visible in December’s numbers, where the average volume per NCAA American football game rose 367% month-over-month, even as the number of games declined.

Onchain rails

Prediction markets have become a positive catalyst for blockchain adoption. Polymarket operates natively on Polygon (a Layer 2 Ethereum blockchain), settling trades in USD Coin (USDC), while Kalshi has steadily been expanding its onchain connectivity through integrations, including Solana via Jupiter and DFlow. These moves have strengthened support for major blockchain networks and unlocked fresh liquidity for prediction markets.

We have also seen Coinbase recently leaning in too. It has now partnered with Kalshi to launch prediction markets on its own platform and entered an agreement to acquire The Clearing Company, a prediction market clearing firm, helping Coinbase to gain both operational expertise and the technical capability to scale prediction markets for institutional participants. This hybrid model of a regulated core and onchain liquidity rails signals where the industry is heading – regulated markets with crypto native interoperability.

Funding supercycle: printing billionaires

The rate of capital invested into prediction market platforms in 2025 was impressive, contributing to the emergence of a new cohort of billionaires under 30. Kalshi and Polymarket, the two leading platforms, completed a number of funding rounds. Kalshi raised $185 million in the summer, followed by $300 million at a $5 billion valuation in October. Less than two months later, it secured another $1 billion at an $11 billion valuation, propelling both co-founders into the ‘three-comma club’.

Polymarket made headlines in October when the New York Stock Exchange's parent company Intercontinental Exchange (ICE) announced a strategic investment of up to $2 billion at an $8 billion valuation in the Polymarket platform, also turning its 27-year-old founder and CEO into a billionaire.

Risks and outlook

As with many other markets, structural risks still exist. These include the potential manipulation of low-liquidity events, conflicts of interest around contracts, and the blurred line between prediction forecasting and gambling. Recently, during Coinbase’s third-quarter earnings call, CEO and co-founder Brian Armstrong had some spontaneous fun after learning that prediction markets were offering contracts on the specific words he might use on the call. He proceeded to rattle off a handful of crypto-related buzzwords to ensure they made it in the call.

There are also concerns about how material non-public information could be exploited on these platforms. For example, in October, there was a surge in contracts for Venezuelan opposition leader María Corina Machado to win the Nobel Peace Prize just hours before she was officially announced as the winner.

Prediction markets are helping to bring the world onchain. In the years ahead, we could see these markets become key data products, integral to risk modelling, macroeconomic forecasting and political polling. The data generated by these markets is becoming a valuable commodity in their own right. For those who can interpret the data, prediction markets are providing a new signal – what is priced into Polymarket and Kalshi today, may well shape how we make decisions tomorrow.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds managed by the Global Equities Team:

- May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund.

- May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares.

- May have a concentrated portfolio, i.e. hold a limited number of investments or have significant sector or factor exposures. If one of these investments or sectors / factors fall in value this can have a greater impact on the Fund's value than if it held a larger number of investments across a more diversified portfolio.

- May invest in emerging markets which carries a higher risk than investment in more developed countries. This may result in higher volatility and larger drops in the value of a fund over the short term.

Certain countries have a higher risk of the imposition of financial and economic sanctions on them which may have a significant economic impact on any company operating, or based, in these countries and their ability to trade as normal. Any such sanctions may cause the value of the investments in the fund to fall significantly and may result in liquidity issues which could prevent the fund from meeting redemptions. - May invest in companies predominantly in a single country which maybe subject to greater political, social and economic risks which could result in greater volatility than investments in more broadly diversified funds.

- May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay.

- May, in certain circumstances, invest in derivatives but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

The risks detailed above are reflective of the full range of Funds managed by the Global Equities Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID."

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

Pieran Maru

Pieran Maru is a Fund Manager in the Global Equities team. Pieran joined Liontrust in 2024 from GAM where he covered software and hardware companies in GAM’s Global Equity team.