This article is featured in the Q4 2025 Future Strategist newsletter, you can read the rest of the newsletter here.

Salmon farming is an often overlooked corner of the consumer staples sector. The industry dynamics are attractive, with supply growth constrained by biological challenges and regulatory barriers, and demand predicted to grow twice as fast over the next few years. With this in mind, we explore how Mowi, one of the world’s largest salmon farmers, is embracing technology to outgrow the broader industry.

Mowi 4.0: how technology is revolutionising salmon farming

Picture a future where salmon farming relies less on guesswork and manual labour and more on accuracy, data-driven decisions and advanced technology. At Mowi, one of the leading salmon producers, this vision is coming to life through its ambitious ‘Mowi 4.0’ digital transformation. By integrating AI, robotics and cloud analytics, Mowi is raising the bar for efficiency, environmental responsibility and fish health – with Google playing a significant role in this innovation.

From buckets to bytes: the old versus the new

Not long ago, salmon farming was a hands-on, almost old-fashioned job. Workers would throw feed into pens by hand, relying on experience to decide when the fish had eaten enough. Monitoring fish health meant leaning over nets or rowing out in boats, hoping to spot problems before they became serious. Overfeeding polluted the seabed, underfeeding slowed growth and everything depended on human judgment. It was labour intensive, imprecise and risky.

Today, that has all changed. Many of Mowi’s farms are now powered by smart technology. Underwater cameras and AI-driven sensors monitor the salmon, day and night. Feeding is automated and precise, pellets drop only when fish are hungry, reducing waste and boosting growth. Remote Operations Centres (ROCs) oversee dozens of farms from screens hundreds of miles away. What used to be guesswork is now data-driven science.

