This article is featured in the Q4 2025 Future Strategist newsletter, you can read the rest of the newsletter here.

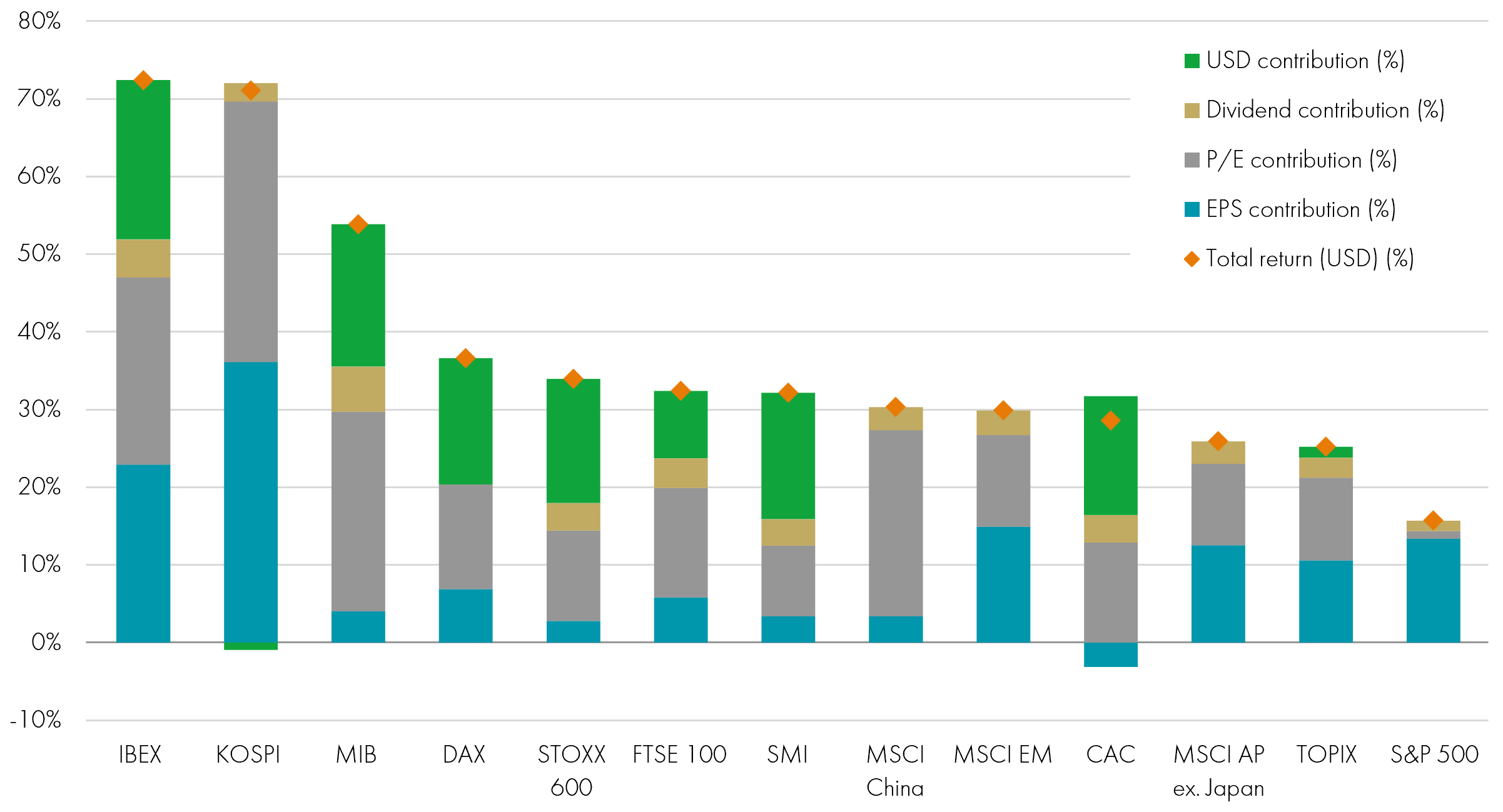

Equity markets enjoyed a third successive year of strong returns in 2025, with the MSCI World ACWI Index rising 21%; this followed positive returns of +15.7% and +20.6% in 2023 and 2024. However, the marked difference in 2025 was the broadening out of returns across geographies and the impact of a 10% decline in the US dollar on dollar-adjusted returns. In fact, the dollar-adjusted returns from almost all major markets globally were stronger than the S&P 500 as the chart from Goldman Sachs below shows.

Nearly all major equity markets have outperformed the US in 2025 in local and in USD terms

Decomposition of YTD return in USD

Source: Datastream, STOXX, Goldman Sachs Global Investment Research, as of January 2026. YTD = Year to date, P/E = Price-to-Earnings, EPS = Earnings per share. Past performance does not predict future returns.

