This article is featured in the Q4 2025 Future Strategist newsletter, you can read the rest of the newsletter here.

Given India’s standout performance over the past five years, 2025 in some ways proved a disappointing year for both the economy and the market. Real GDP (Gross Domestic Product) still grew 8.2% – the fastest of any major economy – but the first half was held back by the overhang from 2024’s General Election and a run of extreme weather (both heat and unseasonal rains). Foreign investors, drawn into the global AI boom, aggressively cut Indian exposure: net FII (foreign institutional investor) selling hit about $18 billion, roughly 50% more than in 2008. Yet despite hostile flows and heavy rotation out of India, the equity market still delivered 9.5% in local currency (4.2% in dollars given rupee weakness in the second half).

Globally, 2025 was of course dominated by the tech sector and the AI investment cycle. Market crowding into a narrow group of US and Asian hardware names became increasingly extreme by the end of the year, and investor anxiety around valuations and concentration risk grew accordingly. In this context, India stands out as the major market with the lowest correlation to global equities, offering diversification precisely when it is most needed.

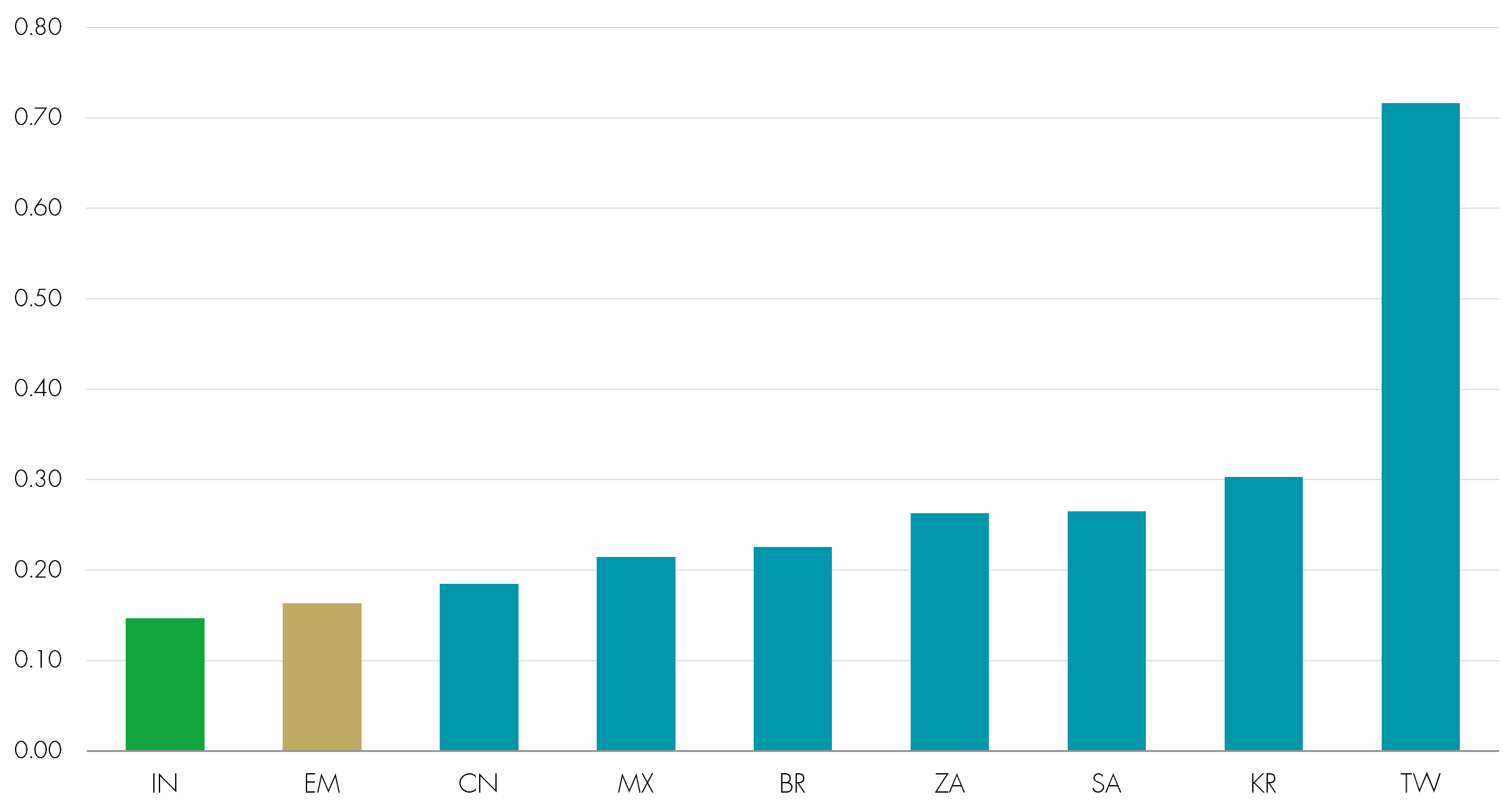

India’s beta to MSCI World ACWI Index

Source: Bloomberg, 30 November 2007 to 31 October 2025. Past performance does not predict future returns.

One of the least-recognised developments in India’s market has been the steady reduction in beta over the past two decades. Previous cycles were dominated by foreign investors on both the way up and the way down, with swings in global liquidity driving a large share of returns. That regime has changed. The key driver has been the emergence of a powerful domestic investment base, supported by rising incomes, captive liquidity and an emerging equity culture.

Over the past decade, domestic institutional ownership has risen steadily, with domestic investors now owning more of the market than foreign investors. Systematic Investment Plans (SIPs) alone have compounded at around 27% a year, with tens of millions of new accounts, creating a structural monthly bid for equities. Consequently, India's beta to the MSCI World ACWI Index reduced from 1.0 a decade ago to 0.4 in the final quarter of 2025, compared with 1.1 for South Korea and 0.9 for Taiwan.