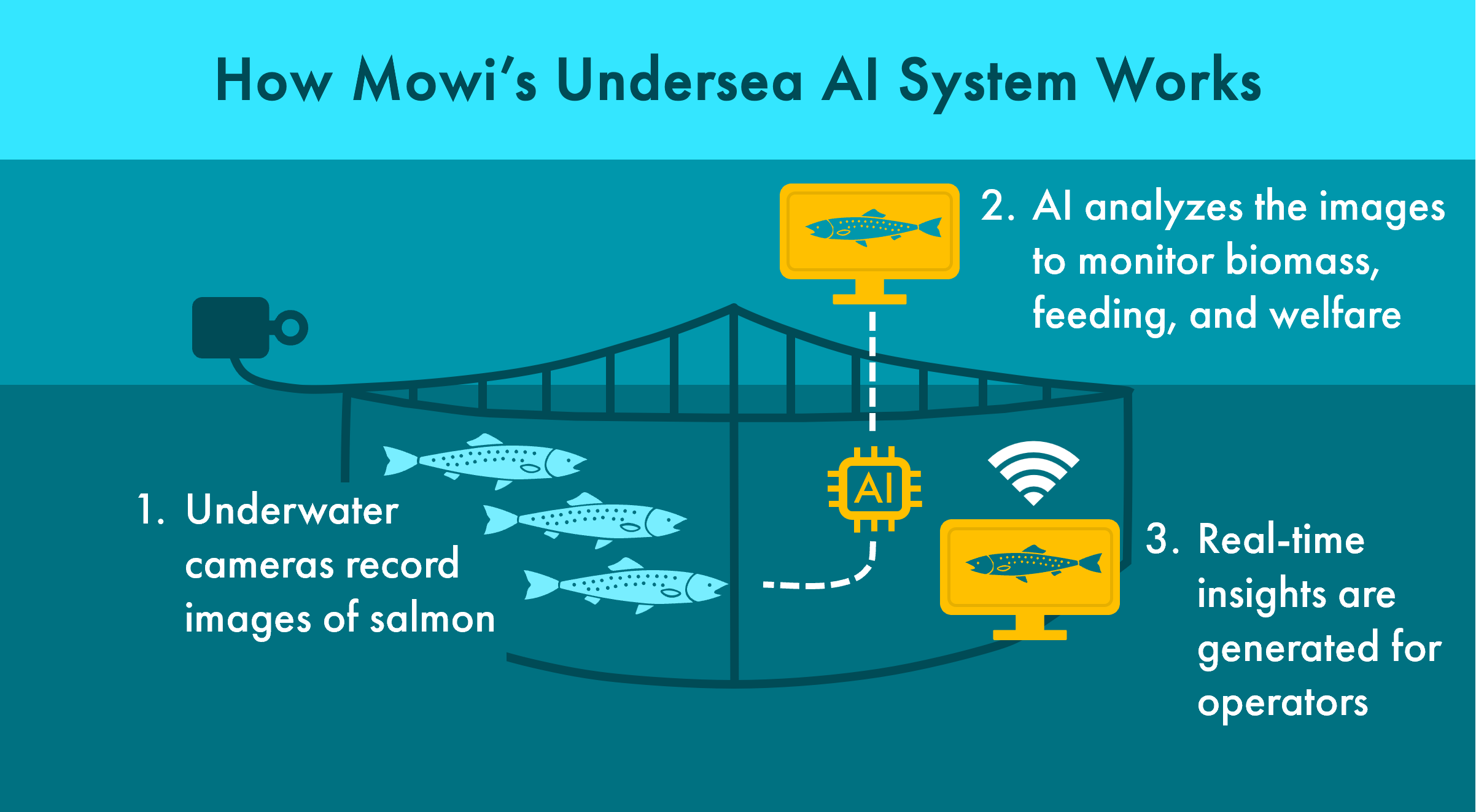

Google’s tidal AI: eyes underwater

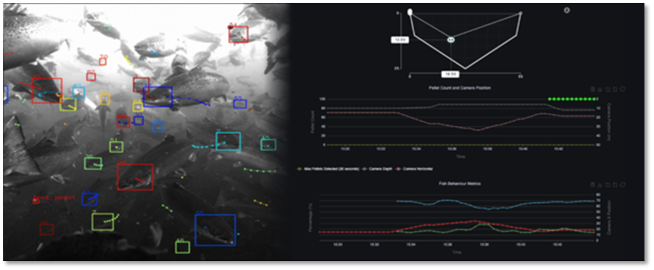

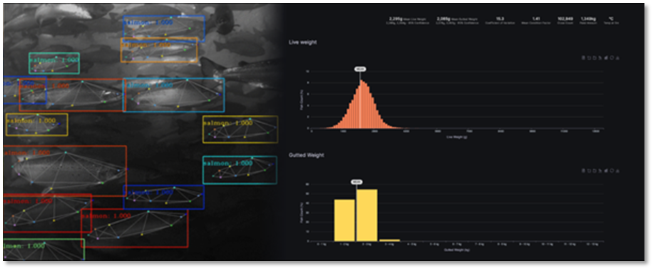

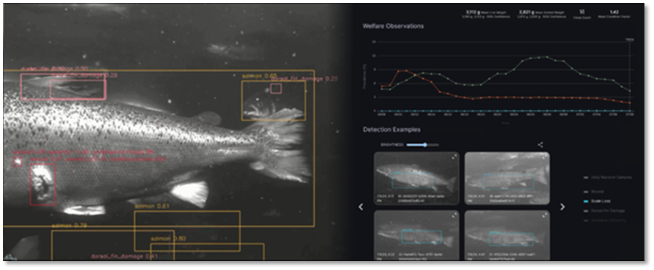

A standout in Mowi’s tech arsenal is its partnership with the Tidal AI platform. Tidal, originally part of Google’s famous Moonshot Factory, brings AI-powered underwater cameras and sensors to many of Mowi’s Norwegian sites. These systems provide real-time insights into fish growth, weight, feeding activity, lice counts and environmental conditions. The Tidal platform, now in over 230 pens, combines machine learning with underwater imaging to monitor everything from biomass to fish welfare, gathering rich behavioural and environmental data that helps Mowi make smarter decisions every day.

Source of images: www.tidalx.ai/en/product, as of January 2026.

Smarter feeding, healthier fish

Automated feeding systems, powered by image recognition and intelligent sensors, have replaced manual feeding. These systems continuously monitor the fish and optimise feeding schedules, ensuring each salmon gets the right amount of food at the right time. This not only maximizes growth but also reduces overfeeding, minimising waste and environmental impact.

AI also helps count sea lice and track fish welfare. If there is a problem, staff can act quickly to keep the fish healthy. Many farms are now managed remotely from central control rooms so fewer people need to be on site.

Robots and remote vehicles: the new farmhands

Robotics play a crucial role in Mowi’s operations. Remotely operated vehicles (ROVs), like the ‘Foover’ systems, handle net inspections and remove dead fish, improving fish welfare and reducing the need for human intervention. This approach boosts efficiency and ensures consistent fish welfare standards across geographically dispersed sites.

Data-driven decisions, from egg to plate

Mowi’s cloud platform connects data from breeding, feeding, farming, processing and logistics. Machine learning analyses everything from lighting and water temperature to feed variants, refining growth, health and yield outcomes. By raising young salmon in land-based tanks before moving them to sea pens, in certain areas Mowi projects that it can increase survival rates by about 50% and reduce lice treatments by 40%.