Emerging markets were a standout in 2025. Total returns of +34% were more than 16% ahead of the S&P 500, the strongest relative performance since 2009. A reversal in the fortunes of the US dollar – a considerable headwind for emerging markets over the past 15 years – offered support. Dollar weakness has given emerging markets’ central banks licence to cut interest rates across the board, supporting economies and markets alike. The strong overall performance was also driven by several idiosyncratic factors. For example, North Asian markets benefited from the global AI capex boom, with Korean equities also supported by the government's value-up program; the rally in precious metals was a key driver for South Africa; and Eastern European markets saw continued reforms as well as looser fiscal policy across the continent as governments boost defence spending.

Latin America is in the early stages of transitioning back to the political right while helped by the ongoing recovery in commodity prices, especially those closely tied to the energy transition such as copper, silver and lithium. Brazil, in particular, stands out given its historically high real interest rates and the prospect of significant monetary policy easing in the coming year.

India – a significant outperformer in recent years – took something of a backseat. On the domestic side, an incremental slowdown in growth saw softer corporate earnings growth, while the re-acceleration in growth and lower valuations elsewhere drew foreign capital out of the market.

One might be forgiven for thinking this backdrop would allow active investors to start reversing the passive dominance of the past decade. However, that has not really happened. In fact, given that most passive equity assets are linked to the S&P 500 and the Magnificent 7 continued to outperform the index, active managers struggled. The Magnificent 7 index rose 25% in 2025, well ahead of the 17% S&P 500 returns. According to Fortune, 75% of the S&P 500 returns since October 2022 (the trough of that year’s sell-down) have come from the Magnificent 7. It has been easy but also dead right to remain heavily exposed to those names.

Looking for possible cracks does reveal not only the geographic change of dominance shown above but also a much more diverse set of returns within Magnificent 7. Google led the pack in 2025 with a stellar 66% return after having been discarded by many as a huge AI loser – some have even called for its early demise! Five of the seven names underperformed the S&P 500 – Amazon +5.5%, Apple +8.7%, Tesla +12.6, Meta +13.2% and Microsoft +15.1%. Only Nvidia joined Google as a significant winner, up 41% as demand continued to run red hot for AI chipsets.

The point here is that maybe the diverse fortunes of the biggest companies are also signalling a change of trend and a more discerning approach to identifying winners and losers. We believe the monumental capex cycle is a key catalyst for possibly the best opportunity to become more selective at the top of the market cap table and cover this in our first article below.

Looking back over the full 2025 year, it is notable that many of the World Index top 10 winners are Chinese tech manufacturers as China ramps up its own capability in the balkanisation of technology sufficiency driven by the US/China tensions. Victory Giant Technology was the +630% index winner for the year, while five Chinese tech companies were up +230% or more.

Turning to sectors, IT continues to generate substantial returns for the overall index but again we have started to see a change in dominance. The contribution from technology to the MSCI World ACWI Index was 30% of total returns in 2025, the lowest level for five years, again suggesting that diversification has started to pay off.

Financials and Industrials were the next two highest contributing sectors and reflect the stronger contributions from outside the US on a geographical basis.

The pieces of the jigsaw seem to be in place for 2025 to have been a pivot year. Overall market returns are likely to remain robust in 2026 given economic growth has remained strong but the best returns look likely to emerge from other parts of the market both from a sector and geographical standpoint.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds managed by the Global Equities Team:

- May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund.

- May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares.

- May have a concentrated portfolio, i.e. hold a limited number of investments or have significant sector or factor exposures. If one of these investments or sectors / factors fall in value this can have a greater impact on the Fund's value than if it held a larger number of investments across a more diversified portfolio.

- May invest in emerging markets which carries a higher risk than investment in more developed countries. This may result in higher volatility and larger drops in the value of a fund over the short term.

Certain countries have a higher risk of the imposition of financial and economic sanctions on them which may have a significant economic impact on any company operating, or based, in these countries and their ability to trade as normal. Any such sanctions may cause the value of the investments in the fund to fall significantly and may result in liquidity issues which could prevent the fund from meeting redemptions. - May invest in companies predominantly in a single country which maybe subject to greater political, social and economic risks which could result in greater volatility than investments in more broadly diversified funds.

- May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay.

- May, in certain circumstances, invest in derivatives but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

The risks detailed above are reflective of the full range of Funds managed by the Global Equities Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID."

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

Mark Hawtin

Mark Hawtin is head of the Global Equities team. Mark joined Liontrust in 2024 from GAM, where he was an Investment Director running global long-only and long/short funds investing in the disruptive growth & technology sectors. Before joining GAM in 2008 he was a partner and portfolio manager with Marshall Wace Asset Management for eight years, managing one of Europe’s largest technology, media and telecoms hedge funds.