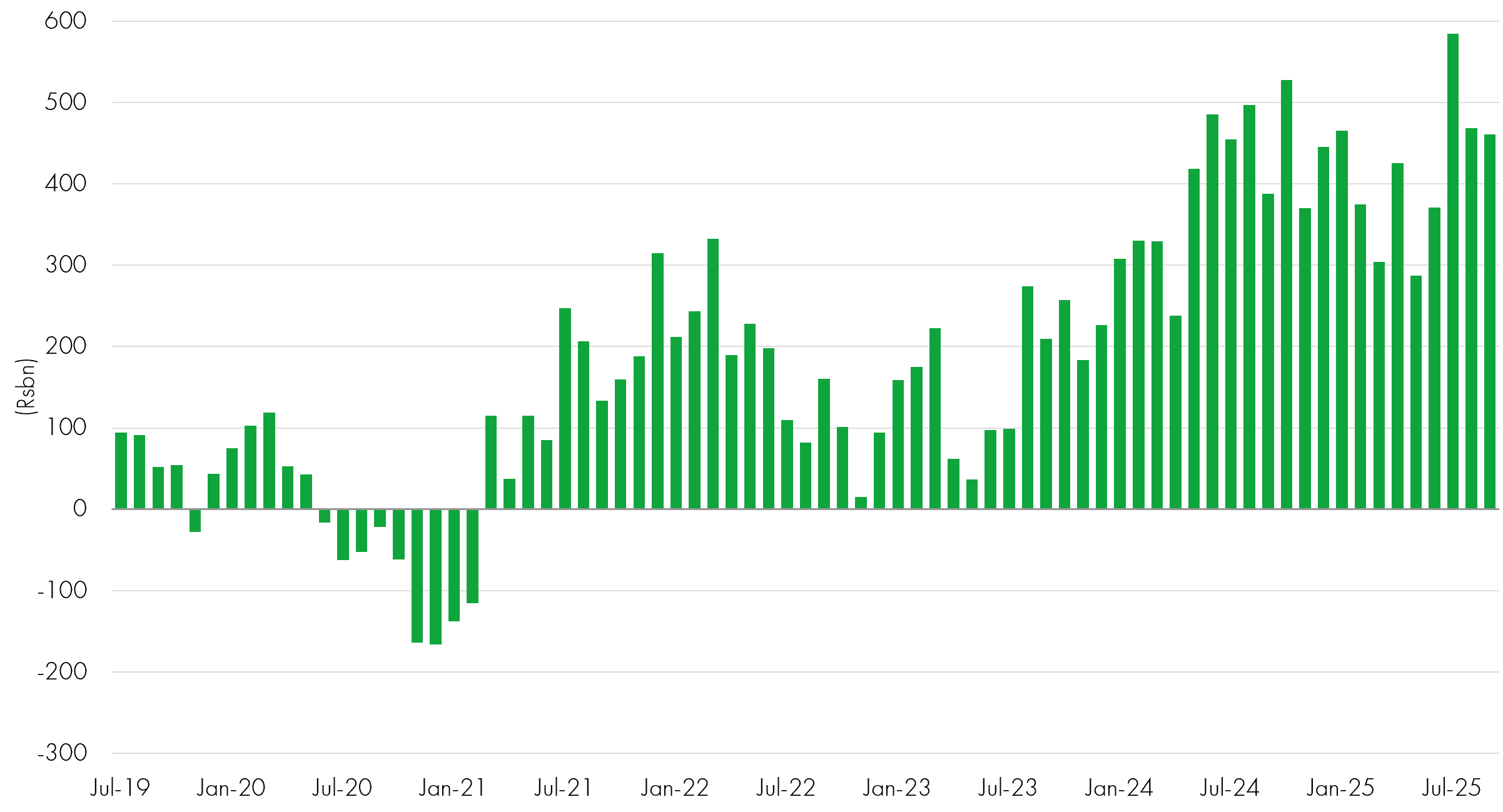

Trend in monthly flows in domestic mutual funds

Source: AMFI, CLSA, Net inflows in equity funds excluding arbitrage funds, September 2025. Past performance does not predict future returns.

Economically, India also displays a high degree of self-determination, with one of the highest shares of domestic demand in GDP among major economies. Goods exports to the US are about 2% of GDP, versus 8-15% for Taiwan and South Korea, which helped India weather the imposition of US tariffs in 2025. The policy response – tax cuts and lower interest rates – was explicitly aimed at supporting household consumption. Importantly, India’s equity market shows the tightest linkage anywhere in emerging markets between domestic GDP growth and corporate earnings growth and has delivered consistently high earnings quality across cycles.

Sectorally, India remains unusual within emerging markets. It has the lowest sector concentration of any major emerging market index: while MSCI Taiwan has around 85% in tech, India has a negligible index weight in tech hardware. Whilst this has led some investors to label India the ‘anti-AI trade’, this description is only half-right. India’s low correlation to the global tech cycle is real, but it also masks the fact that the country is rapidly deploying technology horizontally across sectors – as a user rather than a hardware producer, with companies deploying AI at scale but without the index-level concentration risk North Asian markets exhibit.

Herfindahl-Hirschman index of sector consolidation in emerging markets

Source: Bloomberg, 6 November 2025. Past performance does not predict future returns.