Automation extends beyond farming into processing plants, where repetitive tasks are handled by machines to boost efficiency and product consistency. Mowi’s digital traceability platform, developed with partners like Digimarc, lets consumers scan QR codes to trace each salmon’s journey from hatchery to plate, building trust and transparency.

Big benefits: for business, fish and the planet

The results are impressive. Mowi expects technology to deliver €300–€400 million in cost savings and helps support harvest growth from 500,000 tonnes in 2024 to over 650,000 tonnes by 2029. Key gains include:

- Improved feed conversion and biomass tracking

- Higher survival rates and better health management

- Reduced manual labour and increased uptime via ROVs and sensors

- Enhanced traceability and consumer confidence

Most importantly, Mowi’s holistic integration of AI, robotics, sensing and data analytics is lowering environmental impact, reducing chemical use and strengthening its ESG (Environmental, Social, and Governance) credentials. This attracts premium pricing and investor confidence, helping Mowi maintain strong margins even as industry costs rise.

Why it matters

Mowi’s tech-driven approach means more salmon can be produced with less waste and better care for the fish. It is good for the environment, good for business and gives consumers more confidence in the food they buy.

KEY RISKS

Past performance does not predict future returns. You may get back less than you originally invested.

We recommend this fund is held long term (minimum period of 5 years). We recommend that you hold this fund as part of a diversified portfolio of investments.

The Funds managed by the Global Equities Team:

- May hold overseas investments that may carry a higher currency risk. They are valued by reference to their local currency which may move up or down when compared to the currency of a Fund.

- May encounter liquidity constraints from time to time. The spread between the price you buy and sell shares will reflect the less liquid nature of the underlying holdings.

- May invest in smaller companies and may invest a small proportion (less than 10%) of the Fund in unlisted securities. There may be liquidity constraints in these securities from time to time, i.e. in certain circumstances, the fund may not be able to sell a position for full value or at all in the short term. This may affect performance and could cause the fund to defer or suspend redemptions of its shares.

- May have a concentrated portfolio, i.e. hold a limited number of investments or have significant sector or factor exposures. If one of these investments or sectors / factors fall in value this can have a greater impact on the Fund's value than if it held a larger number of investments across a more diversified portfolio.

- May invest in emerging markets which carries a higher risk than investment in more developed countries. This may result in higher volatility and larger drops in the value of a fund over the short term.

Certain countries have a higher risk of the imposition of financial and economic sanctions on them which may have a significant economic impact on any company operating, or based, in these countries and their ability to trade as normal. Any such sanctions may cause the value of the investments in the fund to fall significantly and may result in liquidity issues which could prevent the fund from meeting redemptions. - May invest in companies predominantly in a single country which maybe subject to greater political, social and economic risks which could result in greater volatility than investments in more broadly diversified funds.

- May hold Bonds. Bonds are affected by changes in interest rates and their value and the income they generate can rise or fall as a result; The creditworthiness of a bond issuer may also affect that bond's value. Bonds that produce a higher level of income usually also carry greater risk as such bond issuers may have difficulty in paying their debts. The value of a bond would be significantly affected if the issuer either refused to pay or was unable to pay.

- May, in certain circumstances, invest in derivatives but it is not intended that their use will materially affect volatility. Derivatives are used to protect against currencies, credit and interest rate moves or for investment purposes. The use of derivatives may create leverage or gearing resulting in potentially greater volatility or fluctuations in the net asset value of the Fund. A relatively small movement in the value of a derivative's underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

The risks detailed above are reflective of the full range of Funds managed by the Global Equities Team and not all of the risks listed are applicable to each individual Fund. For the risks associated with an individual Fund, please refer to its Key Investor Information Document (KIID)/PRIIP KID."

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This material is issued by Liontrust Investment Partners LLP (2 Savoy Court, London WC2R 0EZ), authorised and regulated in the UK by the Financial Conduct Authority (FRN 518552) to undertake regulated investment business.

It should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets.

This information and analysis is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content, no representation or warranty is given, whether express or implied, by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified.

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID) and/or PRIIP/KID, which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.com or direct from Liontrust. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

Kevin Kruczynski

Kevin Kruczynski is a fund manager in the Global Equities team. Kevin joined Liontrust in 2024 from GAM where he managed both global and US equity portfolios. He joined GAM in 2016 from THS Partners, a global equity investment firm and a long-standing sub-advisor of GAM’s oldest global equity strategies.