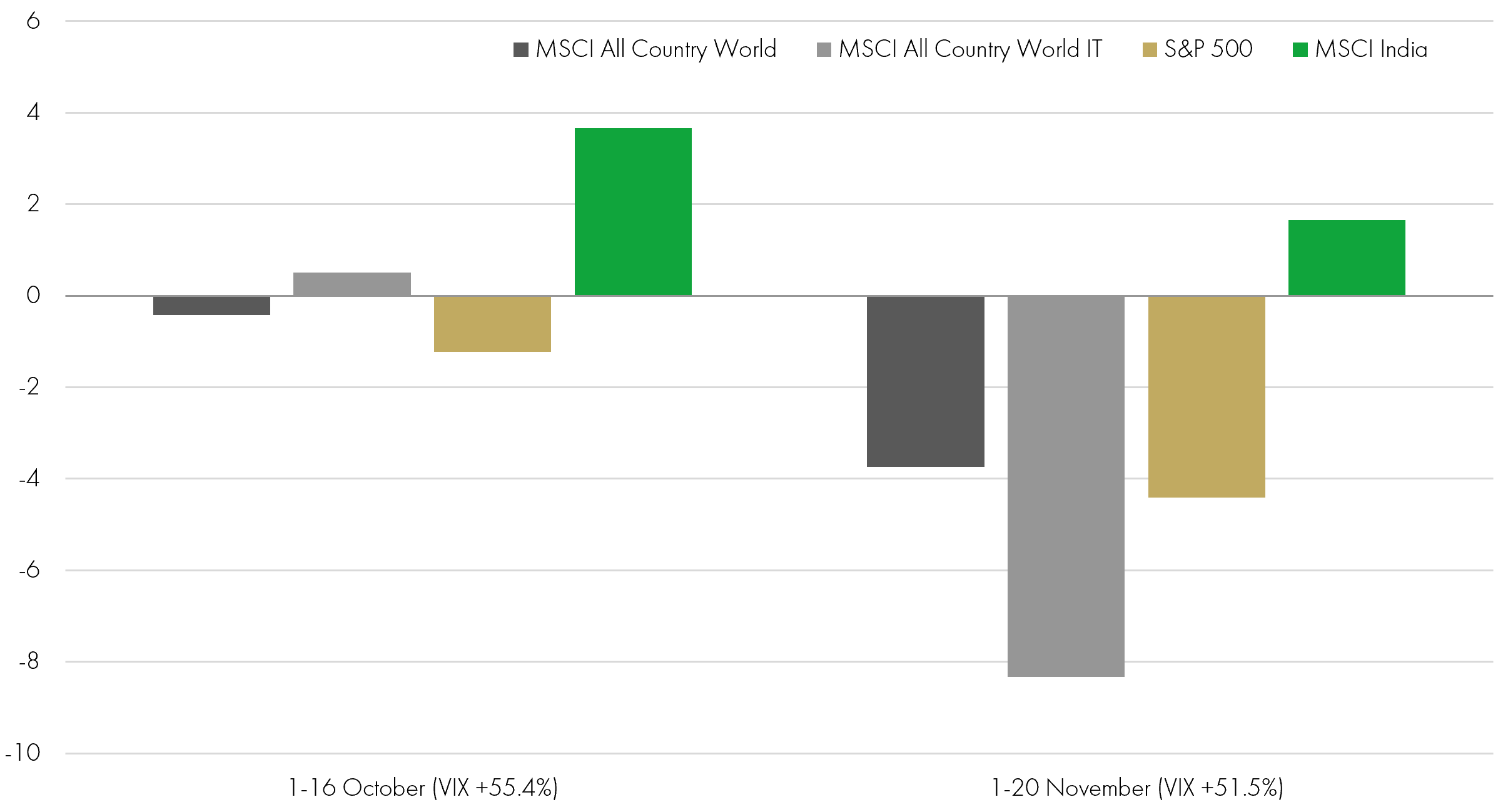

Given the domestic nature of the economy and the growing role of local investors, India is therefore increasingly more insulated from global sentiment swings than any other large market. The country underperformed global equities in 2025, but during bouts of volatility (VIX index +50%) in the final quarter, it demonstrated notably low correlations, relative strength and positive absolute performance. Late in the year, foreign allocations to India sat at record lows relative to benchmarks, and futures positioning reached historic extremes: in September; FIIs positioning in index futures was only 7% long positions against 93% shorts. That bearish stance began to unwind in the final quarter, with outflows slowing and short positions being covered as concerns over stretched global tech valuations grew and investors started to search for alternatives.

Q4 2025 episodes of market volatility

Source: Bloomberg, January 2026. Past performance does not predict future returns.

For investors looking to diversify portfolios in an increasingly concentrated market, India still offers a rare combination: world-leading growth, consistent earnings delivery, ample liquidity and the lowest correlations to global markets. Valuations, after the 2024/25 correction, now sit broadly in line with India’s long-run premium of around 60–70% versus emerging markets on forward PE (Price-to-Earnings ratio) rather than at the extremes of recent years. With earnings growth accelerating again and India’s long-term ROE (Return on Equity) premium to peers intact, India offers a compelling and idiosyncratic structural growth story to investors looking for alternatives to current market concentration risks.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds managed by the Global Equities Team:

- May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund.

- May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares.

- May have a concentrated portfolio, i.e. hold a limited number of investments or have significant sector or factor exposures. If one of these investments or sectors / factors fall in value this can have a greater impact on the Fund's value than if it held a larger number of investments across a more diversified portfolio.

- May invest in emerging markets which carries a higher risk than investment in more developed countries. This may result in higher volatility and larger drops in the value of a fund over the short term.

Certain countries have a higher risk of the imposition of financial and economic sanctions on them which may have a significant economic impact on any company operating, or based, in these countries and their ability to trade as normal. Any such sanctions may cause the value of the investments in the fund to fall significantly and may result in liquidity issues which could prevent the fund from meeting redemptions. - May invest in companies predominantly in a single country which maybe subject to greater political, social and economic risks which could result in greater volatility than investments in more broadly diversified funds.

- May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay.

- May, in certain circumstances, invest in derivatives but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

The risks detailed above are reflective of the full range of Funds managed by the Global Equities Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID."

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

Ewan Thompson

Ewan Thompson is a fund manager, having joined Liontrust as part of the acquisition of Neptune Investment Management in October 2019. Prior to joining Neptune in 2006, he worked as an editor for Yale University Press.